Sara Lee 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

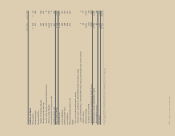

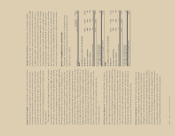

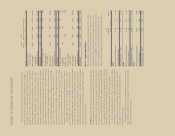

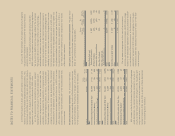

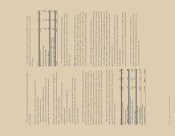

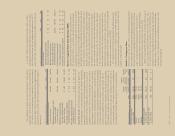

NOTES TO FINANCIAL STATEMENTS

North North

American American International International

In millions Retail Foodservice Beverage Bakery Total

Net book value at

June 27, 2009

Gross goodwill $103 $«729 $322 $«705 $«1,859

Accumulated

impairment losses – (489) (92) (524) (1,105)

Net goodwill 103 240 230 181 754

Foreign exchange/other – – (16) (19) (35)

Net book value at

July 3, 2010

Gross goodwill 103 729 306 686 1,824

Accumulated

impairment losses – (489) (92) (524) (1,105)

Net goodwill 103 240 214 162 719

Foreign exchange/other – – 38 26 64

Acquisitions 36 – 23 – 59

Held for sale – (31) – – (31)

Net book value at

July 2, 2011

Gross goodwill 139 698 367 712 1,916

Accumulated

impairment losses – (489) (92) (524) (1,105)

Net goodwill $139 $«209 $275 $«188 $÷÷811

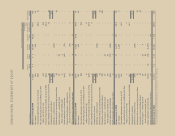

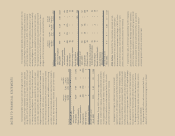

Note 4 – Impairment Charges

The corporation recognized impairment charges in 2011, 2010

and 2009 and the significant impairments are reported on the

“Impairment charges” line of the Consolidated Statements of

Income. The tax benefit is determined using the statutory tax rates

for the tax jurisdiction in which the impairment occurred. The

impact of these charges is summarized in the following tables:

Pretax

Impairment After Tax

In millions Charge Tax Benefit Charge

2011

North American Foodservice $÷15 $÷5 $÷10

International Beverage 624

Total impairments – 2011 $÷21 $÷7 $÷14

2010

North American Foodservice $÷15 $÷5 $÷10

International Bakery 1349

Total impairments – 2010 $÷28 $÷9 $÷19

2009

North American Foodservice $107 $÷– $107

International Bakery 207 25 182

Total impairments – 2009 $314 $25 $289

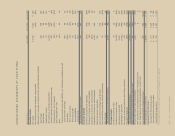

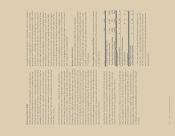

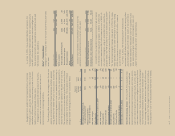

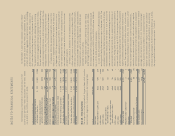

The year-over-year change in the value of trademarks and brand

names and customer relationships is primarily due to changes

in foreign currency exchange rates and the impact of acquisitions

during the year. In 2011, the North American Retail and International

Beverage segments acquired companies that created $47 million

of trademarks and brand names, $34 million of customer rela-

tionships and $5 million of other contractual agreements. The

amortization expense reported in continuing operations for intangible

assets subject to amortization was $62 million in 2011, $55 million in

2010 and $59 million in 2009. The estimated amortization expense

for the next five years, assuming no change in the estimated useful

lives of identifiable intangible assets or changes in foreign exchange

rates, is as follows: $44 million in 2012, $40 million in 2013,

$36 million in 2014, $31 million in 2015 and $14 million in 2016.

At July 2, 2011, the weighted average remaining useful life for trade-

marks is 18 years; customer relationships is 13 years; computer

software is 4 years; and other contractual agreements is 8 years.

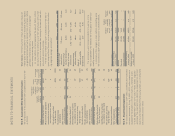

During 2009, the corporation recognized impairment charges

of $79 million related to certain trademarks associated with the

International Bakery segment. These charges are more fully described

in Note 4 to the Consolidated Financial Statements, “Impairment

Charges.” In 2009, trademarks of $8 million and customer relation-

ships and other contractual agreements of $3 million were recognized

with the acquisition of the Café Moka, a Brazilian based producer

and wholesaler of coffee.

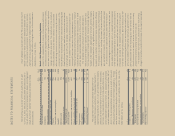

Goodwill In November 2010, the International Beverage segment

acquired Damasco, a Brazilian coffee company, for $32 million and

assumed debt of $27 million and recognized $23 million of goodwill.

In May 2011, the North American Retail segment acquired Aidells, a

gourmet sausage company, for $87 million and recognized $36 mil-

lion of goodwill. In 2009 the International Beverage segment acquired

Café Moka, a Brazilian coffee company, for $10 million and assumed

debt of $20 million and recognized $18 million of goodwill.

In 2009, non-deductible goodwill of $107 million and $124 million

was impaired in the North American foodservice beverage and Spanish

bakery reporting units, respectively. These charges are more fully

described in Note 4 to the Consolidated Financial Statements,

“Impairment Charges.”

The goodwill reported in continuing operations associated with

each business segment and the changes in those amounts during

2011 and 2010 are as follows: