Sara Lee 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

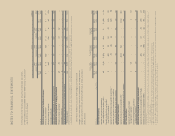

Level 1 assets were valued using market prices based on daily

net asset value (NAV) or prices available through a public stock

exchange. Level 2 assets were valued primarily using market prices,

derived from either an active market quoted price, which may require

adjustments to account for the attributes of the asset, or an inactive

market transaction. The corporation did not have any level 3 assets,

which would include assets for which values are determined by non-

observable inputs. See Note 15 – Financial Instruments for additional

information as to the fair value hierarchy.

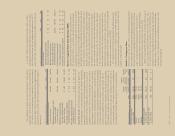

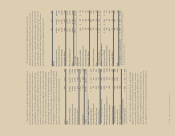

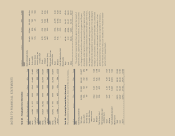

The percentage allocation of pension plan assets based on fair

value as of the respective year-end measurement dates is as follows:

2011 2010

U.S. Plans

Asset category

Equity securities 3% 4%

Debt securities 89 84

Real estate 22

Cash and other 610

Total 100% 100%

International Plans

Asset category

Equity securities 25% 22%

Debt securities 66 69

Real estate 23

Cash and other 76

Total 100% 100%

The overall investment objective is to manage the plan assets

so that they are sufficient to meet the plan’s future obligations

while maintaining adequate liquidity to meet current benefit pay-

ments and operating expenses. The actual amount for which these

obligations will be settled depends on future events and actuarial

assumptions. These assumptions include the life expectancy of

the plan participants and salary inflation. The resulting estimated

future obligations are discounted using an interest rate curve that

represents a return that would be required from high quality corpo-

rate bonds. The corporation has adopted a liability driven investment

(LDI) strategy and it is in various stages of implementation of the

strategy in each of its largest pension plans. This strategy consists

of investing in a portfolio of assets whose performance is driven

by the performance of the associated pension liability. This means

that plan assets managed under an LDI strategy may underperform

general market returns, but should provide for lower volatility of

funded status as its return matches the pension liability movement.

Over time, as pension obligations become better funded, the corpora-

tion will further de-risk its investments and increase the allocation

to fixed income.

The accumulated benefit obligation is the present value of pension

benefits (whether vested or unvested) attributed to employee service

rendered before the measurement date and based on employee

service and compensation prior to that date. The accumulated ben-

efit obligation differs from the projected benefit obligation in that it

includes no assumption about future compensation levels. The

accumulated benefit obligations of the corporation’s pension plans as

of the measurement dates in 2011 and 2010 were $1,370 million

and $1,372 million, respectively, for the U.S. plans and $3,049 mil-

lion and $2,875 million, respectively, for the international plans.

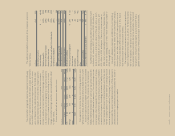

The projected benefit obligation, accumulated benefit obligation

and fair value of plan assets for pension plans with accumulated

benefit obligations in excess of plan assets were:

In millions 2011 2010

U.S. Plans

Projected benefit obligation $1,113 $1,372

Accumulated benefit obligation 1,113 1,372

Fair value of plan assets 987 1,127

International Plans

Projected benefit obligation $÷«294 $1,466

Accumulated benefit obligation 283 1,439

Fair value of plan assets 206 1,268

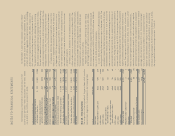

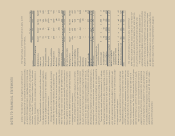

Plan Assets, Expected Benefit Payments and Funding The fair

value of pension plan assets as of July 2, 2011 for the combined

U.S. and International plans was determined as follows:

Quoted

Prices in

Active Significant

Market for Other

Identical Observable

Total Fair Assets Inputs

In millions Value (Level 1) (Level 2)

Equity securities

Non-U.S. securities – pooled funds $÷«875 $÷«875 $÷÷–

Fixed income securities

Government bonds 804 804 –

Corporate bonds 1,000 1,000 –

U.S. pooled funds 157 157 –

Non-U.S. pooled funds 1,247 665 582

Total fixed income securities 3,208 2,626 582

Real estate 93 93 –

Cash and equivalents 121 121 –

Derivatives 49 61 (12)

Other 175 175 –

Total fair value of assets $4,521 $3,951 $570

108/109 Sara Lee Corporation and Subsidiaries