Sara Lee 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

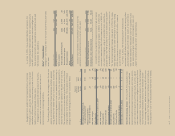

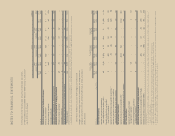

Net Periodic Benefit Cost and Funded Status The components of

the net periodic benefit cost for continuing operations were as follows:

In millions 2011 2010 2009

U.S. Plans

Components of defined benefit

net periodic benefit cost

Service cost $÷÷«7 $÷«17 $÷«21

Interest cost 73 74 69

Expected return on assets (80) (65) (66)

Amortization of

prior service cost 1 (2) –

Net actuarial loss 12 33 (1)

Net periodic benefit cost $÷«13 $«««57 $÷«23

International Plans

Components of defined benefit

net periodic benefit cost

Service cost $÷«32 $÷«31 $÷«30

Interest cost 161 166 166

Expected return on assets (198) (176) (180)

Amortization of

prior service cost 578

Net actuarial loss 23 14 12

Net periodic benefit cost $÷«23 $«««42 $÷«36

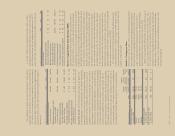

In the fourth quarter of 2011, certain modifications to the

corporation’s defined benefit plan in the Netherlands were approved.

The modifications included changes to the method of benefit index-

ation and employee contribution and salary participation levels. The

plan amendments resulted in a $24 million reduction in the projected

benefit obligation with a corresponding offset to the unamortized

prior service cost balance in Accumulated Other Comprehensive

Income. The corporation also expects to make an additional €60

million contribution to this plan in 2012 related to the agreed upon

plan modifications.

In 2011, the corporation recognized a curtailment loss of

$5 million associated with the fresh bakery businesses as a result

of the expected decline in expected years of future service associ-

ated with the planned disposition of this business. This amount

is being reported as part of the results of discontinued operations.

See Note 5 – “Discontinued Operations” for additional information.

In March 2010, the corporation announced changes to its U.S.

defined benefit pension plans for salaried employees whereby par-

ticipants would no longer accrue benefits under these plans. All

future retirement benefits will be provided through a defined contri-

bution plan. The benefit plan changes resulted in the elimination of

any expected years of future service associated with these plans.

As a result, a pretax curtailment gain of $25 million was recognized,

of which $20 million impacted continuing operations and $5 million

impacted discontinued operations. The curtailment gain resulted

from the recognition of $3 million of previously unamortized net prior

service credits associated with these benefit plans as well as a

$22 million reduction in the projected benefit obligation associated

with one of the plans.

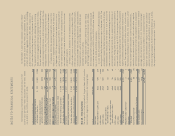

Note 16 Defined Benefit Pension Plans

The corporation sponsors a number of U.S. and foreign pension plans

to provide retirement benefits to certain employees. The benefits

provided under these plans are based primarily on years of service

and compensation levels.

Measurement Date and Assumptions A fiscal year end measurement

date is utilized to value plan assets and obligations for all of the

corporation’s defined benefit pension plans. Prior to 2009 the cor-

poration had utilized a measurement date of March 31.

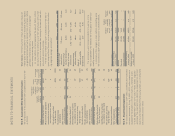

The weighted average actuarial assumptions used in measuring

the net periodic benefit cost and plan obligations of continuing

operations were as follows:

2011 2010 2009

U.S. Plans

Net periodic benefit cost

Discount rate 5.4% 6.5% 6.7%

Long-term rate of return on plan assets 7.3 7.6 7.5

Rate of compensation increase NA 3.5 3.8

Plan obligations

Discount rate 5.6% 5.4% 6.5%

Rate of compensation increase NA NA 3.5

International Plans

Net periodic benefit cost

Discount rate 5.2% 6.4% 6.1%

Long-term rate of return on plan assets 6.7 6.6 6.7

Rate of compensation increase 3.3 3.3 3.3

Plan obligations

Discount rate 5.6% 5.2% 6.4%

Rate of compensation increase 3.1 3.3 3.3

The discount rate is determined by utilizing a yield curve based

on high-quality fixed-income investments that have a AA bond rating

to discount the expected future benefit payments to plan participants.

Compensation increase assumptions are based upon historical expe-

rience and anticipated future management actions. Compensation

changes for participants in the U.S. plans no longer have an impact

on the benefit cost or plan obligations as the participants in the

U.S. salaried plan will no longer accrue additional benefits. In deter-

mining the long-term rate of return on plan assets, the corporation

assumes that the historical long-term compound growth rates of

equity and fixed-income securities and other plan investments will

predict the future returns of similar investments in the plan portfolio.

Investment management and other fees paid out of plan assets are

factored into the determination of asset return assumptions.

106/107 Sara Lee Corporation and Subsidiaries