Sara Lee 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

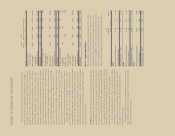

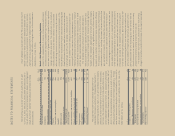

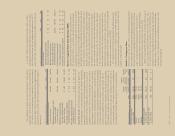

The impact of these actions on the corporation’s business

segments and unallocated corporate expenses is summarized

as follows:

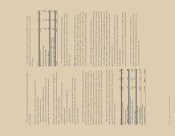

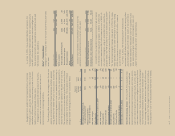

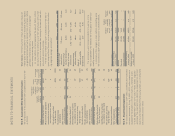

In millions 2011 2010 2009

North American Retail $÷11 $÷÷4 $÷««–

North American Foodservice 6 10 (1)

International Beverage 34 12 53

International Bakery 28 47 38

Decrease in business segment income 79 73 90

Increase in general corporate expenses 84 34 28

Total $163 $107 $118

The following discussion provides information concerning

the exit, disposal and transformation/Project Accelerate/spin-off

activities for each year where actions were initiated and material

reserves exist.

2011 Actions During 2011, the corporation approved certain

actions related to exit, disposal, Project Accelerate and spin-off

activities and recognized charges of $171 million related to these

actions. Each of these activities is expected to be completed within

a 12-month period after being approved and include the following:

• Recognized a charge to implement a plan to terminate

approximately 1,500 employees, related to the European beverage,

North American Retail and North American Foodservice businesses

and the corporate office operations and provide them with severance

benefits in accordance with benefit plans previously communicated

to the affected employee group or with local employment laws. Of

the 1,500 targeted employees, approximately 200 have been termi-

nated. The remaining employees are expected to be terminated

within the next 12 months.

• Recognized costs associated with the transition of services

to an outside third party vendor as part of a business process

outsourcing initiative.

• Recognized third party and employee costs associated with the

planned spin-off of the corporation’s International Beverage operations.

The corporation also recognized $97 million of charges in

discontinued operations primarily related to restructuring actions

taken to eliminate stranded overhead associated with the house-

hold and body care businesses.

The nature of the costs incurred under these plans includes

the following:

Exit Activities, Asset and Business Disposition Actions

These amounts primarily relate to:

• Employee termination costs

• Lease and contractual obligation exit costs

• Gains or losses on the disposition of assets or asset

groupings that do not qualify as discontinued operations

Transformation/Project Accelerate/spin-off costs recognized in

Cost of Sales and Selling, General and Administrative Expenses

These amounts primarily relate to:

• Expenses associated with the installation of new

information systems

• Costs to retain and relocate employees

• Consulting costs

• Costs associated with the transition of services to an

outside third party vendor as part of a business process

outsourcing initiative

Transformation/Project Accelerate/spin-off costs are recognized

in Cost of Sales or Selling, General and Administrative Expenses

in the Consolidated Statements of Income as they do not qualify

for treatment as an exit activity or asset and business disposition

pursuant to the accounting rules for exit and disposal activities.

However, management believes that the disclosure of these trans-

formation/Project Accelerate/spin-off related charges provides the

reader with greater transparency to the total cost of the initiatives.

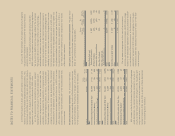

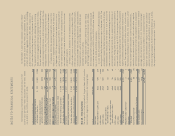

The following is a summary of the (income) expense associated

with new and ongoing actions, which also highlights where the costs

are reflected in the Consolidated Statements of Income along with

the impact on diluted EPS:

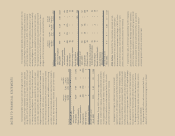

In millions 2011 2010 2009

Exit and business dispositions $«105 $÷«84 $«÷98

Selling, general and

administrative expenses 58 23 20

Reduction in income from continuing

operations before income taxes 163 107 118

Income tax benefit (46) (35) (31)

Reduction in income from

continuing operations $«117 $÷«72 $÷«87

Impact on diluted EPS from

continuing operations $0.19 $0.11 $0.13

94/95 Sara Lee Corporation and Subsidiaries