Sara Lee 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO FINANCIAL STATEMENTS

Stock Options The exercise price of each stock option equals the

market price of the corporation’s stock on the date of grant. Options

can generally be exercised over a maximum term of 10 years. Options

generally cliff vest and expense is recognized on a straightline

basis during the vesting period.

All stock options will be impacted by the spin-off. Option holders

will have a choice to continue to hold their options pursuant to their

normal terms or to accelerate their vesting on the spin-off date with

a six month window to exercise.

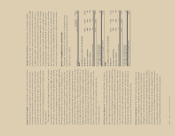

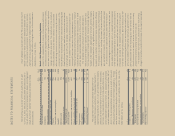

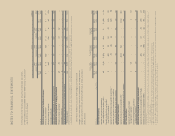

The fair value of each option grant is estimated on the date of

grant using the Black-Scholes option-pricing model and the follow-

ing weighted average assumptions:

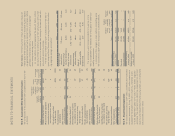

2011 2010 2009

Weighted average

expected lives 7.2 years 8.0 years 8.0 years

Weighted average

risk-free interest rates 2.08% 3.03% 3.1%

Range of risk-free

interest rates 1.91 – 2.66% 3.02 – 3.15% 3.1%

Weighted average

expected volatility 28.0% 27.2% 22.1%

Range of

expected volatility 27.3 – 30.0% 27.2 – 27.6% 22.1%

Dividend yield 2.9% 4.4% 3.0%

The corporation uses historical volatility for a period of time

that is comparable to the expected life of the option to determine

volatility assumptions.

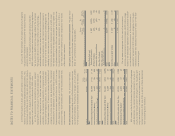

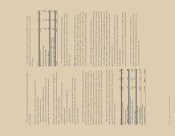

A summary of the changes in stock options outstanding under

the corporation’s option plans during 2011 is presented below:

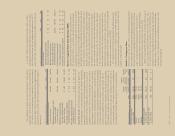

Weighted

Weighted Average Aggregate

Average Remaining Intrinsic

Exercise Contractual Value

Shares in thousands Shares Price Term (Years) (in millions)

Options outstanding

at July 3, 2010 20,036 $15.79 4.7 $16

Granted 2,318 15.49 – –

Exercised (3,106) 16.41 – –

Canceled/expired (1,436) 14.67 – –

Options outstanding

at July 2, 2011 17,812 $15.73 4.6 $66

Options exercisable

at July 2, 2011 12,041 $17.06 2.9 $29

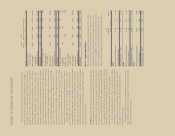

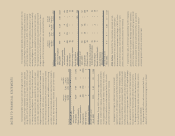

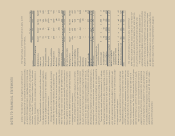

Note 8 – Accumulated Other Comprehensive Income

The components of accumulated other comprehensive income are

as follows:

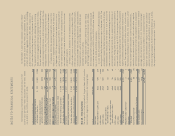

Net Unrealized

Gain (Loss) Pension/

on Qualifying Post- Accumulated

Cumulative Cash Flow retirement Other

Translation Hedges Liability Comprehensive

In millions Adjustment and Other Adjustment Income (Loss)

Balance at June 28, 2008 $«539 $«21 $(411) $«149

Measurement date adjustment ––3 3

Amortization of net actuarial

loss and prior service credit ––1 1

Net actuarial loss arising

during the period – – (299) (299)

Postretirement plan

amendments – – 55 55

Other comprehensive

income (loss) activity (561) (32) 79 (514)

Balance at June 27, 2009 (22) (11) (572) (605)

Disposition of Godrej J.V. 14 – – 14

Amortization of net actuarial

loss and prior service credit – – 19 19

Net actuarial loss arising

during the period – – (323) (323)

Pension plan curtailment – – 27 27

Pension and postretirement

plan amendments – – (4) (4)

Other comprehensive

income (loss) activity (96) 10 46 (40)

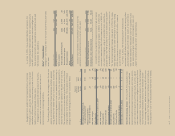

Balance at July 3, 2010 (104) (1) (807) (912)

Disposition of Household &

Body Care businesses 55 – – 55

Amortization of net actuarial

loss and prior service credit – – 16 16

Net actuarial gain arising

during the period – – 326 326

Pension plan curtailment – – 25 25

Other comprehensive

income (loss) activity 277 7 (50) 234

Balance at July 2, 2011 $«228 $÷«6 $(490) $(256)

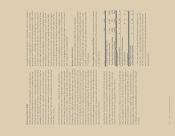

Note 9 – Stock-Based Compensation

The corporation has various stock option, employee stock purchase

and stock award plans. At July 2, 2011, 101.9 million shares were

available for future grant in the form of options, restricted shares

or stock appreciation rights out of 118.7 million shares originally

authorized. The corporation will satisfy the requirement for common

stock for share-based payments by issuing shares out of authorized

but unissued common stock.