Sara Lee 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

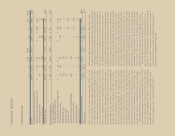

FINANCIAL REVIEW

As previously noted, reported SG&A reflects amounts recognized

for actions associated with Project Accelerate, the business trans-

formation program, spin-off related costs and other significant

amounts. These amounts include the following:

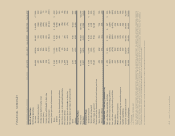

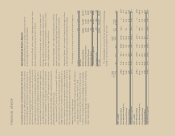

In millions 2011 2010 2009

Project Accelerate/Transformation costs $14 $«28 $«21

Spin-off related costs 44––

Curtailment gain – (14) (6)

Gain on property disposition – – (14)

Tax indemnification charge –26 –

Balance sheet corrections – – (11)

Total $58 $«40 $(10)

Additional information regarding the transformation/Project

Accelerate costs can be found in Note 6 to the Consolidated Financial

Statements, “Exit, Disposal and Transformation Activities.”

The corporation recognized curtailment gains in 2010 and 2009

related to its defined benefit pension plans. Additional information

regarding the pension charges and curtailment gains can be found

in Note 16 to the Consolidated Financial Statements, “Defined

Benefit Pension Plans.”

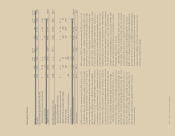

Exit Activities, Asset and Business Dispositions Exit activities,

asset and business dispositions are as follows:

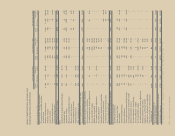

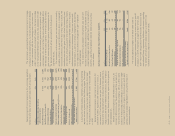

In millions 2011 2010 2009

Charges for (income from) exit activities

Severance $÷95 $45 $98

Exit of leases and other

contractual obligations 9 14 (1)

Other 151

Asset and business dispositions –20 –

Total $105 $84 $98

The net charges in 2011 are $21 million higher than 2010

as a result of a $50 million increase in severance costs related

to restructuring actions partially offset by the decline in lease and

contractual obligation exit costs and a $20 million charge related

to an asset disposition in Spain in the prior year.

The net charges in 2010 are $14 million lower than 2009

as a result of a $53 million decline in severance costs related to

restructuring actions partially offset by a $20 million charge related

to an asset disposition in Spain.

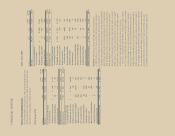

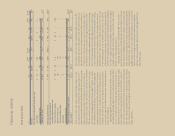

Total SG&A expenses reported in 2011 by the business

segments decreased by $27 million, or 1.4%, versus 2010 prima-

rily due to lower MAP spending and the benefits of cost saving

initiatives partially offset by the impact of inflation on wages and

employee benefits and the impact of the reclassification of certain

shipping and handling costs previously included in Cost of sales.

Amortization of intangibles increased by $1 million in 2011

versus 2010. General corporate expenses, which are not allocated

to the individual business segments, decreased by $91 million due

to a reduction in information technology costs, the impact of head-

count reductions, lower employee benefit costs, lower franchise

taxes and a gain on the sale of the corporate airplane. Unrealized

mark-to-market gains on commodity derivatives included in SG&A

increased by $6 million as compared to the prior year.

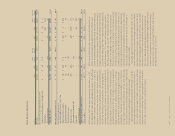

Total selling, general and administrative expenses in 2010

increased $111 million, or 5.4%. Changes in foreign currency

exchange rates, primarily in the European euro, increased SG&A

expenses by $31 million, or 1.6%. The remaining increase in SG&A

expenses was $80 million, or 3.8%. Measured as a percent of

sales, SG&A expenses increased from 24.8% in 2009 to 26.2%

in 2010. SG&A expenses as a percent of sales increased in each

of the business segments, with the exception of North American

Foodservice. The results reflect the impact of higher MAP expenses

and the impact of the 53rd week partially offset by the benefits of

cost saving initiatives.

Total SG&A expenses reported in 2010 by the business segments

increased by $80 million, or 4.4%, versus 2009 primarily due to

higher MAP spending, the impact of changes in foreign currency

exchange rates, the impact of inflation on wages and employee

benefits and the impact of the 53rd week partially offset by the

benefits of cost saving initiatives.

Amortization of intangibles in 2010 was unchanged versus

2009. General corporate expenses in 2010 increased by $33 million

due to a $26 million tax indemnification charge related to a previ-

ously divested business, higher Project Accelerate charges and the

year-over-year negative impact of approximately $22 million of gains

in 2009 – primarily a non-income related foreign tax refund and a

reduction in contingent lease accruals. These increases were partially

offset by a pension curtailment gain and lower benefit plan expenses.

Unrealized mark-to-market losses on commodity derivatives declined

$2 million on a year-over-year basis.