Sara Lee 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

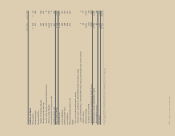

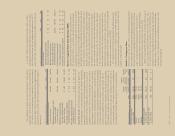

International Bakery Property, Goodwill and Trademarks

In 2009,

the corporation concluded that the carrying amount of the Spanish

bakery reporting unit, which is part of the International Bakery

segment, exceeded its fair value. Based upon a comparison of

the implied fair value of the goodwill in the reporting unit with the

carrying value, management concluded that a $124 million goodwill

impairment charge needed to be recognized for which there is no

tax benefit. The impairment loss recognized equaled the entire

amount of remaining goodwill in the Spanish bakery reporting unit.

The corporation also assessed the realization of the Spanish bakery

long-lived assets. The corporation considered the results of a third

party fair value estimate of these long-lived assets and recorded

an impairment charge of $83 million ($58 million after tax) for

the difference between fair value and carrying value. Of this total,

$79 million related to trademarks, the associated fair value of

which was estimated using the royalty savings method.

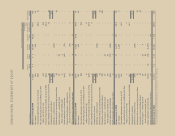

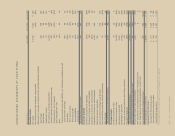

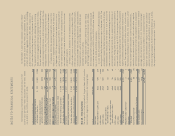

Note 5 – Discontinued Operations

The businesses that formerly comprised the North American Fresh

Bakery and International Household and Body Care segments as

well as the North American refrigerated dough operations previously

reported as part of the North American Foodservice segment are

classified as discontinued operations and are presented in a sepa-

rate line in the Consolidated Statements of Income for all periods

presented. The assets and liabilities of these businesses to be

sold meet the accounting criteria to be classified as held for sale

and have been aggregated and reported on separate lines of the

Condensed Consolidated Balance Sheets for all periods presented.

On November 9, 2010, the corporation signed an agreement

to sell its North American fresh bakery business to Grupo Bimbo

for $959 million, which includes the assumption of $34 million of

debt. Per the agreement, the purchase price is subject to various

adjustments, including a reduction by up to $140 million if and to

the extent that Grupo Bimbo is required to divest certain assets in

connection with obtaining regulatory approval. The regulatory review

process is ongoing but may result in a purchase price reduction in

excess of $140 million. The agreement will enable Grupo Bimbo to

use the Sara Lee brand in the fresh bakery category throughout the

world, except Western Europe, Australia and New Zealand, while

the corporation retains the brand for all other categories and geog-

raphies. The sale also includes a small portion of business that is

currently part of the North American Foodservice segment which

is not reflected as discontinued operations as it does not meet the

definition of a component pursuant to the accounting rules. The

transaction, which is subject to customary closing conditions and regu-

latory clearances, is anticipated to close in the first quarter of 2012.

The corporation currently tests goodwill and intangible assets

not subject to amortization for impairment in the fourth quarter of

its fiscal year and whenever a significant event occurs or circum-

stances change that would more likely than not reduce the fair

value of these intangible assets. Prior to 2010, the impairment

tests were performed in the second quarter. Other long-lived assets

are tested for recoverability whenever events or changes in circum-

stances indicate that its carrying value may not be recoverable.

The following is a discussion of each impairment charge:

2011

North American Foodservice Property

The corporation recognized

a $15 million impairment charge related to the write-down of

manufacturing equipment associated with the foodservice bakery

operations of the North American Foodservice segment.

International Beverage Property

The corporation recognized a

$6 million impairment charge related to the write-down of beverage

equipment associated with the International Beverage segment.

2010

North American Foodservice Property

The corporation recognized

a $15 million impairment charge related to the write-down of

manufacturing equipment associated with the foodservice bakery

operations of the North American Foodservice segment due to the

loss of a customer contract.

International Bakery Property

The corporation recognized a

$13 million impairment charge related to the write-down of bakery

equipment associated with the Spanish bakery operations of the

International Bakery segment.

2009

North American Foodservice Goodwill

In 2009, the corporation

determined that the carrying amount of its North American food-

service beverage reporting unit, which is reported in the North

American Foodservice segment, exceeded its fair value. Based

upon a comparison of the implied fair value of the goodwill in the

reporting unit with the carrying value, management concluded that

a $107 million impairment charge needed to be recognized. The

impairment loss recognized equaled the entire amount of remaining

goodwill in the North American foodservice beverage reporting unit.

No tax benefit was recognized on the charge.

90/91 Sara Lee Corporation and Subsidiaries