Sara Lee 2011 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO FINANCIAL STATEMENTS

On September 7, 2010, the corporation completed a tender

offer for any and all of its 61⁄4% Notes due September 15, 2011,

of which $1.11 billion aggregate principal amount was outstanding.

At the time of expiration of the tender offer, $653.3 million of the

61⁄4% notes had been validly tendered. On September 8, 2010,

the corporation announced that it was redeeming the remaining

$456.7 million of aggregate principal outstanding of the 61⁄4% Notes.

This debt was redeemed on October 8, 2010. The corporation recog-

nized a total charge of $55 million in 2011 associated with the early

extinguishment of this debt. This charge is reported on the Debt

extinguishment costs line of the Consolidated Income Statement.

In September 2010, the company issued $400 million 2.75%

Notes due in September 2015 and $400 million 4.1% Notes due

in September 2020, the proceeds of which were used to fund a

portion of the redemption of the 61⁄4% Notes. The remaining portion

of the redemption of the 61⁄4% Notes in the second quarter of 2011

was funded by cash on hand and the net proceeds from commer-

cial paper issuances.

In March, 2010, a subsidiary of the corporation issued €300

million of debt, which is scheduled to mature in March 2012. The

notes were issued at a fixed rate of 2.25% but have effectively been

converted into variable rate debt using interest rate swap instruments.

The proceeds were used to retire €285 million of debt that was

scheduled to mature in 2011.

Payments required on long-term debt during the years ending

2012 through 2016 are $473 million, $521 million, $20 million,

$77 million and $405 million, respectively. The corporation made

cash interest payments of $123 million, $131 million and $156 mil-

lion in 2011, 2010 and 2009, respectively.

In June 2011, the corporation amended its $1.85 billion five-year

revolving credit facility that was set to expire in December 2011. The

amendment lowered the dollar amount of the facility to $1.2 billion

and extended the maturity date to the earlier of June 4, 2013 or the

date on which the spin-off of the international beverage business is

consummated. The credit facility has an annual fee of 0.05% as of

July 2, 2011. Pricing under this facility is based on the corporation’s

current credit rating. As of July 2, 2011, the corporation did not have

any borrowings outstanding under the credit facility. This agreement

supports commercial paper borrowings and other financial instru-

ments. The corporation had $150 million of letters of credit under

this facility outstanding as of July 2, 2011. The corporation’s credit

facility and debt agreements contain customary representations,

warranties and events of default, as well as, affirmative, negative

and financial covenants with which the corporation is in compliance.

One financial covenant includes a requirement to maintain an interest

coverage ratio of not less than 2.0 to 1.0. The interest coverage

ratio is based on the ratio of EBIT to consolidated net interest

expense with consolidated EBIT equal to net income plus interest

expense, income tax expense, and extraordinary or non-recurring

non-cash charges and gains. For the 12 months ended July 2, 2011,

the corporation’s interest coverage ratio was 7.0 to 1.0.

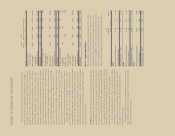

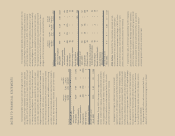

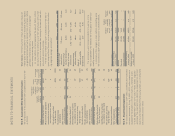

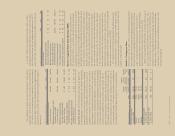

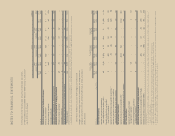

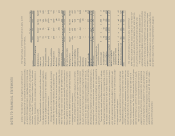

The following is a reconciliation of net income (loss) to net

income (loss) per share – basic and diluted – for the years ended

July 2, 2011, July 3, 2010 and June 27, 2009:

In millions except earnings per share 2011 2010 2009

Income from continuing operations

attributable to Sara Lee $÷«338 $÷582 $«184

Income (loss) from discontinued

operations attributable to Sara Lee 213 (160) 180

Gain on sale of discontinued operations 736 84 –

Net income attributable to Sara Lee $1,287 $÷506 $«364

Average shares outstanding – basic 621 688 701

Dilutive effect of stock compensation 432

Diluted shares outstanding 625 691 703

Income (loss) per common share – Basic

Income from continuing operations $÷0.54 $«0.85 $0.26

Income from discontinued operations 1.53 (0.11) 0.26

Net income $÷2.07 $«0.74 $0.52

Income (loss) per common share – Diluted

Income from continuing operations $÷0.54 $«0.84 $0.26

Income from discontinued operations 1.52 (0.11) 0.26

Net income $÷2.06 $«0.73 $0.52

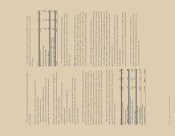

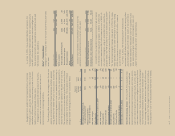

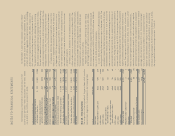

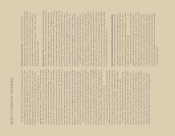

Note 12 – Debt Instruments

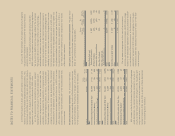

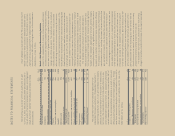

The composition of the corporation’s long-term debt, which includes

capital lease obligations, is summarized in the following table:

In millions Maturity Date 2011 2010

Senior debt

Euro denominated – 2.25% note 2012 434 375

6.25% notes 2012 – 1,110

3.875% notes 2013 500 500

10% zero coupon notes

($19 million face value) 2014 15 14

10% – 14.25% zero coupon notes

($105 million face value) 2015 72 64

2.75% notes 2016 400 –

4.1% notes 2021 400 –

6.125% notes 2033 500 500

Total senior debt 2,321 2,563

Obligations under capital lease 33

Other debt 81 43

Total debt 2,405 2,609

Unamortized discounts (5) (6)

Hedged debt adjustment to fair value 926

Total long-term debt 2,409 2,629

Less current portion (473) (2)

$1,936 $2,627