Sara Lee 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The amounts reported for operating segment income and

operating income may include, but are not limited to, amounts rec-

ognized in the Consolidated Statements of Income for exit activities,

asset and business dispositions, impairment charges, transformation/

Accelerate charges, and pension curtailment gains/losses. See the

Operating Results by Business Segment section of the Financial

Review for additional information regarding these amounts.

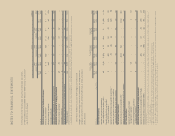

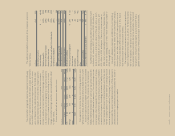

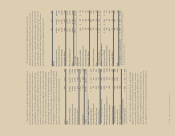

In millions 2011 2010 2009

Assets

North American Retail $1,432 $1,293 $1,266

North American Foodservice 645 687 754

International Beverage 2,334 1,871 1,932

International Bakery 682 607 719

5,093 4,458 4,671

Net assets held for sale 1,676 2,614 2,827

Other12,764 1,764 1,921

Total assets $9,533 $8,836 $9,419

Depreciation

North American Retail $99 $÷÷«97 $÷÷«95

North American Foodservice 40 50 41

International Beverage 95 88 91

International Bakery 22 24 25

256 259 252

Discontinued operations 35 88 109

Other 11 21 22

Total depreciation $÷«302 $÷«368 $÷«383

Additions to Long-Lived Assets

North American Retail $÷«232 $÷«163 $÷«110

North American Foodservice 28 32 47

International Beverage 157 85 100

International Bakery 17 20 20

434 300 277

Other 15 6 26

Total additions to long-lived assets $÷«449 $÷«306 $÷«303

1 Principally cash and cash equivalents, certain corporate fixed assets, deferred tax assets

and certain other noncurrent assets.

The corporation’s management uses operating segment income,

which is defined as operating income before general corporate

expenses and amortization of trademarks and customer relation-

ship intangibles, to evaluate segment performance and allocate

resources. Management believes it is appropriate to disclose this

measure to help investors analyze the business performance and

trends of the various business segments. Interest and other debt

expense, as well as income tax expense, are centrally managed,

and accordingly, such items are not presented by segment since

they are not included in the measure of segment profitability reviewed

by management. The accounting policies of the segments are the

same as those described in Note 2 to the Consolidated Financial

Statements, “Summary of Significant Accounting Policies.”

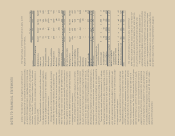

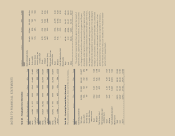

In millions 2011 2010 2009

Sales

North American Retail $2,868 $2,818 $2,767

North American Foodservice 1,566 1,547 1,776

International Beverage 3,548 3,221 3,062

International Bakery 726 785 795

8,708 8,371 8,400

Intersegment (27) (32) (34)

Total $8,681 $8,339 $8,366

Operating Segment Income (Loss)

North American Retail $÷«307 $÷«343 $÷«247

North American Foodservice 79 60 (20)

International Beverage 452 592 493

International Bakery (12) (14) (194)

Total operating segment income 826 981 526

General corporate expenses (188) (259) (225)

Mark-to-market derivative gain/(loss) 11 (13) (12)

Amortization of intangibles (22) (21) (21)

Contingent sale proceeds – 133 150

Total operating income 627 821 418

Net interest expense (85) (115) (120)

Debt extinguishment costs (55) – –

Income from continuing operations

before income taxes $÷«487 $÷«706 $÷«298

Net sales for a business segment may include sales between

segments. Such sales are at transfer prices that are equivalent

to market value. Revenues from Wal-Mart Stores Inc. represent

approximately $1.0 billion $1.0 billion and $900 million of the

corporation’s consolidated revenues for continuing operations in

2011, 2010 and 2009, respectively. Each of the corporation’s busi-

ness segments sells to this customer, except International Bakery.

114/115 Sara Lee Corporation and Subsidiaries