Sara Lee 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL REVIEW

Guarantees The corporation is a party to a variety of agreements

under which it may be obligated to indemnify a third party with respect

to certain matters. Typically, these obligations arise as a result of

contracts entered into by the corporation under which the corporation

agrees to indemnify a third party against losses arising from a breach

of representations and covenants related to such matters as title to

assets sold, the collectibility of receivables, specified environmental

matters, lease obligations assumed and certain tax matters. In each

of these circumstances, payment by the corporation is conditioned on

the other party making a claim pursuant to the procedures specified

in the contract. These procedures allow the corporation to challenge

the other party’s claims. In addition, the corporation’s obligations

under these agreements may be limited in terms of time and/or

amount, and in some cases the corporation may have recourse

against third parties for certain payments made by the corporation.

It is not possible to predict the maximum potential amount of future

payments under certain of these agreements, due to the conditional

nature of the corporation’s obligations and the unique facts and

circumstances involved in each particular agreement. Historically,

payments made by the corporation under these agreements have

not had a material effect on the corporation’s business, financial

condition or results of operations. The corporation believes that if

it were to incur a loss in any of these matters, such loss would not

have a material effect on the corporation’s business, financial

condition or results of operations.

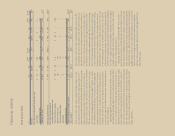

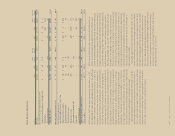

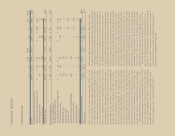

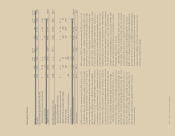

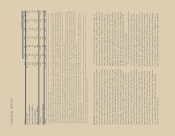

Payments Due by Fiscal Year

In millions Total 2012 2013 2014 2015 2016 Thereafter

Long-term debt $2,409 $÷«473 $÷«521 $÷20 $÷77 $405 $÷«913

Interest on debt obligations1957 96 86 73 63 52 587

Operating lease obligations 243 58 43 31 25 17 69

Purchase obligations23,420 1,732 817 384 233 186 68

Other long-term liabilities3380 75 86 75 69 42 33

Subtotal 7,409 2,434 1,553 583 467 702 1,670

Contingent lease obligations474 15 11 10 8 2 28

Total5$7,483 $2,449 $1,564 $593 $475 $704 $1,698

1 Interest obligations on floating rate debt instruments are calculated for future periods using interest rates in effect at the end of 2011. See Note 12 to the Consolidated Financial Statements

for further details on the corporation’s long-term debt.

2 Purchase obligations include expenditures to purchase goods and services in the ordinary course of business for production and inventory needs (such as raw materials, supplies, packaging,

manufacturing arrangements, storage, distribution and union wage agreements); capital expenditures; marketing services; information technology services; and maintenance and other profes-

sional services where, as of the end of 2011, the corporation has agreed upon a fixed or minimum quantity to purchase, a fixed, minimum or variable pricing arrangement and the approximate

delivery date. Future cash expenditures will vary from the amounts shown in the table above. The corporation enters into purchase obligations when terms or conditions are favorable or when a

long-term commitment is necessary. Many of these arrangements are cancelable after a notice period without a significant penalty. Additionally, certain costs of the corporation are not included

in the table since at the end of 2011 an obligation did not exist. An example of these includes situations where purchasing decisions for these future periods have not been made at the end of

2011. Ultimately, the corporation’s decisions and cash expenditures to purchase these various items will be based upon the corporation’s sales of products, which are driven by consumer demand.

The corporation’s obligations for accounts payable and accrued liabilities recorded on the balance sheet are also excluded from the table.

3 Represents the projected payment for long-term liabilities recorded on the balance sheet for deferred compensation, restructuring costs, deferred income, sales and other incentives. It also includes

the projected annual pension contribution of 32 million British pounds through 2016 related to the terms of an agreement to fully fund certain U.K. pension obligations. The corporation has employee

benefit obligations consisting of pensions and other postretirement benefits, including medical; other than the U.K. pension funding amounts, noted previously, pension and postretirement obliga-

tions, including any contingent amounts that may be due related to multi-employer pension plans, have been excluded from the table. A discussion of the corporation’s pension and postretirement

plans, including funding matters, is included in Notes 16 and 17 to the Consolidated Financial Statements. The corporation’s obligations for employee health and property and casualty losses are

also excluded from the table. Finally, the amount does not include any reserves for income taxes because we are unable to reasonably predict the ultimate amount or timing of settlement of our

reserves for income taxes. See Note 18 to the corporation’s consolidated financial statements regarding income taxes for further details.

4 Contingent lease obligations represent leases on property operated by others that only become an obligation of the corporation in the event that the owners of the businesses are unable to

satisfy the lease liability. A significant portion of these amounts relates to leases operated by Coach, Inc. At July 2, 2011, the corporation has not recognized a contingent lease liability on the

Consolidated Balance Sheets.

5 Contractual commitments and obligations identified under the accounting rules associated with accounting for contingencies are reflected and disclosed on the Consolidated Balance Sheets

and in the related notes. Amounts exclude any payments related to deferred tax balances including any tax related to future repatriation of foreign earnings. See Note 18 to the corporation’s

Consolidated Financial Statements regarding income taxes for further details.

In 2010, the corporation recognized a $26 million charge for

a tax indemnification related to the corporation’s direct selling busi-

ness that was divested in 2006. In October 2009, the Spanish tax

administration upheld the challenge made by its local field exami-

nation against tax positions taken by the corporation’s Spanish

subsidiaries. In November 2009, the corporation filed an appeal

against this claim with the Spanish Tax Court. In April 2010, the

Spanish Chief Inspector upheld a portion of the claim raised by the

Spanish tax authorities, which the corporation will appeal. The cor-

poration believes it is adequately reserved for the claim upheld by

the Spanish Chief Inspector. The corporation is currently appealing

the Court’s decision and has obtained a bank guarantee of €64

million as security against all allegations.

The material guarantees for which the maximum potential amount

of future payments can be determined, include the corporation’s

contingent liability on leases on property operated by others that

is described above, and the corporation’s guarantees of certain

third-party debt. These debt guarantees require the corporation to

make payments under specific debt arrangements in the event that

the third parties default on their debt obligations. The maximum

potential amount of future payments that the corporation could be

required to make in the event that these third parties default on

their debt obligations is approximately $12 million. At the present

time, the corporation does not believe it is probable that any of

these third parties will default on the amount subject to guarantee.