Sara Lee 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO FINANCIAL STATEMENTS

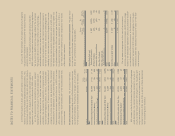

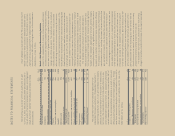

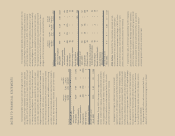

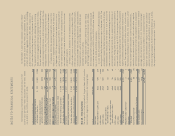

The following table summarizes the net charges taken for the exit,

disposal and Project Accelerate activities approved during 2010

and the related status as of July 2, 2011. The accrued amounts

remaining represent those cash expenditures necessary to satisfy

remaining obligations. The majority of the cash payments to satisfy

the accrued costs are expected to be paid in the next 12 months.

The corporation does not anticipate any additional material future

charges related to the 2010 actions. The composition of these

charges and the remaining accruals are summarized below.

Employee Asset and

Termination IT and Non- Business

and Other Other cancellable Disposition

In millions Benefits Costs Leases Actions Total

Exit, disposal and

other costs recognized

during 2010 $«59 $«24 $«15 $«20 $118

Charges recognized in

discontinued operations 969–24

Cash payments (22) (21) (11) – (54)

Non-cash charges (1)–––(1)

Foreign exchange impacts (5)–––(5)

Asset and business

disposition losses – – – (20) (20)

Accrued costs as of

July 3, 2010 40 9 13 – 62

Cash payments (24) (9) (5) – (38)

Change in estimate (4)–––(4)

Change in estimate recognized

in discontinued operations (1)–––(1)

Non-cash charges (5)–2–(3)

Foreign exchange impacts 3–––3

Asset and business

disposition losses –––––

Accrued costs as of

July 2, 2011 $÷«9 $÷«– $«10 $÷«– $÷19

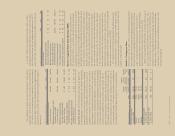

2009 Actions During 2009, the corporation approved certain

actions related to exit, disposal, transformation and Project

Accelerate activities and recognized net charges of $120 million

related to these actions. Each of these activities is to be com-

pleted within a 12-month period and include the following:

• Implemented a plan to terminate approximately 1,000 employees

primarily related to the European beverage and bakery operations

and the fresh bakery operations and corporate office group in North

America and provide them with severance benefits in accordance

with benefit plans previously communicated to the affected

employee group or with local employment laws.

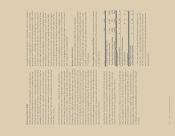

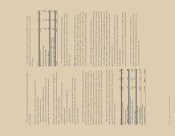

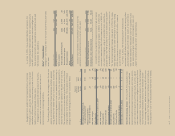

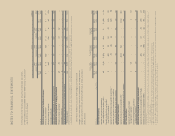

The following table summarizes the net charges taken for the

exit, disposal, Project Accelerate and spin-off activities approved

during 2011 and the related status as of July 2, 2011. The accrued

amounts remaining represent those cash expenditures necessary

to satisfy remaining obligations. The majority of the cash payments

to satisfy the accrued costs are expected to be paid in the next

12 months. Approximately $30 million to $40 million of additional

charges are expected to be recognized within the next twelve month

period related to the 2011 actions. The corporation expects to

incur total charges of approximately $425 million in 2012 related

to these restructuring actions as well as additional restructuring

and other actions associated with cost reduction efforts related to

the spin-off. See the Business Overview section of the Financial

Review for additional information.

Non-

Employee cancellable

Termination IT and Leases/

and Other Other Contractual

In millions Benefits Costs Obligations Total

Exit, disposal and

other costs recognized

during 2011 $104 $«58 $9 $«171

Charges recognized in

discontinued operations 59 38 – 97

Cash payments (40) (72) – (112)

Non-cash charges 2––2

Foreign exchange impacts 4––4

Accrued costs as of

July 2, 2011 $129 $«24 $9 $«162

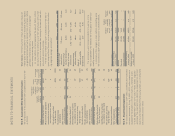

2010 Actions During 2010, the corporation approved certain

actions related to exit, disposal, and Project Accelerate activities

and recognized charges of $118 million related to these actions.

Each of these activities is to be completed within a 12-month

period after being approved and include the following:

• Recognized a charge to implement a plan to terminate

approximately 1,100 employees, primarily related to European

beverage, European bakery and North American foodservice opera-

tions, and provide them with severance benefits in accordance with

benefit plans previously communicated to the affected employee

group or with local employment laws. Of the 1,100 targeted employ-

ees, approximately 70 employees have not yet been terminated,

but are expected to be terminated within the next 12 months.

• Recognized costs associated with the transition of services

to an outside third party vendor as part of a business process

outsourcing initiative.

• Recognized a $20 million net loss associated with the

disposition of certain bakery manufacturing facilities in Spain.