Sara Lee 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

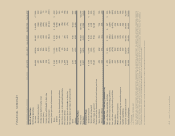

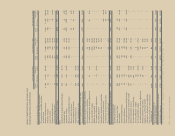

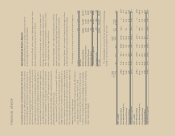

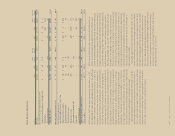

50/51 Sara Lee Corporation and Subsidiaries

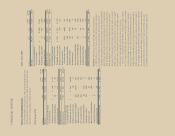

Impact of Significant Items on Income from

Continuing Operations and Net Income

Year ended July 2, 2011 Year ended July 3, 2010 Year ended June 27, 2009

Pretax Diluted EPS Pretax Diluted EPS Pretax Diluted EPS

In millions except per share data Impact Net Income Impact 1Impact Net Income Impact 1Impact Net Income Impact 1

Significant items affecting comparability

of income from continuing operations

and net income

Business outsourcing costs $÷(20) $÷(14) $(0.02) $÷(27) $÷(18) $(0.03) $÷(21) $÷(14) $(0.02)

Severance charges (1) (1) – (46) (32) (0.05) (98) (70) (0.10)

Lease exit costs – – – (14) (8) (0.01) 1 1 –

Business disposition costs – – – (20) (14) (0.02) – (4) (0.01)

Accelerated depreciation (2) (1) – (11) (7) (0.01) – – –

Total Project Accelerate charges (23) (16) (0.02) (118) (79) (0.12) (118) (87) (0.13)

Other

International stranded overhead charges (66) (47) (0.07) – – – – – –

Curtailment gain – – – 20 13 0.02 12 8 0.01

Impairment charges (21) (14) (0.02) (28) (19) (0.03) (314) (289) (0.41)

Mexican tax indemnification charge – – – (26) (26) (0.04) – – –

Balance sheet corrections – – – – – – 11 7 0.01

Gain on property dispositions – – – – – – 14 10 0.01

Spin-off related costs (76) (55) (0.09) – – – – – –

Debt extinguishment costs (55) (35) (0.06) – – – – – –

Impact of significant items on income from

continuing operations before income taxes (241) (167) (0.27) (152) (111) (0.16) (395) (351) (0.50)

Significant tax matters affecting comparability

UK net operating loss utilization – – – – 11 0.02 – – –

Tax audit settlements/reserve adjustments – 27 0.04 – 198 0.29 – 14 0.02

Tax on unremitted earnings – – – – (121) (0.18) – – –

Belgian tax proceeding – – – – (44) (0.06) – – –

Tax valuation allowance adjustment – (7) (0.01) – (5) (0.01) – – –

Tax credit adjustment – – – – 25 0.04 – – –

Deferred tax adjustment on repatriation – – – – 11 0.02 – – –

Provision expense corrections – – – – – – – (19) (0.03)

Tax benefit on foreign exchange gains – – – – – – – 29 0.04

Other tax adjustments, net – – – – 12 0.02 – (3) –

Impact on income from continuing operations (241) (147) (0.24) (152) (24) (0.04) (395) (330) (0.47)

Significant items impacting

discontinued operations

Professional fees/other (36) (28) (0.04) (35) (31) (0.04) (6) (4) –

Exit activities (59) (42) (0.07) (17) (14) (0.02) (17) (12) (0.02)

Accelerated depreciation (3) (2) – (2) (2) – – – –

Pension curtailment (4) (2) – (6) (5) (0.01) 5 4 –

Pension partial withdrawal liability charge 3 2 – (23) (15) (0.02) (31) (20) (0.03)

Licensing agreement termination charge (39) (27) (0.04) – – – – – –

Antitrust (provision)/reversal 27 18 0.03 (28) (28) (0.04) – – –

Tax basis difference – Fresh Bakery – 122 0.20 – – – – – –

Tax basis difference – H&BC –(2)– –2– –––

Tax on unremitted earnings – (6) (0.01) – (428) (0.62) – – –

Tax audit settlements/reserve adjustments – (1) – – (2) – – – –

Valuation allowance adjustment – 10 0.02 – 40 0.06 – – –

Capital loss carryforward benefit – – – – 22 0.03 – – –

Deferred tax adjustment on repatriation – – – – 9 0.01 – – –

Gain (loss) on the sale of discontinued

operations, net 1,304 736 1.18 158 84 0.12 – – –

Impact of significant items on

discontinued operations 1,193 778 1.25 47 (368) (0.53) (49) (32) (0.05)

Impact of significant items on net income

attributable to Sara Lee $«952 $«631 $«1.01 $(105) $(392) $(0.57) $(444) $(362) $(0.51)

1 The earnings per share (EPS) impact of individual amounts in the table above are rounded to the nearest $0.01 and may not add to the total.