Sara Lee 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66/67 Sara Lee Corporation and Subsidiaries

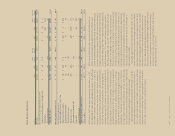

The corporation expects to contribute approximately $200 million

of cash to its pension plans in 2012 as compared to approximately

$124 million in 2011 and $273 million in 2010. The contribution

amounts are for pension plans of continuing operations and pen-

sion plans where the corporation has agreed to retain the pension

liability after certain business dispositions were completed. The

exact amount of cash contributions made to pension plans in any

year is dependent upon a number of factors, including minimum

funding requirements in the jurisdictions in which the company

operates, the timing of cash tax benefits for amounts funded and

arrangements made with the trustees of certain foreign plans. As

a result, the actual funding in 2012 may be materially different

from the estimate.

During 2006, the corporation entered into an agreement with

the plan trustee to fully fund certain U.K. pension obligations by

calendar 2015. The anticipated 2012 contributions reflect the

amounts agreed upon with the trustees of these U.K. plans. Under

the terms of this agreement, the corporation will make annual pen-

sion contributions of 32 million British pounds to the U.K. plans

through calendar 2015. Subsequent to 2015, the corporation has

agreed to keep the U.K. plans fully funded in accordance with local

funding standards. If at any time prior to January 1, 2016, Sara Lee

Corporation ceases having a credit rating equal to or greater than

all three of the following ratings, the annual pension funding of these

U.K. plans will increase by 20%: Standard & Poor’s minimum credit

rating of “BBB-,” Moody’s Investors Service minimum credit rating of

“Baa3” and FitchRatings minimum credit rating of “BBB -.” The cor-

poration’s credit ratings are currently above these levels and are

discussed below in this Liquidity section.

The corporation participates in various multi-employer pension

plans that provide retirement benefits to certain employees covered

by collective bargaining agreements (MEPP). Participating employers

in a MEPP are jointly responsible for any plan underfunding. MEPP

contributions are established by the applicable collective bargaining

agreements; however, the MEPPs may impose increased contribu-

tion rates and surcharges based on the funded status of the plan

and the provisions of the Pension Protection Act, which requires

substantially underfunded MEPPs to implement rehabilitation plans

to improve funded status. Factors that could impact funded status

of a MEPP include investment performance, changes in the partici-

pant demographics, financial stability of contributing employers and

changes in actuarial assumptions.

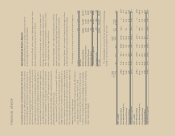

Debt The corporation’s total long-term debt decreased $220 million

in 2011, to $2,409 million at July 2, 2011. In 2011, the corporation

redeemed all of its 6.25% Notes due September 2011, of which

$1.11 billion aggregate principal amount was outstanding. The com-

pany issued $400 million 2.75% Notes due in September 2015

and $400 million 4.1% Notes due September 2020, the proceeds

of which were used to fund a portion of the redemption of the 6.25%

Notes. The remaining long-term debt of $2,409 million is due to

be repaid as follows: $473 million in 2012, $521 million in 2013,

$20 million in 2014, $77 million in 2015, $405 million in 2016

and $913 million thereafter. Debt obligations due to mature in the

next year are expected to be satisfied with cash on hand, cash

from operating activities or with additional borrowings.

From time to time, the corporation opportunistically may

repurchase or retire its outstanding debt through cash purchases

and/or exchanges for equity securities, in open market purchases,

privately negotiated transactions or otherwise. Such repurchases

or exchanges, if any, will depend on prevailing market conditions,

the corporation’s liquidity requirements, contractual restrictions

and other factors. The amounts involved could be material.

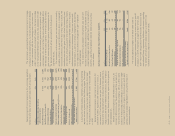

Including the impact of swaps, which are effective hedges and

convert the economic characteristics of the debt, the corporation’s

long-term debt and notes payable consist of 68.3% fixed-rate debt

as of July 2, 2011, as compared with 68.6% as of July 3, 2010. The

slight decrease in fixed-rate debt at the end of 2011 versus the

end of 2010 is due to the repayment of long-term fixed rate debt

that matured or was redeemed during the period. The corporation

monitors the interest rate environments in the geographic regions in

which it operates and modifies the components of its debt portfolio

as necessary to manage interest rate and foreign currency risks.

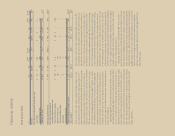

Pension Plans As shown in Note 16 to the Consolidated Financial

Statements, titled “Defined Benefit Pension Plans,” the funded

status of the corporation’s defined benefit pension plans is defined

as the amount the projected benefit obligation exceeds the plan

assets. The funded status of the plans for total continuing opera-

tions is an overfunded position of $38 million at the end of fiscal

2011 as compared to an underfunded position of $448 million

at the end of fiscal 2010.