Sara Lee 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO FINANCIAL STATEMENTS

In 2011, the North American fresh bakery operations recognized

a $122 million tax benefit associated with the excess tax basis

related to these assets.

In 2010, the household and body care operations reported

$453 million of tax expense which includes the following significant

tax amounts: i) a $428 million tax charge related to the company’s

third quarter decision to no longer reinvest overseas earnings

attributable to overseas cash and the net assets of the household

and body care businesses; ii) a $40 million tax benefit related to

the reversal of a tax valuation allowance on United Kingdom net

operating loss carryforwards as a result of the gain from the house-

hold and body care business dispositions; and iii) a $22 million

tax benefit related to the anticipated utilization of U.S. capital loss

carryforwards available to offset the capital gain resulting from the

household and body care business dispositions. Also in 2010, a

$10 million pretax curtailment loss was recognized in the results

of discontinued operations.

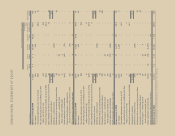

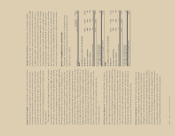

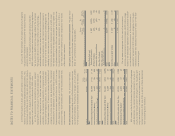

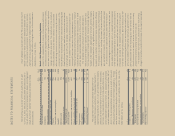

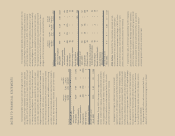

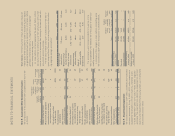

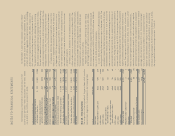

Gain (Loss) on the Sale of Discontinued Operations The gain (loss)

on the sales of discontinued operations recognized in 2011 and

2010 are summarized in the following tables.

Pretax Tax

Gain (Loss) (Charge)/ After Tax

In millions on Sale Benefit Gain (Loss)

2011

Global Body Care and

European Detergents $÷«867 $(376) $491

Air Care Products 273 (179) 94

Australia/New Zealand Bleach 48 (17) 31

Shoe Care Products 115 4 119

Other Household and

Body Care Businesses 1–1

Total $1,304 $(568) $736

2010

Godrej Sara Lee joint venture $÷«150 $÷(72) $÷78

Other 8 (2) 6

Total $÷«158 $÷(74) $÷84

The tax expense recognized on the sale of the household

and body care businesses in 2011 includes a $190 million charge

related to the anticipated repatriation of the cash proceeds received

on the disposition of these businesses. In the fourth quarter, a

repatriation tax benefit of $79 million was recognized on the gain

transactions, which was reflected in the income taxes on the shoe

care products gain.

In the fourth quarter of 2011, steps were taken to market and

dispose of the North American refrigerated dough business. This

business was classified as held for sale and reported as a discon-

tinued operation. On August 9, 2011, the corporation signed an

agreement to sell this business to Ralcorp for $545 million.

As of the end of 2011, the corporation has closed or received

binding offers for virtually all of its household and body care

businesses – body care, air care, shoe care and insecticides. The

corporation has completed the disposition of its global body care

and European detergents business, as well as, its Australia/New

Zealand bleach business. It has also completed the disposition of

a majority of its shoe care and air care businesses. The corporation

also entered into an agreement to sell its non-Indian insecticides

businesses and received a deposit on the sale. In 2010, the corpo-

ration disposed of its Godrej Sara Lee joint venture, an insecticide

business in India, which had been part of the household and body

care businesses.

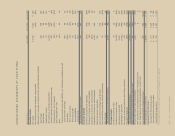

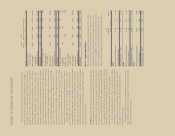

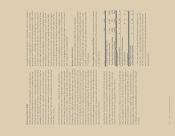

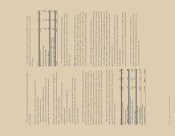

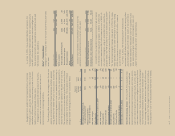

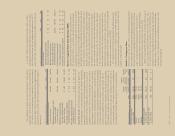

Results of Discontinued Operations The amounts in the tables

below reflect the operating results of the businesses reported as

discontinued operations. The amounts of any gains or losses related

to the disposal of these discontinued operations are excluded.

Pretax

Income Income

In millions Net Sales (Loss) (Loss)

2011

International Household and Body Care $1,078 $÷72 $÷«36

North American Fresh Bakery 2,037 58 159

North American Refrigerated Dough 307 42 27

Total $3,422 $172 $«222

2010

International Household and Body Care $2,126 $254 $(199)

North American Fresh Bakery 2,128 32 23

North American Refrigerated Dough 326 56 37

Total $4,580 $342 $(139)

2009

International Household and Body Care $2,000 $245 $«155

North American Fresh Bakery 2,200 13 10

North American Refrigerated Dough 316 47 31

Total $4,516 $305 $«196

With respect to the North American fresh bakery and refrigerated

dough businesses, the reported amounts represent a full year of

results for each year presented. With respect to the household and

body care businesses, the reported results represent less than a

full year of results in 2011 and 2010 as certain of these businesses

were sold during 2011 and 2010.