Sara Lee 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sara Lee Corporation and Subsidiaries 83

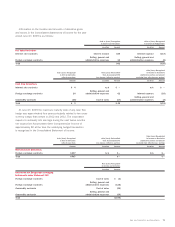

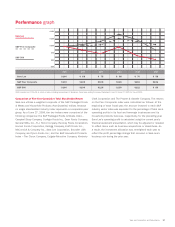

2009 2008 2007

Sales1,2

North American Retail $÷2,767 $÷2,613 $÷2,535

North American Fresh Bakery 2,200 2,028 1,856

North American Foodservice 2,092 2,186 2,165

International Beverage 3,041 3,215 2,617

International Bakery 790 929 799

International Household and Body Care 2,025 2,291 2,042

12,915 13,262 12,014

Intersegment (34) (50) (31)

Total $12,881 $13,212 $11,983

Operating Segment Income (Loss)3,4,5

North American Retail $÷÷«260 $÷÷«155 $÷÷÷«80

North American Fresh Bakery 33 60 14

North American Foodservice 54 (302) 135

International Beverage 488 547 317

International Bakery (193) (346) 38

International Household and Body Care 242 315 272

Total operating segment income 884 429 856

Amortization of trademarks

and other intangibles (65) (67) (64)

General corporate expenses – other3,4,5 (238) (254) (352)

General corporate expenses – derivatives (18) 22 2

Contingent sale proceeds 150 130 120

Total operating income 713 260 562

Net interest expense (125) (100) (133)

Income from continuing operations

before income taxes $÷÷«588 $÷÷«160 $÷÷«429

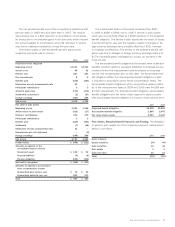

1Includes sales between segments. Such sales are at transfer prices that are equivalent

to market value.

2Revenues from Wal-Mart Stores, Inc. represent approximately $1.5 billion, $1.3 billion and $1.3 bil-

lion of the corporation’s consolidated revenues in 2009, 2008 and 2007, respectively. Each

of the corporation’s business segments sells to this customer, except International Bakery.

32009 includes amounts recognized for exit activities, asset and business dispositions, impairment

charges, transformation expenses and accelerated depreciation in the Consolidated Statements

of Income that impacted operating segment income by: North American Retail – nil; North

American Fresh Bakery – a charge of $37; North American Foodservice – a charge of $106;

International Beverage – a charge of $32; International Bakery – a charge of $245; International

Household and Body Care – a charge of $10; Corporate Office – a charge of $31.

42008 includes amounts recognized for exit activities, asset and business dispositions, impairment

charges, transformation expenses and accelerated depreciation in the Consolidated Statements

of Income that impacted operating segment income by: North American Retail – a charge of

$34; North American Fresh Bakery – a charge of $3; North American Foodservice – a charge

of $436; International Beverage – a charge of $15; International Bakery – a charge of $409;

International Household and Body Care – a charge of $7; Corporate Office – a charge of $37.

52007 includes amounts recognized for exit activities, asset and business dispositions, impairment

charges, transformation expenses and accelerated depreciation in the Consolidated Statements

of Income that impacted operating segment income by: North American Retail – a charge of

$118; North American Fresh Bakery – a charge of $42; North American Foodservice – a charge

of $11; International Beverage – a charge of $139; International Bakery – a charge of $18;

International Household and Body Care – a charge of $17; Corporate Office – a charge of $72.

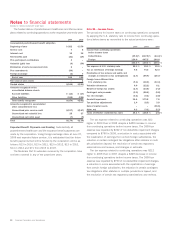

2009 2008 2007

Assets

North American Retail $1,266 $÷1,287 $÷1,197

North American Fresh Bakery 1,140 1,160 1,135

North American Foodservice 1,134 1,258 1,744

International Beverage 2,217 2,637 2,886

International Bakery 730 1,153 1,485

International Household and Body Care 2,117 2,664 2,880

8,604 10,159 11,327

Net assets held for sale –72 2

Discontinued operations – – 185

Other1813 599 241

Total assets $9,417 $10,830 $11,755

Depreciation

North American Retail $÷÷«95 $÷÷÷«92 $÷÷«117

North American Fresh Bakery 67 63 61

North American Foodservice 51 69 66

International Beverage 88 88 72

International Bakery 26 28 24

International Household and Body Care 35 34 35

362 374 375

Discontinued operations –525

Other 21 24 20

Total depreciation $÷«383 $÷÷«403 $÷÷«420

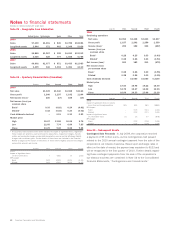

Additions to Long-Lived Assets

North American Retail $÷«110 $÷÷149 $÷÷«220

North American Fresh Bakery 58 77 58

North American Foodservice 58 70 88

International Beverage 103 142 127

International Bakery 22 26 28

International Household and Body Care 40 46 74

391 510 595

Other 17 24 51

Total additions to long-lived assets $÷«408 $÷÷«534 $÷÷«646

1Principally cash and cash equivalents, certain corporate fixed assets, deferred tax assets

and certain other noncurrent assets.