Sara Lee 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

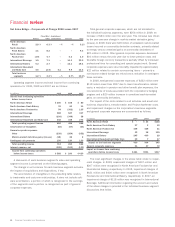

Financial review

30 Sara Lee Corporation and Subsidiaries

2009 versus 2008

Net sales decreased by $174 million, or 5.4%.

The impact of foreign currency changes, particularly in the European

euro, Brazilian real, Australian dollar, and British pound, decreased

reported net sales by $284 million, or 9.1%. Acquisitions net of

dispositions after the start of 2008 increased sales by $37 million,

or 1.2%. The remaining increase in net sales of $73 million, or 2.5%

resulted from price increases to offset higher commodity costs, a

favorable sales mix shift, and increased green coffee export sales

in Brazil, which were partially offset by lower unit volumes. Pricing

actions represented approximately 2% of the overall increase in

net sales. Unit volumes decreased 2.8% due to declines in the

retail channel in both Europe and Brazil. Retail volumes in Europe

decreased due to volume declines in traditional roast and ground

due in part to competitive pressures from private label and hard

discounters as well as the weak economic conditions throughout

Europe, partially offset by growth in single serve coffee in France

and Germany. Unit volumes declined in Brazil due in part to price

increases. Unit volumes in the foodservice channel decreased

slightly due in part to a decline in liquid coffee concentrates.

Operating segment income decreased by $59 million, or 10.8%.

Changes in foreign currency exchange rates decreased operating

segment income by $40 million, or 7.2%. The net impact of the

change in exit activities, asset and business dispositions, transfor-

mation/Accelerate charges, and accelerated depreciation decreased

operating segment income by $43 million. Operating results were

favorably impacted by a $12 million curtailment gain related to

postretirement benefit plan changes and a $14 million gain on the

disposition of property. Acquisitions made after the start of 2008,

increased operating segment income by $2 million. The remaining

operating segment income decrease of $4 million, or 0.7% was

due to the impact of higher green coffee costs, the decline in unit

volumes and higher manufacturing costs, partially offset by pricing

actions, a favorable shift in sales mix, and the benefits of continuous

improvement programs.

2008 versus 2007

Net sales increased by $598 million, or 22.9%.

The impact of changes in foreign currency exchange rates, particularly

in the European euro and Brazilian real, increased reported net sales

by $347 million, or 14.3%, while a disposition decreased sales

by $2 million. The remaining net sales increase of $253 million,

or 8.6%, was due to the impact of pricing actions, a favorable sales

mix into higher priced single serve products and concentrates, and

an increase in unit volumes. Net unit volumes increased 1.5% with

increases in both the retail and foodservice sectors. In the retail

channel, volume growth was driven by increases in single-serve

products, especially in France and the Netherlands, and in instant

coffees. Unit volume growth in the foodservice channel was driven

by increased sales of liquid coffee concentrates.

Operating segment income increased by $230 million, or 72.8%.

Changes in foreign currency exchange rates increased operating

segment income by $59 million, or 14.2%. The net impact of the

change in exit activities, asset and business dispositions, transfor-

mation charges, depreciation and impairment charges increased

operating segment income by $124 million, or 49.4%. The remaining

operating segment income increase of $47 million, or 9.2%, was

due to the favorable impact of price increases, higher unit volumes

and the benefits of continuous improvement programs, which were

partially offset by higher green coffee and packaging costs and

an increase in SG&A costs due to higher labor costs to support

general growth in the business.

International Beverage

Dollar Percent Dollar Percent

In millions 2009 2008 Change Change 2008 2007 Change Change

Net sales $3,041 $3,215 $(174) (5.4) % $3,215 $2,617 $598 22.9 %

Increase/(decrease) in net sales from

Changes in foreign currency exchange rates $«««««««– $«««284 $(284) $÷÷÷«– $÷(347) $347

Acquisitions/dispositions 45 8 37 – 2 (2)

Total $«««««45 $«««292 $(247) $÷÷÷«– $÷(345) $345

Operating segment income $«««488 $«««547 $««(59) (10.8) % $÷«547 $÷«317 $230 72.8 %

Increase/(decrease) in operating segment income from

Changes in foreign currency exchange rates $«««««««– $«««««40 $««(40) $÷÷÷«– $÷÷(59) $÷59

Exit activities, asset and business dispositions (50) (4) (46) (4) (12) 8

Transformation/Accelerate charges (8) (10) 2 (10) (8) (2)

Curtailment gain 12–12 –––

Impairment charge – – – – (118) 118

Accelerated depreciation – (1) 1 (1) (1) –

Gain on property disposition 14–14 –––

Acquisitions/dispositions 2–2 –––

Total $««««(30) $«««««25 $««(55) $÷÷(15) $÷(198) $183

Gross margin % 40.0 % 41.4 % (1.4) % 41.4 % 43.0 % (1.6) %