Sara Lee 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business Sold in 2008

Mexican Meats

In March 2008, the corporation completed the

disposition of its investment in its Mexican meats operation as it

wanted to more closely focus on its core brands in the U.S. The

corporation recognized a pretax loss of $23 and an after tax loss

of $24. A total of $55 of cash proceeds was received from the

disposition of the business. The Mexican meats operation had

been reported in the North American Retail segment.

Businesses Sold in 2007

European Meats

In June 2006, the corporation entered into a

definitive agreement to sell its European Meats business. The

transaction closed in August 2006 after receiving European regula-

tory approval and the corporation recognized a pretax and after tax

gain of $18 and $17, respectively. The capital gain related to this

transaction was offset by capital losses on other disposition trans-

actions. A total of $337 of cash proceeds was received from the

disposition of the business and an additional $238 was received

from the repayment of an obligation to the corporation, which was

included in the net assets sold.

The corporation has not had any significant continuing involve-

ment in the business after the disposal date and does not expect

any material direct cash inflows or outflows with the sold entity.

Branded Apparel Americas/Asia

In February 2005, as part of its

transformation plan, the corporation announced its intent to spin

off the corporation’s apparel business in the Americas/Asia. This

business is referred to as Branded Apparel Americas/Asia. In prepa-

ration for the spin off, the corporation incorporated Hanesbrands

Inc., a Maryland corporation to which it transferred the assets and

liabilities that relate to the Branded Apparel Americas/Asia busi-

ness. On September 5, 2006, Hanesbrands borrowed $2,600 from

a group of banks. Net of loan origination fees, Hanesbrands received

$2,558 of cash proceeds. Using a portion of the proceeds received

from the borrowing, Hanesbrands paid a dividend of $1,950 to the

corporation. Immediately following this dividend payment, Sara Lee

distributed to each stockholder of record one share of Hanesbrands

common stock for every eight shares of Sara Lee common stock

held. The spin off was tax free on a U.S. tax basis to the corpora-

tion and its shareholders.

After the spin off was completed, Hanesbrands paid $450

to the corporation to settle the note payable it had with Sara Lee

Corporation. In addition, the corporation recognized as expense

$23 of investment banker and other fees as a direct result of this

transaction. The after tax loss recognized on these fees was $17.

These amounts are recognized as part of the net gain on disposal

of discontinued operations in 2007. The corporation has no signifi-

cant continuing involvement in this business after the disposal date

and does not expect any material direct cash inflows or outflows

with this business.

Subsequent to the spin off date, the corporation has completed

certain postclosing adjustments, tax reporting and other postclosing

reconciliations in various areas, including completing the split of

the corporation’s pension plans and the determination under ERISA

rules of the relevant asset split to each plan. The net assets of the

Hanesbrands business distributed were $29 and this amount is

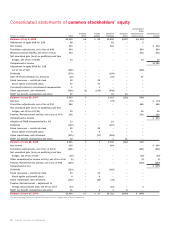

reflected as a dividend in the corporation’s Consolidated Statements

of Common Stockholders’ Equity.

Philippines Portion of European Branded Apparel

Substantially all of

the European Branded Apparel business was sold in February 2006.

When this business was sold, certain operations in the Philippines

were awaiting local governmental approval to legally transfer the

assets. Under the terms of the sale agreement, the buyer of this

business assumed financial responsibility for all of the operations,

including the Philippines business, even though legal transfer of the

Philippines assets had not been completed. In September 2006,

upon receiving local government approval, the corporation completed

the legal transfer of the assets and recognized in 2007 a pretax

and after tax gain of $8 and $6, respectively. Under the terms of

the sale agreement of the business, the buyer assumed financial

responsibility for the Philippines business in February 2006 upon

the initial closing of the sale transaction. As such, no financial

results for the Philippines business are included in the results

of the corporation after that date.

The corporation has no significant continuing involvement in this

business after the disposal date and does not expect any material

direct cash inflows or outflows with the sold entity.

Other

During 2007, the corporation completed certain postclosing

adjustments which included certain working capital adjustments

related to the assets transferred, finalized certain related tax report-

ing and completed certain financial and tax reporting adjustments

related to the U.K. Apparel and Direct Selling businesses that were

sold in 2006. As a result of these adjustments, the corporation

recognized a pretax and after tax gain in discontinued operations

of $2 and $10, respectively.

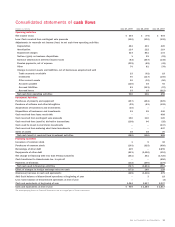

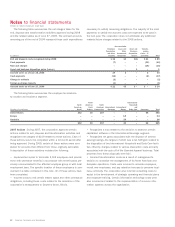

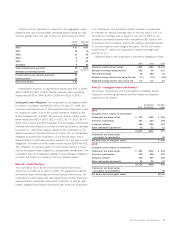

Discontinued Operations Cash Flows The corporation’s discontinued

operations impacted the cash flows of the corporation as summarized

in the table below.

2008 2007

Discontinued operations impact on

Cash from operating activities $10 $«88

Cash from investing activities (8) (47)

Cash from financing activities (5) (56)

Net cash impact of discontinued operations $«(3) $(15)

Cash balance of discontinued operations

At start of period $««3 $«18

At end of period –3

Decrease in cash of discontinued operations $«(3) $(15)

Sara Lee Corporation and Subsidiaries 59