Sara Lee 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial review

28 Sara Lee Corporation and Subsidiaries

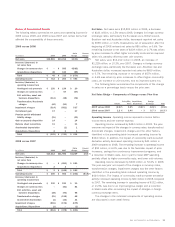

2009 versus 2008

Net sales increased by $172 million, or 8.5%.

The increase in net sales was primarily attributable to positive pricing

actions to cover higher wheat and other input costs, which increased

net sales by approximately 6%, and an increase in unit volumes. Unit

volumes increased 3.2% due to higher unit volumes for both branded

and non-branded fresh bakery products. The increase in branded

products was due in part to increased promotional activity. The

increase in non-branded unit volumes was due to a net gain in new

private label customers versus the prior year and an increasing shift

to private label due to the weak economic conditions partially offset

by a decline in sales to restaurant and institutional customers.

Operating segment income decreased by $27 million, or 45.5%.

Operating segment income was negatively impacted by a $31 million

charge to recognize a partial withdrawal liability related to a multi-

employer pension plan as well as an increase in exit activities and

transformation/Accelerate charges. The remaining operating segment

income increase of $7 million, or 10.8%, was attributable to the

benefit of price increases, unit volume gains, and savings from

continuous improvement programs. These increases were partially

offset by higher costs for key ingredients and wages; an unfavor-

able sales mix shift to lower margin private label products; higher

SG&A costs driven by higher sales commissions, and higher labor,

other employee benefits and administrative costs; and the negative

impact of nonrecurring gains from the early termination of certain

commodity contracts in the prior year.

2008 versus 2007

Net sales increased $172 million, or 9.3% over

2007. The increase in net sales was attributable to positive pricing

actions to cover higher commodity costs and higher unit volumes.

Net unit volumes increased 1.1% due to an increase in unit volumes

for both branded and non-branded fresh bakery products. Net sales

of Sara Lee branded products increased 19% versus the prior year.

Operating segment income increased by $46 million in 2008.

The net impact of the change in exit activities, asset and business

dispositions, transformation charges, impairment charges and

accelerated depreciation increased operating segment income

by $39 million. The remaining operating segment income increase

of $7 million, or 13.6%, was due to the benefits of price increases,

nonrecurring gains from the early termination of certain commodity

contracts and savings from continuous improvement programs.

These benefits were offset somewhat by higher costs for key

ingredients and wages, and higher SG&A costs driven primarily

by labor, fuel, and selling expenses.

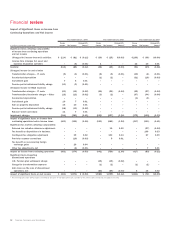

North American Fresh Bakery

Dollar Percent Dollar Percent

In millions 2009 2008 Change Change 2008 2007 Change Change

Net sales $2,200 $2,028 $172 8.5 % $2,028 $1,856 $172 9.3 %%

Operating segment income $÷«««33 $«««««60 $«(27) (45.5) % $«««««60 $«««««14 $««46 NM

Increase/(decrease) in operating segment income from

Exit activities, asset and business dispositions $÷««««(5) $÷««««(3) $«««(2) $««««««(3) $««««««(4) $««««1

Transformation/Accelerate charges (1) – (1) – (20) 20

Impairment charge – – – – (16) 16

Pension partial withdrawal liability charge (31) – (31) – – –

Accelerated depreciation ––– –(2)2

Total $««««(37) $««««««(3) $«(34) $««««««(3) $««««(42) $««39

Gross margin % 45.3 % 47.2 % (1.9) % 47.2 % 47.5 % (0.3) %%