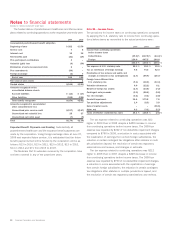

Sara Lee 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

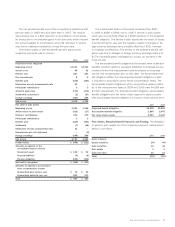

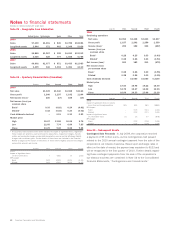

The net periodic benefit cost of the corporation’s defined benefit

pension plans in 2008 was $34 lower than in 2007. The decline

was primarily due to a $28 reduction in amortization of net actuar-

ial losses due to net actuarial gains in the prior year, which reduced

the amount subject to amortization; and a $6 reduction in service

cost due to headcount reductions versus the prior year.

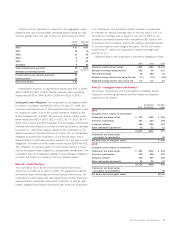

The funded status of defined benefit pension plans at the

respective year-ends was as follows:

2009 2008

Projected benefit obligation

Beginning of year $4,744 $4,926

Service cost 66 91

Interest cost 257 267

Plan amendments 26

Benefits paid (225) (241)

Elimination of early measurement date 32 –

Participant contributions 33

Actuarial (gain) loss (179) (476)

Settlement/curtailment (2) (87)

Foreign exchange (480) 255

End of year 4,218 4,744

Fair value of plan assets

Beginning of year 4,423 4,346

Actual return on plan assets (315) (27)

Employer contributions 306 175

Participant contributions 33

Benefits paid (225) (241)

Settlement (3) (88)

Elimination of early measurement date 22 –

Hanesbrands spin off adjustment –(3))

Foreign exchange (459) 258

End of year 3,752 4,423

Funded status $÷(466) $÷(321)

Amounts recognized on the

consolidated balance sheets

Noncurrent asset $÷«133 $÷÷«93

Accrued liabilities (4) (9)

Pension obligation (595) (405)

Net liability recognized $÷(466) $÷(321)

Amounts recognized in accumulated

other comprehensive income

Unamortized prior service cost $÷÷«74 $÷÷«93

Unamortized actuarial loss, net 883 570

Total $÷«957 $÷«663

The underfunded status of the plans increased from $321

in 2008 to $466 in 2009, due to a $671 decline in plan assets

which was only partially offset by a $526 reduction in the projected

benefit obligation. The decline in plan assets was the result of losses

incurred during the year and the negative impact of changes in for-

eign currency exchange rates, partially offset by a $131 increase

in employer contributions. The decline in the projected benefit obli-

gation was due to changes in foreign currency exchange rates and

$179 of actuarial gains resulting from, in part, an increase in the

discount rate.

The accumulated benefit obligation is the present value of pension

benefits (whether vested or unvested) attributed to employee service

rendered before the measurement date and based on employee

service and compensation prior to that date. The accumulated ben-

efit obligation differs from the projected benefit obligation in that

it includes no assumption about future compensation levels. The

accumulated benefit obligations of the corporation’s pension plans

as of the measurement dates in 2009 and 2008 were $4,089 and

$4,543, respectively. The projected benefit obligation, accumulated

benefit obligation and fair value of plan assets for pension plans

with accumulated benefit obligations in excess of plan assets were:

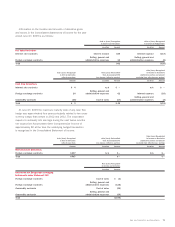

2009 2008

Projected benefit obligation $2,878 $3,009

Accumulated benefit obligation 2,809 2,945

Fair value of plan assets 2,283 2,603

Plan Assets, Expected Benefit Payments and Funding The allocation

of pension plan assets as of the respective year-end measurement

dates is as follows:

2009 2008

Asset category

Equity securities 24% 40%

Debt securities 63 46

Real estate 32

Cash and other 10 12

Total 100% 100%

Sara Lee Corporation and Subsidiaries 77