Sara Lee 2009 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial review

18 Sara Lee Corporation and Subsidiaries

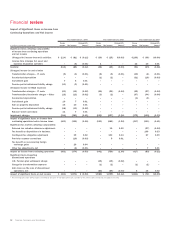

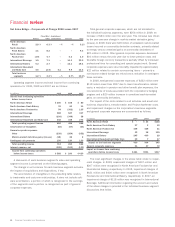

Impact of Significant Items on Income from

Continuing Operations and Net Income

Year ended June 27, 2009 Year ended June 28, 2008 Year ended June 30, 2007

Pretax Diluted EPS Pretax Diluted EPS Pretax Diluted EPS

In millions except per share data Impact Net Income Impact 1Impact Net Income Impact 1Impact Net Income Impact 1

Significant items affecting comparability

of income from continuing operations

and net income

(Charges for) income from exit activities $÷(114) $÷(81) $÷(0.12) $÷(39) $÷(25) $(0.03) $(106) $÷(69) $(0.09)

Income from (charges for) asset and

business disposition activities – (4) (0.01) 1 – – 12 10 0.01

Subtotal (114) (85) (0.12) (38) (25) (0.03) (94) (59) (0.08)

(Charges) income in cost of sales

Transformation charges – IT costs (5) (3) (0.01) (8) (5) (0.01) (10) (6) (0.01)

Accelerated depreciation – – – (1) (1) – (31) (19) (0.03)

Curtailment gain 750.01 ––– –––

Pension partial withdrawal liability charge (13) (9) (0.01) – – – – – –

(Charges) income in SG&A expenses

Transformation charges – IT costs (21) (15) (0.02) (40) (26) (0.04) (42) (27) (0.04)

Transformation/Accelerate charges – Other (18) (12) (0.02) (3) (2) – (67) (44) (0.06)

Accelerated depreciation ––– ––– (1)(1)–

Curtailment gain 1070.01 ––– –––

Gain on property disposition 14 10 0.01 – – – – – –

Pension partial withdrawal liability charge (18) (11) (0.02) – – – – – –

Balance sheet corrections 1170.01 ––– –––

Impairment charges (314) (289) (0.41) (851) (827) (1.16) (172) (145) (0.19)

Impact of significant items on income from

continuing operations before income taxes (461) (395) (0.56) (941) (886) (1.24) (417) (301) (0.41)

Significant tax matters affecting comparability

Deferred tax valuation allowance adjustment – – – – 19 0.03 – (27) (0.04)

Tax benefit on disposition of a business – – – – – – – 169 0.23

Contingent tax obligation adjustment – 15 0.02 – 103 0.14 – 67 0.09

Provision expense corrections – (19) (0.03) – 5 0.01 – – –

Tax benefit on non-recurring foreign

exchange gains –290.04 ––– –––

Other tax adjustments, net – (4) (0.01) – – – – 7 0.01

Impact on income from continuing operations (461) (374) (0.53) (941) (759) (1.06) (417) (85) (0.12)

Significant items impacting

discontinued operations

U.K. Pension plan settlement charge – – – (15) (15) (0.02) – – –

Charge for transformation expenses – – – (1) (1) – (1) (1) –

Gain (loss) on the sale of discontinued

operations, net – – – (23) (24) (0.03) 5 16 0.02

Impact of significant items on net income $÷(461) $(374) $««(0.53) $(980) $(799) $(1.12) $(413) $÷(70) $(0.09)

1The earnings per share (EPS) impact of individual amounts in the table above are rounded to the nearest $0.01 and may not add to the total.