Sara Lee 2009 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sara Lee Corporation and Subsidiaries 29

2009 versus 2008

Net sales decreased by $94 million, or 4.3%.

Changes in foreign currency, primarily the Canadian dollar,

decreased net sales by $5 million. Dispositions after the start

of 2008 reduced net sales by $108 million. The remaining net

sales increase of $19 million, or 0.9% was due to higher product

pricing to cover the increase in key raw material costs across all

categories. The positive pricing actions increased sales by approxi-

mately 5%. These increases were partially offset by unit volume

declines for beverage, meat and bakery products. Overall net unit

volumes decreased 4.2%. The decline in beverage volumes was

driven by softness in traditional roast and ground and other coffee

products due to competitive and economic pressures, while the

decline in meat volumes was driven in part by the planned exit

of certain lower margin business as well as demand softness.

A slight decline in volumes for bakery products was driven by

volume softness in foodservice pizza dough offset by growth in

refrigerated dough and frozen bakery products.

Operating segment income increased by $356 million due to

a $324 million reduction in impairment charges. A $107 million

impairment charge related to goodwill associated with the beverage

business was recorded in the current year and a $431 million

impairment charge related to goodwill and fixed assets in the

foodservice bakery and beverage businesses was recorded in the

prior year. The net impact of the change in exit activities, asset

and business dispositions increased operating segment income by

$6 million. Dispositions after the start of 2008 reduced operating

segment income by $2 million. The remaining operating segment

income increase of $28 million, or 21.2% was due to the favorable

impact of pricing actions, continuous improvement savings and lower

SG&A costs, which were only partially offset by higher commodity

and labor costs and lower unit volumes.

2008 versus 2007

Net sales increased $21 million, or 1.0% over

2007. Changes in foreign currency exchange rates, primarily the

Canadian dollar, increased net sales by $4 million, or 0.2%. The

remaining net sales increase of $17 million, or 0.8%, was due to

selected price increases to cover higher commodity costs and an

improved product mix related to beverage products partially offset

by a 3.9% decline in unit volumes. Net unit volumes decreased

as a result of volume declines for meat and beverage products

partially offset by higher volumes for private label bakery products.

The volume declines were due in part to the planned exit of certain

low-margin meats, sauces and dressing products, and overall

volume softness due to competitive and economic pressures.

Operating segment income decreased by $437 million versus

the prior year. The net change in exit activities, asset and business

dispositions, transformation charges, impairment charges and

depreciation decreased operating segment income by $425 million.

This change included $431 million of impairment charges related

to goodwill and fixed assets in the foodservice bakery and beverage

businesses. The remaining operating segment income decline of

$12 million, or 9.2%, was due to higher commodity and overhead

costs as well as lower unit volumes, partially offset by pricing actions,

and savings from continuous improvement initiatives.

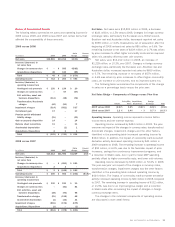

North American Foodservice

Dollar Percent Dollar Percent

In millions 2009 2008 Change Change 2008 2007 Change Change

Net sales $2,092 $2,186 $««(94) (4.3) % $2,186 $2,165 $«««21 1.0 %

Increase/(decrease) in net sales from

Changes in foreign currency exchange rates $«««««««– $«««««««5 $««««(5) $«««««««– $««««««(4) $«««««4

Dispositions – 108 (108) – – –

Total $«««««««– $«««113 $(113) $«««««««– $««««««(4) $«««««4

Operating segment income (loss) $«««««54 $««(302) $«356 NM $««(302) $«««135 $(437) NM

Increase/(decrease) in operating segment income (loss) from

Exit activities, asset and business dispositions $«««««««1 $««««««(5) $«««««6 $««««««(5) $««««««(7) $«««««2

Transformation/Accelerate charges ––– –(3)3

Impairment charge (107) (431) 324 (431) – (431)

Disposition –2(2) –––

Accelerated depreciation ––– –(1)1

Total $««(106) $««(434) $«328 $÷(436) $÷÷(11) $(425)

Gross margin % 25.5 % 25.0 % 0.5 % 25.0 % 26.4 % (1.4) %%