Sara Lee 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

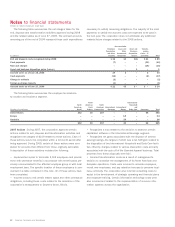

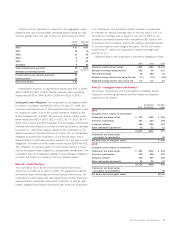

Future minimum payments, by year and in the aggregate, under

capital leases and noncancelable operating leases having an origi-

nal term greater than one year at June 27, 2009 were as follows:

Capital Operating

Leases Leases

2010 $«27 $101

2011 18 75

2012 13 52

2013 635

2014 325

Thereafter 586

Total minimum lease payments 72 $374

Amounts representing interest (12)

Present value of net minimum payments 60

Current portion 19

Noncurrent portion $«41

Depreciation expense of capital lease assets was $22 in 2009,

$20 in 2008 and $27 in 2007. Rental expense under operating

leases was $143 in 2009, $146 in 2008 and $130 in 2007.

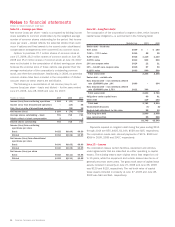

Contingent Lease Obligation The corporation is contingently liable

for leases on property operated by others. At June 27, 2009, the

maximum potential amount of future payments the corporation could

be required to make, if all of the current operators default on the

rental arrangements, is $135. The minimum annual rentals under

these leases are $28 in 2010, $22 in 2011, $17 in 2012, $14 in

2013, $12 in 2014 and $42 thereafter. The two largest components

of these amounts relate to a number of retail store leases operated

by Coach, Inc. and certain leases related to the corporation’s U.K.

Apparel operations that have been sold. Coach, Inc. is contractually

obligated to provide the corporation, on an annual basis, with a

standby letter of credit approximately equal to the next year’s rental

obligations. The letter of credit in place at the close of 2009 was $12.

This obligation to provide a letter of credit expires when the corpo-

ration’s contingent lease obligation is substantially extinguished. The

corporation has not recognized a liability for the contingent obligation

on either the Coach, Inc. leases or the U.K. Apparel leases.

Note 14 – Credit Facilities

The corporation has a $1.85 billion credit facility that had an

annual fee of 0.08% as of June 27, 2009. This agreement supports

commercial paper borrowings and other financial instruments. The

corporation’s credit facility and debt agreements contain customary

representations, warranties and events of default, as well as, affir-

mative, negative and financial covenants with which the corporation

is in compliance. One financial covenant includes a requirement

to maintain an interest coverage ratio of not less than 2.0 to 1.0.

The interest coverage ratio is based on the ratio of EBIT to con -

solidated net interest expense with consolidated EBIT equal to net

income plus interest expense, income tax expense, and extraordinary

or non-recurring non-cash charges and gains. For the 12 months

ended June 27, 2009, the corporation’s interest coverage ratio

was 8.4 to 1.0.

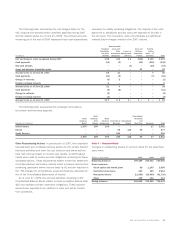

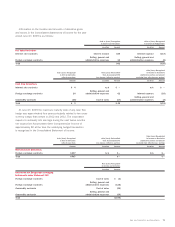

Selected data on the corporation’s short-term obligations follow:

2009 2008 2007

Maximum month-end borrowings $469 $280 $1,348

Average borrowings during the year 291 56 271

Year-end borrowings 20 280 23

Weighted average interest rate during the year 3.7% 3.9% 5.2%

Weighted average interest rate at year-end 6.7 3.1 3.9

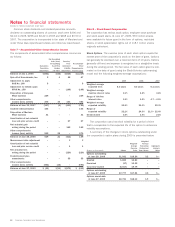

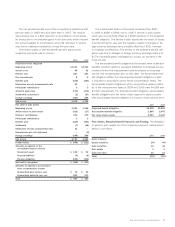

Note 15 – Intangible Assets and Goodwill

The primary components of the corporation’s intangible assets

reported in continuing operations and the related amortization

expense are as follows:

Accumulated Net Book

Gross Amortization Value

2009

Intangible assets subject to amortization

Trademarks and brand names $÷«703 $322 $÷«381

Customer relationships 427 229 198

Computer software 385 258 127

Other contractual agreements 32 21 11

$1,547 $830 717

Trademarks and brand names

not subject to amortization 89

Net book value of intangible assets $÷«806

2008

Intangible assets subject to amortization

Trademarks and brand names $÷«864 $331 $÷«533

Customer relationships 440 208 232

Computer software 394 244 150

Other contractual agreements 32 21 11

$1,730 $804 926

Trademarks and brand names

not subject to amortization 95

Net book value of intangible assets $1,021

Sara Lee Corporation and Subsidiaries 67