Sara Lee 2009 Annual Report Download - page 57

Download and view the complete annual report

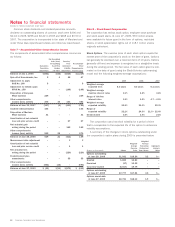

Please find page 57 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Goodwill Goodwill is the difference between the purchase price

and the fair value of the assets acquired and liabilities assumed in

a business combination. When a business combination is completed,

the assets acquired and liabilities assumed are assigned to the

reporting unit or units of the corporation given responsibility for

managing, controlling and generating returns on these assets and

liabilities. Reporting units are business components at or one level

below the operating segment level for which discrete financial infor-

mation is available and reviewed by segment management. In many

instances, all of the acquired assets and liabilities are assigned

to a single reporting unit and in these cases all of the goodwill is

assigned to the same reporting unit. In those situations in which

the acquired assets and liabilities are allocated to more than one

reporting unit, the goodwill to be assigned to each reporting unit

is determined in a manner similar to how the amount of goodwill

recognized in the business combination is determined.

Goodwill is not amortized; however, it is assessed for impairment

at least annually and as triggering events may occur. The corpora-

tion performs its annual review in the second quarter of each year.

Recoverability of goodwill is evaluated using a two-step process.

The first step involves a comparison of the fair value of a reporting

unit with its carrying value. If the carrying value of the reporting unit

exceeds its fair value, the second step of the process is necessary

and involves a comparison of the implied fair value and the carrying

value of the goodwill of that reporting unit. If the carrying value of

the goodwill of a reporting unit exceeds the implied fair value of

that goodwill, an impairment loss is recognized in an amount equal

to the excess.

In evaluating the recoverability of goodwill, it is necessary

to estimate the fair values of the reporting units. In making this

assessment, management relies on a number of factors to discount

anticipated future cash flows, including operating results, business

plans and present value techniques. In 2009, the fair value of

goodwill is estimated based on a discounted cash flow model using

management’s business plans and projections as the basis for

expected future cash flows for the first ten years and a 2% residual

growth rate thereafter. Management believes the assumptions used

for the impairment test are consistent with those utilized by a market

participant performing similar valuations for our reporting units. A

separate discount rate derived from published sources was utilized

for each reporting unit and, on a weighted average basis, the dis-

count rate used was 8.9%. Rates used to discount cash flows are

dependent upon interest rates, market-based risk premium and the

cost of capital at a point in time. Because some of the inherent

assumptions and estimates used in determining the fair value of

these reporting units are outside the control of management, includ-

ing interest rates, market-based risk premium, the cost of capital,

and tax rates, changes in these underlying assumptions and our

credit rating can also adversely impact the business units’ fair values.

The amount of any impairment is dependent on these factors, which

cannot be predicted with certainty.

Exit and Disposal Activities Exit and disposal activities primarily

consist of various actions to sever employees, exit certain contractual

obligations and dispose of certain assets. Charges are recognized

for these actions at their fair value in the period in which the liabil-

ity is incurred. Adjustments to previously recorded charges resulting

from a change in estimated liability are recognized in the period in

which the change is identified. Our methodology used to record

these charges is described below.

Severance

Severance actions initiated by the corporation are

generally covered under previously communicated benefit arrange-

ments under GAAP, which provides for termination benefits in the

event that an employee is involuntarily terminated. Liabilities are

recorded under these arrangements when it is probable that employ-

ees will be entitled to benefits and the amount can be reasonably

estimated. This occurs when management with the appropriate

level of authority approves an action to terminate employees who

have been identified and targeted for termination within one year.

Noncancelable Lease and Contractual Obligations

Liabilities are

incurred for noncancelable lease and other contractual obligations

when the corporation terminates the contract in accordance with

contract terms or when the corporation ceases using the right con-

veyed by the contract or exits the leased space. The charge for these

items is determined based on the fair value of remaining lease

rentals reduced by the fair value of estimated sublease rentals that

could reasonably be obtained for the property, estimated using an

expected present value technique.

Other

For other costs associated with exit and disposal activities,

a charge is recognized at its fair value in the period in which the

liability is incurred, estimated using an expected present value tech-

nique, generally when the services are rendered.

Stock-Based Compensation The corporation recognizes the cost

of employee services received in exchange for awards of equity

instruments based upon the grant date fair value of those awards.

Income Taxes As a global commercial enterprise, the corporation’s

tax rate from period to period is affected by many factors. The most

significant of these factors includes changes in tax legislation, the

global mix of earnings, the tax characteristics of the corporation’s

income, the timing and recognition of goodwill impairments, acqui -

sitions and dispositions and the portion of the income of foreign

subsidiaries that is expected to be repatriated to the U.S. and be

taxable. In addition, the corporation’s tax returns are routinely audited

and finalization of issues raised in these audits sometimes affects

the tax provision. It is reasonably possible that tax legislation in the

jurisdictions in which the corporation does business may change in

future periods. While such changes cannot be predicted, if they occur,

the impact on the corporation’s tax assets and obligations will need

to be measured and recognized in the financial statements.

Sara Lee Corporation and Subsidiaries 55