Sara Lee 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

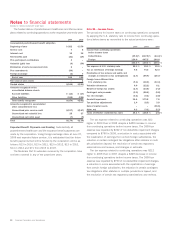

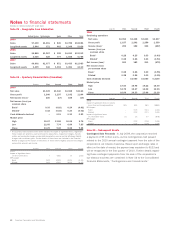

Notes to financial statements

Dollars in millions except per share data

82 Sara Lee Corporation and Subsidiaries

Due to the inherent complexities arising from the nature of the

company’s businesses, and from conducting business and being

taxed in a substantial number of jurisdictions, significant judgments

and estimates are required to be made. Agreement of tax liabilities

between Sara Lee Corporation and the many tax jurisdictions in

which the company files tax returns may not be finalized for several

years. Thus, the company’s final tax-related assets and liabilities

may ultimately be different from those currently reported.

Our total unrecognized tax benefits that, if recognized, would

affect our effective tax rate were $418 as of June 27, 2009. This

amount differs from the balance of unrecognized tax benefits as of

June 27, 2009 primarily due to uncertain tax positions that created

deferred tax assets in jurisdictions which have not been realized due

to a lack of profitability in the respective jurisdictions. At this time,

the corporation estimates that it is reasonably possible that the lia-

bility for unrecognized tax benefits will decrease by approximately

$100 – $160 in the next 12 months from a variety of uncertain tax

positions as a result of the completion of various worldwide tax

audits currently in process and the expiration of the statute of

limitations in several jurisdictions.

The company recognizes interest and penalties related to

unrecognized tax benefits in tax expense. During the years ended

June 27, 2009 and June 28, 2008, the corporation recognized

$15 and $2, respectively, of interest and penalties in tax expense.

As of June 27, 2009 and June 28, 2008, the corporation had

accrued interest and accrued penalties of approximately $111 and

$96, respectively.

The corporation’s tax returns are routinely audited by federal, state

and foreign tax authorities and these audits are at various stages

of completion at any given time. The Internal Revenue Service (IRS)

has completed examinations of the company’s U.S. income tax returns

through July 3, 2004. Fiscal years remaining open to examination in

the Netherlands include 2003 and forward. Other foreign jurisdictions

remain open to audits ranging from 1999 forward. With few excep-

tions, the company is no longer subject to state and local income

tax examinations by tax authorities for years before June 28, 2003.

In addition, in July 2009, the Spanish tax authorities announced

a challenge against tax positions claimed by the corporation’s Spanish

subsidiaries for fiscal years 2003 through 2005. We are disputing

their challenge and will continue to have further proceedings with

the Spanish tax authorities regarding this issue. There is a reason-

able possibility that the ultimate resolution will be higher or lower

than the amounts reserved.

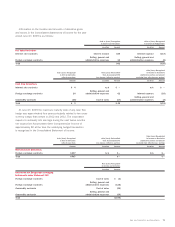

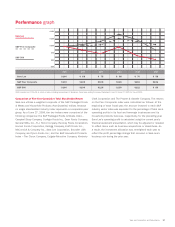

The following table presents a reconciliation of the beginning

and ending amount of unrecognized tax benefits for the years

ended June 27, 2009 and June 28, 2008. The corporation has

adjusted its 2008 balances for certain revisions to unrecognized

tax benefits to conform to the current year presentation.

June 27, June 28,

Year ended 2009 2008

Unrecognized tax benefits

Beginning of year balance $591 $580

Increases based on current period tax positions 28 85

Increases based on prior period tax positions 22 15

Decreases based on prior period tax positions (30) (32)

Decreases related to settlements with tax authorities (10) (47)

Decreases related to a lapse of applicable

statute of limitation (7) (46)

Foreign currency translation adjustment (47) 36

End of year balance $547 $591

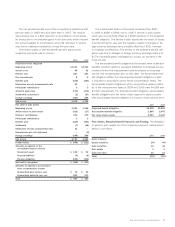

Note 22 – Business Segment Information

The following are the corporation’s six business segments and the

types of products and services from which each reportable segment

derives its revenues.

•North American Retail sells a variety of packaged meat and

frozen bakery products to retail customers in North America and

includes the corporation’s U.S.

Senseo

retail coffee business.

•North American Fresh Bakery sells a variety of fresh bakery

products to retail customers in North America.

•North American Foodservice sells a variety of meats, bakery,

and beverage products to foodservice customers in North America

such as broad-line foodservice distributors, restaurants, hospitals

and other large institutions.

•International Beverage sells coffee and tea products in major

markets around the world, including Europe, Australia and Brazil.

•International Bakery sells a variety of bakery and dough products

to retail and foodservice customers in Europe and Australia.

•International Household and Body Care sells products in four

primary categories – body care, air care, shoe care and insecticides –

in markets around the world, including the U.S., Europe, India and

the Asia Pacific region.

The corporation’s management uses operating segment income,

which is defined as operating income before general corporate

expenses and amortization of trademarks and customer relation-

ship intangibles, to evaluate segment performance and allocate

resources. Management believes it is appropriate to disclose this

measure to help investors analyze the business performance and

trends of the various business segments. Interest and other debt

expense, as well as income tax expense, are centrally managed,

and accordingly, such items are not presented by segment since

they are not included in the measure of segment profitability reviewed

by management. The accounting policies of the segments are the

same as those described in Note 2 to the Consolidated Financial

Statements, “Summary of Significant Accounting Policies.”