Sara Lee 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financial review

Commodity prices directly impact our business because of their

effect on the cost of raw materials used to make our products and

the cost of inputs to manufacture, package and ship our products.

Many of the commodities we use, including beef, pork, coffee, wheat,

corn, corn syrup, soybean and corn oils, butter, sugar and fuel, have

experienced price volatility due to factors beyond our control. The

company’s objective is to offset commodity price increases with pricing

actions and to offset any operating costs increases with continuous

improvement savings.

The company’s business results are also heavily influenced by

changes in foreign currency exchange rates. For the most recently

completed fiscal year, approximately 45% of net sales and approxi-

mately 60% of operating segment income were generated outside

of the U.S. As a result, changes in foreign currency exchange rates,

particularly the European euro, can have a significant impact on

the reported results.

The company’s international operations provide a significant

portion of the company's cash flow from operating activities, which

has required and is expected to continue to require the company

to repatriate a greater portion of cash generated outside of the

U.S. The repatriation of these funds has resulted in higher income

tax expense and cash tax payments.

The corporation believes that, based on its current cash balance

and continued access to financing, the recent turmoil and decreased

liquidity in the financial markets will not have a material adverse impact

on our liquidity or cash flow. In light of the current credit market

instability, however, the corporation has taken certain actions to

maintain its liquidity and preserve operating flexibility. Although the

corporation continues to regularly access the commercial paper

market, it has shortened maturities on its commercial paper and

reduced the total amount of its commercial paper that matures

each day in response to reduced market liquidity.

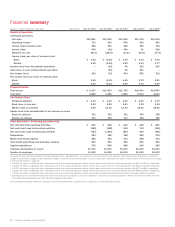

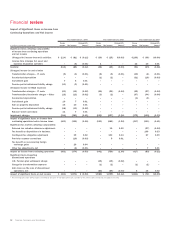

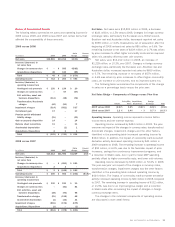

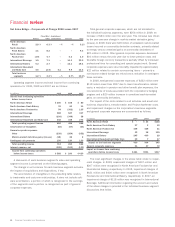

Summary of Results

2009 Compared with 2008 The business highlights for 2009

include the following:

•Net sales decreased by 2.5% to $12.9 billion, reflecting the

negative impact of changes in foreign currency exchange rates and

lower unit volumes partially offset by price increases to offset higher

commodity costs.

•Reported operating income increased by $453 million to $713

million due to a $537 million reduction in impairment charges year

over year. Operating income was negatively impacted by unrealized

mark-to-market losses of $18 million on commodity derivatives as

compared to $22 million of gains in the prior year.

•The $314 million non-cash pretax impairment charge in 2009

was related to goodwill and other long-lived assets associated with

the Spanish bakery businesses and goodwill associated with the

North American foodservice beverage business.

•Operating segment income was favorably impacted by the year-

over-year reduction in impairment charges as well as pricing actions,

cost savings achieved from continuous improvement initiatives

and lower spending on media advertising and promotions (MAP).

These improvements were offset by the negative impact of changes

in foreign currency exchange rates and lower volumes.

•Income from continuing operations and net income were

$364 million, or $0.52 per share on a diluted basis. The year-over-

year improvement reflects the impact of the impairment charges

noted above as well as the positive impact of pricing actions and

cost savings initiatives.

•Cash from operating activities increased by $294 million due

to a significant reduction in cash used to fund working capital

requirements partially offset by a $131 million increase in cash

contributions to pension plans.

•Capital expenditures for property, plant and equipment and

computer software declined $136 million which is partially due to

reduced investment in information systems and manufacturing

capacity in 2009 compared to the prior year.

•The company’s total debt declined by $368 million due to the

repayment of both short term and maturing long-term debt utilizing

cash on hand and cash generated from operating activities.

•The company expended $103 million to repurchase 11.4 million

shares of its common stock under a share repurchase program.

16 Sara Lee Corporation and Subsidiaries