Sara Lee 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Pension Plans As shown in Note 19 to the Consolidated Financial

Statements, titled “Defined Benefit Pension Plans,” the funded status

of the corporation’s defined benefit pension plans is defined as the

amount the projected benefit obligation exceeds the plan assets.

The underfunded status of the plans is $466 million at the end of

fiscal 2009 as compared to $321 million at the end of fiscal 2008.

The corporation expects to contribute approximately $180 million

of cash to its pension plans in 2010 as compared to $306 million

in 2009, $175 million in 2008 and $191 million in 2007. The 2010

contributions are for pension plans of continuing operations and

pension plans where the corporation has agreed to retain the pension

liability after certain business dispositions were completed. The exact

amount of cash contributions made to pension plans in any year is

dependent upon a number of factors, including minimum funding

requirements in the jurisdictions in which the company operates, the

timing of cash tax benefits for amounts funded and arrangements

made with the trustees of certain foreign plans. As a result, the actual

funding in 2010 may be materially different from the estimate.

During 2006, the corporation entered into an agreement with the

plan trustee to fully fund certain U.K. pension obligations by 2015.

The anticipated 2010 contributions reflect the amounts agreed upon

with the trustees of these U.K. plans. Under the terms of this

agreement, the corporation will make annual pension contributions

of 32 million British pounds to the U.K. plans through 2015.

Subsequent to 2015, the corporation has agreed to keep the U.K.

plans fully funded in accordance with local funding standards. If at any

time prior to January 1, 2016, Sara Lee Corporation ceases having

a credit rating equal to or greater than all three of the following ratings,

the annual pension funding of these U.K. plans will increase by 20%:

Standard & Poor’s minimum credit rating of “BBB-,” Moody’s Investors

Service minimum credit rating of “Baa3” and FitchRatings minimum

credit rating of “BBB -.” The corporation’s credit ratings are currently

above these levels and are discussed below in this Liquidity section.

The corporation participates in various multi-employer pension

plans that provide retirement benefits to certain employees covered

by collective bargaining agreements (MEPP). MEPPs are managed by

trustee boards comprised of participating employer and labor union

representatives, and participating employers are jointly responsible

for any plan underfunding. The corporation’s MEPP contributions

are established by the applicable collective bargaining agreements;

however, our required contributions may increase based on the funded

status of the plan and the provisions of the Pension Protection Act,

Sara Lee Corporation and Subsidiaries 35

Cash Dividends

Dividends paid during 2009 were $302 million as

compared to $296 million in 2008 and $374 million in 2007. The

decline in dividends paid from 2007 to 2009 is due to a lower

number of shares outstanding due to the impact of the share repur-

chase program. The annual dividend rate in 2009 was $0.44 per share.

Liquidity

Notes Payable Notes payable decreased from $280 million in 2008

to $20 million in 2009 as the corporation utilized cash generated

from operating activities and cash on hand to repay a significant

portion of the notes payable. At the end of 2009, the corporation

had cash and cash equivalents on the balance sheet of $959 million,

which was $325 million lower than the balance at June 28, 2008.

As noted above, the decline in cash was due in part to the use

of cash to repay debt, repurchase stock and pay dividends as well

as the $172 million negative impact of changes in foreign currency

exchange rates, as a large portion of the cash is denominated in

euros. Despite the recent liquidity issues in the global credit markets,

the corporation has been able to continue using the commercial

paper market to fund short-term borrowing needs.

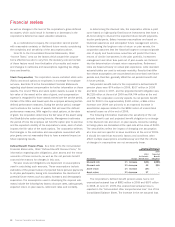

Debt The corporation’s total long-term debt decreased $108 million

in 2009, to $2,800 million at June 27, 2009. Long-term debt maturing

during 2009 was repaid using cash on hand and a new 2-year

financing arrangement for 285 million euros at EURIBOR plus 1.75%

that was entered into in January 2009. The corporation’s total

remaining long-term debt of $2,800 million is due to be repaid as

follows: $55 million in 2010, $425 million in 2011, $1,164 million

in 2012, $528 million in 2013, $25 million in 2014 and $603 million

thereafter. Of the amounts that are due to be repaid in 2010, approx-

imately $25 million matures in the first quarter and the remainder

matures throughout the year. Debt obligations due to mature in the

next year are expected to be satisfied with cash on hand, cash

from operating activities or with additional borrowings.

Including the impact of swaps, which are effective hedges and

convert the economic characteristics of the debt, the corporation’s

long-term debt and notes payable consist of 70.3% fixed-rate debt

as of June 27, 2009, as compared with 66.2% as of June 28, 2008.

The increase in fixed-rate debt at the end of 2009 versus the end

of 2008 is due to the repayment of long-term variable rate debt during

the period. The corporation monitors the interest rate environments

in the geographic regions in which it operates and modifies the

components of its debt portfolio as necessary to manage interest

rate and foreign currency risks.