Sara Lee 2009 Annual Report Download - page 71

Download and view the complete annual report

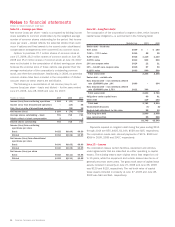

Please find page 71 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 16 – Contingencies and Commitments

Contingent Asset The corporation sold its European cut tobacco

business in 1999. Under the terms of that agreement, the corporation

will receive an annual cash payment of 95 euros if tobacco continues

to be a legal product in the Netherlands, Germany and Belgium

through July 15, 2009. The contingencies associated with the 2009

and prior payments passed in the first quarter of each fiscal year and

the corporation received the annual payments and recorded income

in the contingent sales proceeds line in the Consolidated Statements

of Income. The payments received increased diluted earnings per

share by $0.21 in 2009, $0.18 in 2008 and $0.16 in 2007. Tobacco

continued to be legal in the required countries through the date of

filing these financial statements and the corporation will recognize

income associated with the final scheduled payment in the first

quarter of 2010.

Contingent Liabilities The corporation is a party to various pending

legal proceedings, claims and environmental actions by government

agencies. The corporation records a provision with respect to a claim,

suit, investigation or proceeding when it is probable that a liability

has been incurred and the amount of the loss can reasonably be

estimated. Any provisions are reviewed at least quarterly and are

adjusted to reflect the impact and status of settlements, rulings,

advice of counsel and other information pertinent to the particular

matter. The recorded liabilities for these items were not material to

the Consolidated Financial Statements of the corporation in any of

the years presented. Although the outcome of such items cannot

be determined with certainty, the corporation’s general counsel and

management are of the opinion that the final outcome of these mat-

ters will not have a material adverse impact on the consolidated

financial position, results of operations or liquidity.

Aris

Since 1995, three complaints have been filed on behalf of

employees of a former subsidiary of the corporation known as Aris

Philippines, Inc. (Aris) alleging unfair labor practices associated with

Aris’ termination of manufacturing operations in the Philippines. Each

of these three complaints includes allegations with the same issues

and facts. With regard to two of these complaints, Aris prevailed in

the administrative hearings held in the Philippines. Although impli-

cated in these complaints, the corporation was not a party. The third

complaint is a consolidation of cases filed in the Republic of the

Philippines, Department of Labor and Employment and the National

Labor Relations Commission (NLRC) from 1998 through July 1999

by individual complainants. On December 11, 1998, the third com-

plaint was amended to name the corporation as a party. The case

is styled: Emelinda Mactlang, et al. v. Aris Philippines, Inc., et al. In

the underlying proceedings during 2006, the arbitrator ruled against

the corporation and awarded the plaintiffs $60 in damages and fees.

The corporation appealed this administrative ruling. On December 19,

2006, the NLRC issued a ruling setting aside the arbitrator’s ruling,

and remanded the case to the arbitrator for further proceedings.

The complainants and the corporation have filed motions for recon-

sideration – the corporation seeking a final judgment and outright

dismissal of the case, instead of a remand to the arbitrator; and

complaints seeking to reinstate the original arbitrator’s judgment

against the defendants, including the corporation. The respective

motions for reconsideration have been fully briefed by the parties

and we await the NLRC’s rulings.

The corporation’s request to the Court of Appeals to reconsider

its decision to require that the bond related to the arbitrator’s

original ruling be set at approximately $25 has been denied. On

December 10, 2007, the corporation petitioned the Supreme Court

for review, arguing, among other things, that the appellate court’s

decision is now moot in light of the December 19, 2006 ruling by the

NLRC setting aside the underlying judgment. Plaintiffs also petitioned

the Supreme Court for review, arguing, among other things, that the

appellate court’s decision should be modified to require plaintiffs to

post the entire monetary award. No additional bond posting is required

until all allowable appeals have been exhausted. On March 24, 2008,

the Supreme Court issued a resolution requiring all parties to file

comments on their respective petitions. The parties have already

filed their respective comments to the pending petitions with the

Supreme Court and await a decision. The corporation continues to

believe that the plaintiffs’ claims are without merit; however, it is

reasonably possible that this case will be ruled against the corpo -

ration and have a material adverse impact on the corporation’s

financial position, results of operations or cash flows.

American Bakers Association (ABA) Retirement Plan

The corporation

is a participating employer in the American Bakers Association

Retirement Plan. In 1979, the Pension Benefit Guaranty Corporation

(PBGC) determined that the ABA plan was an aggregate of single-

employer pension plans rather than a multiple employer plan. Under

the express terms of the ABA plan’s governing documents, the

corporation’s contributions can only be used to pay for the benefits

of its own employee-participants. Based upon the 1979 PBGC deter-

mination and the advice of counsel, the corporation has recognized

its obligations under the plan as if it participated in a single-employer

defined benefit plan under the provisions of Statement of Financial

Accounting Standards No. 87, “Employers Accounting for Pensions.”

In August 2006, the PBGC reversed its 1979 determination

and concluded that the ABA plan is and always has been a multiple

employer plan in which the participating parties share in the plan

underfunding. During its bankruptcy proceedings, the other major

participating employer in the ABA plan, who subsequently withdrew

from the ABA plan, reached an agreement with the PBGC in connec-

tion with its underfunding.

Sara Lee Corporation and Subsidiaries 69