Sara Lee 2009 Annual Report Download - page 74

Download and view the complete annual report

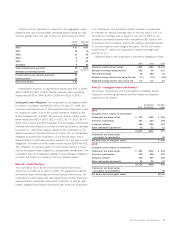

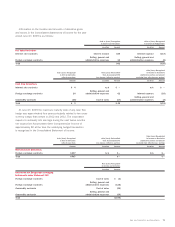

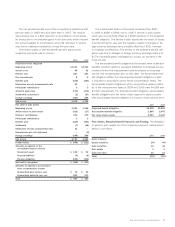

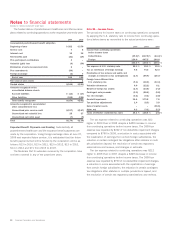

Please find page 74 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to financial statements

Dollars in millions except per share data

Fair Value Hedge A hedge of a recognized asset or liability or an

unrecognized firm commitment is declared as a fair value hedge

which qualify for hedge accounting. For fair value hedges, both the

effective and ineffective portions of the changes in the fair value of

the derivative, along with the gain or loss on the hedged item that

is attributable to the hedged risk, are recorded in earnings and are

reported in the Consolidated Statements of Income on the same

line as the hedged item.

Cash Flow Hedge A hedge of a forecasted transaction, firm

commitment or of the variability of cash flows to be received or

paid related to a recognized asset or liability is declared a cash

flow hedge. Cash flow hedges qualify for hedge accounting. The

effective portion of the change in the fair value of the derivative

that is declared as a cash flow hedge is recorded in accumulated

other comprehensive income (within common stockholders’ equity)

and later reclassified to the income statement at the same time

the underlying hedged item impacts the income statement. In addi-

tion, both the fair value of changes excluded from the corporation’s

effectiveness assessments and the ineffective portion of the

changes in the fair value of derivatives used as cash flow hedges

are reported in “Selling, general and administrative expenses”

line in the Consolidated Statements of Income.

Net Investment Hedge A hedge of the exposure of changes in the

underlying foreign currency denominated subsidiary net assets is

declared as a net investment hedge. Net investment hedges qualify

for hedge accounting. Net investment hedges can include either

derivative or non-derivative instruments including non-U.S. dollar

financing transactions or non-U.S. dollar assets or liabilities, includ-

ing intercompany loans. The effective portion of the change in the

fair value of net investment hedges is recorded in the cumulative

translation adjustment account within common stockholders’ equity.

At June 27, 2009 the U.S. dollar equivalent of intercompany loans

designated as net investment hedges was $3.2 billion.

Mark-to-Market Hedge A derivative that is not qualified for hedge

accounting in one of the categories above is accounted for under

mark-to-market accounting and referred to as a mark-to-market

hedge. Changes in the fair value of a mark-to-market hedge are

recognized in the Consolidated Statements of Income to act as an

economic hedge against the changes in the values of another item

or transaction. Changes in the fair value of derivatives classified as

mark-to-market hedges are reported in earnings in either the “Cost

of sales” or “Selling, general and administrative expenses” lines of

the Consolidated Statements of Income where the change in value

of the underlying transaction is recorded.

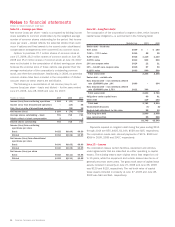

Types of Derivative Instruments

Interest Rate and Cross Currency Swaps

To manage interest rate

risk, the corporation has entered into interest rate swaps that effec-

tively convert certain fixed-rate debt instruments into floating-rate

debt instruments. Interest rate swap agreements that are effective

at hedging the fair value of fixed-rate debt agreements are designated

and accounted for as fair value hedges. The corporation utilizes

interest rate swap derivatives in order to maintain a targeted amount

of both fixed-rate and floating-rate long term debt and notes payable.

Currently the corporation has a fixed interest rate on approximately

70% of long-term debt and notes payable issued.

The corporation has issued certain foreign-denominated debt

instruments and utilizes cross currency swaps to reduce the variabil-

ity of functional currency cash flows related to the foreign currency

debt. Cross currency swap agreements that are effective at hedging

the variability of foreign-denominated cash flows are designated

and accounted for as cash flow hedges. As of June 27, 2009, the

total notional amount of the corporation’s interest rate swaps and

cross currency swaps were $385 and $786, respectively.

In 2009, in connection with the funding of the anticipated

retirement of the 6.25% notes in September 2011, the corporation

executed a $50 forward starting swap to effectively fix the cash flows

related to interest payments on the anticipated debt issuance.

Currency Forward Exchange, Futures and Option Contracts

The

corporation uses forward exchange and option contracts to reduce

the effect of fluctuating foreign currencies on short-term foreign-

currency-denominated intercompany transactions, third-party product-

sourcing transactions, foreign-denominated investments and other

known foreign currency exposures. Gains and losses on the deriva-

tive instruments are intended to offset losses and gains on the

hedged transaction in an effort to reduce the earnings volatility

resulting from fluctuating foreign currency exchange rates. Forward

currency exchange contracts mature at the anticipated cash require-

ment date of the hedged transaction, generally within one year to

eighteen months. Forward currency exchange contracts which are

effective at hedging the fair value of a recognized asset or liability

are designated and accounted for as fair value hedges. All remain-

ing currency forward and options contracts are accounted for as

mark-to-market hedges.

The principal currencies hedged by the corporation include the

European euro, British pound, Danish krone, Hungarian forint, U.S.

dollar, Swiss franc and Australian dollar. As of June 27, 2009, the

net U.S. dollar equivalent of commitments to purchase and sell

foreign currencies is $2,374 and $2,347, respectively, using the

exchange rate at the reporting date. The corporation hedges virtually

all foreign exchange risk derived from recorded transactions and firm

commitments and only hedges foreign exchange risk related to antic-

ipated transactions where the exposure is potentially significant.

72 Sara Lee Corporation and Subsidiaries