Sara Lee 2009 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial review

future fiscal years as a result of goodwill impairments. However, such

impact is wholly dependent on whether any of the corporation’s

reporting units are required to record a goodwill impairment charge,

the magnitude of any potential charge, and the extent of the corpo-

ration’s tax basis in the goodwill. As a result, management is not

able to predict the potential impact any future goodwill impairment

charges may have on the corporation’s effective tax rate.

•Remittance of Foreign Earnings – The corporation incurred a tax

charge of $58 million related to the repatriation of earnings from

certain foreign subsidiaries, compared to a $118 million tax charge

in 2008. This 2009 charge increased the effective rate by 9.8%.

The corporation expects to incur charges in future fiscal years from

the remittance of foreign earnings. See the discussion of

Repatriation

of Foreign Earnings and Income Taxes

in the Liquidity section of

Management’s Discussion and Analysis for more information.

•Finalization of Tax Reviews and Audits and Changes in Estimate

on Tax Contingencies – A $16 million benefit resulted from the

resolution of tax audits, the expiration of statutes of limitations,

and changes in estimate on tax contingencies, in various countries

including China, France, Greece, Italy, Kenya, Morocco, Spain, the

United Kingdom, the United States, and various state and local

jurisdictions. Of this amount, $3 million related to the resolution

of tax audits, $4 million related to the expiration of statutes of

limitations, and $9 million related to changes in estimate on tax

contingencies. In 2008, the corporation realized a $96 million tax

benefit upon reducing its tax contingency reserves related to uncertain

tax positions. The corporation expects that its effective tax rate will

continue to be impacted in future fiscal years due to the resolution

of tax contingencies. Currently, the corporation believes that it is

reasonably possible that the liability for unrecognized tax benefits

will decrease by approximately $100 million to $160 million within

the next 12 months from a variety of uncertain tax positions as a

result of the resolution of audits and the expiration of statutes of

limitations in several jurisdictions. A majority of this decrease would

impact the corporation’s effective tax rate. For a summary of open

audit years by significant jurisdiction and other critical estimates

surrounding the finalization of tax reviews and audits, see

Income

Tax es

under Critical Accounting Estimates included in Management’s

Discussion and Analysis.

•Receipt of Contingent Sales Proceeds – The corporation

recognized a tax benefit of $53 million related to its receipt of non-

taxable contingent sales proceeds pursuant to the sale terms of its

European cut tobacco business in 1999, compared to a $46 million

benefit in 2008. The corporation will continue to recognize a tax

rate reduction related to contingent sales proceeds received during

the agreement term, which is effective through July 2009.

22 Sara Lee Corporation and Subsidiaries

rates on the date of receipt. These amounts were recognized in the

corporation’s earnings when received and the payments increased

diluted earnings per share from continuing operations in 2009,

2008 and 2007 by $0.21, $0.18 and $0.16, respectively. Tobacco

continued to be a legal product in the required countries through

the final payment date in July 2009 and the corporation will

recognize income associated with the final scheduled payment

in the first quarter of 2010.

Net Interest Expense Net interest expense increased by $25 million

in 2009 to $125 million. The increase in net interest expense was

a result of a $42 million reduction in interest income resulting from

a decline in cash and cash equivalents, a portion of which was used

to repay debt. This increase was partially offset by a $17 million

decline in interest expense due to lower average debt levels. Net

interest expense declined by $33 million in 2008 as compared to the

prior year. The decrease was a result of a $74 million decline in

interest expense due to lower average debt levels, which more than

offset a $41 million reduction in interest income resulting from a

decline in cash and cash equivalents, a portion of which was used

to repay debt.

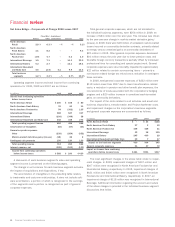

Income Tax Expense The effective tax rate on continuing operations

in 2009, 2008 and 2007 was impacted by a number of significant

items that are shown in the reconciliation of the corporation’s effective

tax rate to the U.S. statutory rate in Note 21 to the Consolidated

Financial Statements. Additional information regarding income taxes

can be found in “Critical Accounting Estimates” within Management’s

Discussion and Analysis.

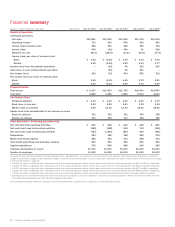

In millions 2009 2008 2007

Continuing operations

Income before income taxes $÷«588 $÷«160 $429

Income tax expense (benefit) 224 201 (11)

Effective tax rates 38.1% 125.6% (2.6) %

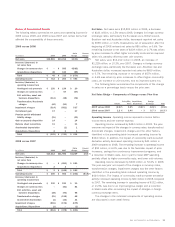

2009 vs. 2008

In 2009, the corporation recognized tax expense

on continuing operations of $224 million, or an effective tax rate

of 38.1%, compared to tax expense of $201 million in 2008, or an

effective tax rate of 125.6%. The significant components impacting

the corporation’s 2009 effective tax rate are as follows:

•Goodwill Impairment – The corporation’s 2009 effective tax rate

increased by 14.4% as a result of recognizing $242 million of non-

deductible goodwill impairments during the year, compared to

$790 million of non-deductible goodwill impairments in 2008. The

corporation expects that its effective tax rate may be impacted in