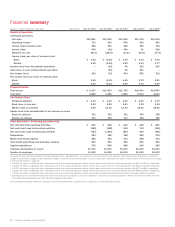

Sara Lee 2009 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Sara Lee Corporation and Subsidiaries 17

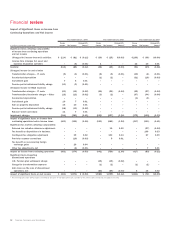

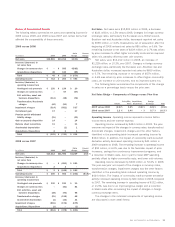

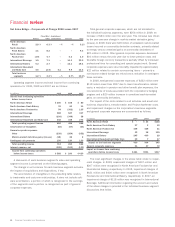

Significant Items Affecting Comparability The reported results for

2009, 2008 and 2007 reflect amounts recognized for restructuring

actions and other significant amounts that impact comparability.

The nature of these items includes the following:

Exit Activities, Asset and Business Dispositions

These costs are

reported on a separate line of the Consolidated Statements of

Income. Exit activities primarily relate to charges taken to recognize

severance actions approved by the corporation’s management and

the exit of leased facilities or other contractual arrangements.

Asset and business disposition activities include costs associated

with separating businesses targeted for sale and preparing financial

statements for these businesses, as well as gains and losses

associated with the disposition of asset groups that do not qualify

for discontinued operations reporting. More information on these

costs can be found in Note 5 to the Consolidated Financial

Statements, “Exit, Disposal and Transformation Activities.”

Project Accelerate Costs

Project Accelerate is a series of global cost

reduction and efficiency projects initiated in fiscal 2009. The costs

include charges associated with the transition of business support

services to an outside third party vendor as part of a business

process outsourcing initiative announced in 2009 as well as costs

associated with the outsourcing of a portion of the North American

and European finance processing functions, information systems

application development and maintenance as well as indirect pro-

curement activities. These costs are recognized in the Consolidated

Statements of Income in Selling, general and administrative expenses

or Cost of sales. Employee termination costs, lease exit costs

and gains or losses on the disposition of assets or asset groupings

that do not qualify as discontinued operations associated with

these initiatives are reported as part of exit activities, asset and

business dispositions.

The corporation currently expects to recognize more than

$300 million of one-time charges related to Project Accelerate,

approximately half of which was incurred in 2009 and the remain-

der is expected to be incurred predominately in 2010. It also

anticipates annualized savings in the range of $350 million to

$400 million by 2012.

Business Transformation Costs

In February 2005, the corporation

announced a transformation plan designed to improve performance

and better position the corporation for long-term growth. The plan

involved significant changes in the organization structure, portfolio

changes including the disposition of a significant portion of the cor-

poration’s businesses and initiatives to improve operational efficiency.

The costs related to the transformation include costs to retain

and relocate existing employees, recruit new employees, third-party

consulting costs associated with transformation efforts, and

amortization costs for new enterprise-wide software. In addition,

these costs include accelerated depreciation, which is incremental

depreciation associated with decisions to close facilities at dates

sooner than originally anticipated, pursuant to an exit plan. These

costs are recognized in Cost of sales or Selling, general and

administrative expenses in the Consolidated Statements of Income

as they do not qualify for treatment as an exit activity or asset and

business disposition under the accounting rules for exit or disposal

activities. However, management believes that the disclosure of

these transformation related charges provides the reader greater

transparency to the total cost of the transformation plan. More

information on these costs can be found in Note 5 to the Consolidated

Financial Statements, “Exit, Disposal and Transformation Activities.”

Impairment Charges

These costs are included on a separate line

of the Consolidated Statements of Income and represent charges

for the impairment of fixed assets, intangible assets, goodwill and

investments held by the corporation. More information regarding

impairment charges can be found in Note 3 to the Consolidated

Financial Statements, “Impairment Charges.”

The reported results were also impacted by certain discrete

tax matters that affect comparability. They include contingent tax

obligation adjustments, tax on repatriation of prior years’ earnings,

valuation allowance adjustments and various other tax matters. The

tax impact of the various items is determined using the statutory rates

in the individual tax jurisdictions in which the charge was incurred.

The impact of the above items on net income and diluted earnings

per share is summarized on the following page.