Sara Lee 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to financial statements

Dollars in millions except per share data

Deferred taxes are recognized for the future tax effects of

temporary differences between financial and income tax reporting

using tax rates for the years in which the differences are expected

to reverse. Federal income taxes are provided on that portion of

the income of foreign subsidiaries that are expected to be remitted

to the U.S. and be taxable.

The management of the corporation periodically estimates the

probable tax obligations of the corporation using historical experi-

ence in tax jurisdictions and informed judgments in accordance with

GAAP. For a tax benefit to be recognized, a tax position must be

more-likely-than-not to be sustained upon examination by the taxing

authority. The corporation adjusts these reserves in light of chang-

ing facts and circumstances; however, due to the complexity of

some of these situations, the ultimate payment may be materially

different from the estimated recorded amounts. Any adjustment to

a tax reserve impacts the corporation’s tax expense in the period

in which the adjustment is made.

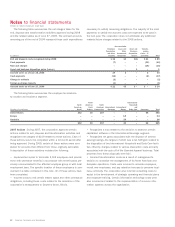

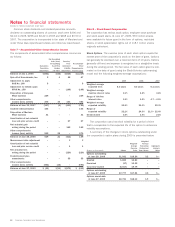

Defined Benefit, Postretirement and Life-Insurance Plans

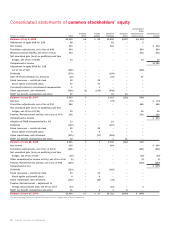

Beginning in 2007, the corporation recognizes the funded status

of defined pension and postretirement plans in the statement of

financial position. The funded status is measured as the difference

between the fair market value of the plan assets and the benefit

obligation. For a defined benefit pension plan, the benefit obligation

is the projected benefit obligation; for any other defined benefit

postretirement plan, such as a retiree health care plan, the benefit

obligation is the accumulated postretirement benefit obligation. Any

overfunded status should be recognized as an asset and any under-

funded status should be recognized as a liability. As part of the initial

recognition of the funded status, any transitional asset/(liability),

prior service cost (credit) or actuarial (gain)/loss that had not yet

been recognized as a component of net periodic cost was recog-

nized in the accumulated other comprehensive income section of

the Consolidated Statements of Common Stockholders’ Equity, net

of tax. Accumulated other comprehensive income will be adjusted

as these amounts are subsequently recognized as a component of

net periodic benefit costs in future periods.

GAAP prescribes additional disclosure requirements including the

classification of the current and noncurrent components of plan liabil-

ities, as well as the disclosure of amounts included in Accumulated

Other Comprehensive Income (Loss) that will be recognized as a

component of net periodic benefit cost in the following year.

GAAP also requires the consistent measurement of plan assets

and benefit obligations as of the date of the fiscal year end statement

of financial position. Beginning in 2009, the corporation measures

its plan assets and liabilities as of fiscal year end pursuant to the

new GAAP measurement date provisions.

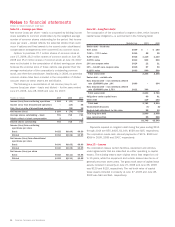

Financial Instruments The corporation uses financial instruments,

including forward exchange, options, futures and swap contracts,

to manage its exposures to movements in interest rates, foreign

exchange rates and commodity prices. The use of these financial

instruments modifies the exposure of these risks with the intent to

reduce the risk or cost to the corporation. The corporation does not

use derivatives for trading purposes and is not a party to leveraged

derivatives.

The corporation uses either hedge accounting or mark-to-market

accounting for its derivative instruments. Under hedge accounting,

the corporation formally documents its hedge relationships, includ-

ing identification of the hedging instruments and the hedged items,

as well as its risk management objectives and strategies for under-

taking the hedge transaction. This process includes linking derivatives

that are designated as hedges of specific assets, liabilities, firm

commitments or forecasted transactions. The corporation also for-

mally assesses, both at inception and at least quarterly thereafter,

whether the derivatives that are used in hedging transactions are

highly effective in offsetting changes in either the fair value or cash

flows of the hedged item. If it is determined that a derivative ceases

to be a highly effective hedge, or if the anticipated transaction is no

longer likely to occur, the corporation discontinues hedge account-

ing and any deferred gains or losses are recorded in the “Selling,

general and administrative expenses” line in the Consolidated

Statements of Income. Derivatives are recorded in the Consolidated

Balance Sheets at fair value in other assets and other liabilities.

For more information about accounting for derivatives see Note 18.

Self-Insurance Reserves The corporation purchases third-party

insurance for workers’ compensation, automobile and product and

general liability claims that exceed a certain level. The corporation

is responsible for the payment of claims under these insured limits.

The undiscounted obligation associated with these claims is accrued

based on estimates obtained from consulting actuaries. Historical

loss development factors are utilized to project the future develop-

ment of incurred losses, and these amounts are adjusted based

upon actual claim experience and settlements. Accrued reserves,

excluding any amounts covered by insurance, were $201 and $202

as of June 27, 2009 and June 28, 2008, respectively.

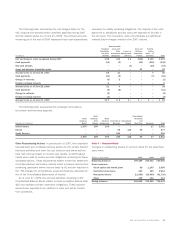

Business Acquisitions All business acquisitions have been accounted

for under the purchase method. Cash, the fair value of other assets

distributed, securities issued unconditionally and amounts of consid-

eration that are determinable at the date of acquisition are included

in determining the cost of an acquired business. Consideration that

is issued or issuable at the expiration of a contingency period, or

that is held in escrow pending the outcome of a contingency, is not

recorded as a liability or shown as an outstanding security unless

the outcome of the contingency is determinable.

Substantially all consideration associated with business acquisi-

tions involves the payment of cash. These amounts are disclosed

in the Consolidated Statements of Cash Flows.

56 Sara Lee Corporation and Subsidiaries