Sara Lee 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

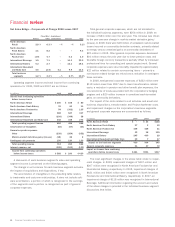

International Bakery

Dollar Percent Dollar Percent

In millions 2009 2008 Change Change 2008 2007 Change Change

Net sales $«790 $«929 $(139) (14.9) % $«929 $«799 $«130 16.1 %

Increase/(decrease) in net sales from

Changes in foreign currency exchange rates $÷÷«– $«««70 $««(70) $÷÷«– $(102) $«102

Disposition – 14 (14) «– – –

Total $÷÷«– $«««84 $««(84) $÷÷«– $(102) $«102

Operating segment income (loss) $(193) $(346) $«153 44.1 % $(346) $÷«38 $(384) NM

Increase/(decrease) in operating segment income (loss) from

Changes in foreign currency exchange rates $÷÷«– $«««««4 $««««(4) $÷÷«– $÷÷(7) $÷÷«7

Exit activities, asset and business dispositions (37) (7) (30) (7) (14) 7

Transformation/Accelerate charges (1) (2) 1 (2) (4) 2

Impairment charge (207) (400) 193 (400) – (400)

Disposition «– (1) 1 – – –

Total $(245) $(406) $«161 $(409) $÷(25) $(384)

Gross margin % 37.7 % 37.6 % 0.1 % 37.6 % 40.0 % (2.4) %

2008 versus 2007

Net sales in 2008 increased $130 million, or

16.1% over 2007. The impact of changes in foreign currency exchange

rates, particularly in the European euro, increased reported net

sales by $102 million, or 13.1%. The remaining net sales increase

of $28 million, or 3.0%, was primarily a result of price increases

to cover higher commodity costs and higher unit volumes in Europe,

partially offset by an unfavorable sales mix due to an increase in

private label sales. Net unit volumes increased 0.3% due to an

increase in private label fresh bread volumes in Spain, and refrigerated

dough volumes in Europe, which were partially offset by a volume

decline in private label frozen products and the planned exit of

certain products in Australia.

Operating segment income in 2008 decreased by $384 million

versus 2007. Changes in foreign currency exchange rates increased

operating segment income by $7 million, or 12.6%. The net impact

of the change in exit activities, asset and business dispositions,

transformation charges and impairment charges decreased operating

segment income by $391 million due primarily to a $400 million

goodwill impairment charge related to the Spanish bakery operations.

The remaining operating segment income was unchanged versus the

prior year as favorable pricing actions and savings from continuous

improvement programs were offset by higher commodity and labor

costs and an unfavorable sales mix shift to private label in Spain.

Sara Lee Corporation and Subsidiaries 31

2009 versus 2008

Net sales decreased by $139 million, or 14.9%.

The impact of foreign currency changes, particularly in the European

euro and the Australian dollar, decreased reported net sales by

$70 million, or 7.1%. A disposition subsequent to the start of 2008

reduced net sales by $14 million, or 1.3%. The remaining net sales

decrease of $55 million, or 6.5%, was the result of unit volume

declines. The impact of unit volume declines were only partially

offset by price increases in response to higher commodity costs,

which increased net sales by approximately 6%. Net unit volumes

decreased 11.6% due to a decline in fresh bread volumes in Spain

as a result of lower branded sales, due in part to economic and

competitive pressures, as well as the loss of some private label

contracts; a decrease in refrigerated dough volumes in Europe

due to lower export sales; and a small volume decline in Australia

due in part to the planned exit of certain lower margin business.

Operating segment income increased by $153 million, or 44.1%

due to a $193 million reduction in impairment charges. An impairment

charge of $207 million was recorded in 2009 as compared to an

impairment charge of $400 million in 2008. The net change in exit

activities, asset and business dispositions and transformation/

Accelerate charges decreased operating segment income by

$29 million, while a disposition subsequent to the start of 2008

increased operating segment income by $1 million. Changes in

foreign currency rates decreased operating segment income by

$4 million, or 5.5%. The remaining decrease in operating segment

income was $8 million, or 13.9%, as the impact of lower unit

volumes, higher costs associated with key raw materials, and

an unfavorable sales mix shift were only partially offset by price

increases, continuous improvement savings and lower SG&A costs

due to cost control efforts.