Sara Lee 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The corporation has held foreign exchange option contracts to

reduce the foreign exchange fluctuations on anticipated purchase

transactions. As of June 27, 2009 there are no foreign exchange

option contracts outstanding.

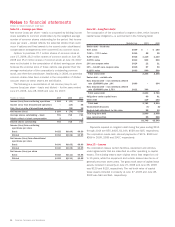

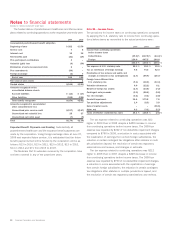

Commodity Futures and Options Contracts

The corporation uses

commodity futures and options to hedge commodity price risk. The

principal commodities hedged by the corporation include hogs, beef,

natural gas, diesel fuel, coffee, corn, wheat and other ingredients.

The corporation does not use significant levels of commodity finan-

cial instruments to hedge commodity prices and primarily relies

upon fixed rate supplier contracts to determine commodity pricing.

In circumstances where commodity-derivative instruments are used,

there is a high correlation between the commodity costs and the

derivative instruments. For those instruments where the commodity

instrument and underlying hedged item correlate between 80 – 125%,

the corporation accounts for those contracts as cash flow hedges.

However, the majority of commodity derivative instruments are

accounted for as mark-to-market hedges.

As of June 27, 2009 the total notional amount of commodity

futures and option contracts was $150 and $16, respectively. The

notional amount of commodity futures contracts is determined by

the initial cost of the contracts while the notional amount of options

contracts is determined by the delta adjusted value as of period end.

The corporation only enters into futures and options contracts

that are traded on established, well-recognized exchanges that offer

high liquidity, transparent pricing, daily cash settlement and collater-

alization through margin requirements.

Cash Flow Presentation

The settlement of derivative contracts

related to the purchase of inventory, commodities or other hedged

items that utilize hedge accounting are reported in the Consolidated

Statements of Cash Flows as an operating cash flow, while those

derivatives that utilize the mark-to-market hedge accounting model

are reported in investing activities when those contracts are realized

in cash. Fixed to floating rate swaps are reported as a component

of interest expense and therefore are reported in cash flow from

operating activities similar to how cash interest payments are

reported. The portion of the gain or loss on a cross currency swap

that offsets the change in the value of interest expense is recognized

in cash flow from operations, while the gain or loss on the swap

that is offsetting the change in value of the debt is classified as

a financing activity in the Consolidated Statement of Cash Flows.

Contingent Features/Concentration of Credit Risk

All of the

corporation’s derivative instruments are governed by the International

Swaps and Derivatives Association (i.e. ISDA) master agreement,

requiring the corporation to maintain an investment grade credit

rating from both Moody’s and Standard & Poor’s credit rating agen-

cies. If the corporation’s debt were to fall below investment grade,

it would be in violation of these provisions, and the counterparties

to the derivative instruments could request immediate payment or

demand immediate collateralization on the derivative instruments

in net liability positions. The aggregate fair value of all derivative

instruments with credit-risk-related contingent features that are in

a liability position on June 27, 2009, is $301 for which the corpo -

ration has posted no collateral. If the credit-risk-related contingent

features underlying these agreements were triggered on June 27,

2009, the corporation would be required to post collateral of,

at most, $301 with its counterparties.

A large number of major international financial institutions are

counterparties to the corporation’s financial instruments including

cross currency swaps, interest rate swaps, and currency exchange

forwards and swaps. The corporation enters into financial instru-

ment agreements only with counterparties meeting very stringent

credit standards (a credit rating of A-/A3 or better), limiting the

amount of agreements or contracts it enters into with any one party

and, where legally available, executing master netting agreements.

These positions are continually monitored. While the corporation

may be exposed to credit losses in the event of nonperformance

by individual counterparties of the entire group of counterparties,

it has not recognized any losses with these counterparties in the

past and does not anticipate material losses in the future.

Trade accounts receivable due from customers that the corporation

considers highly leveraged were $138 at June 27, 2009 and $158

at June 28, 2008.

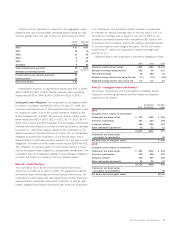

Fair Value Measurements Effective the beginning of 2009, the

corporation implemented SFAS 157, “Fair Value Measurements”

(SFAS 157), which defines fair value, establishes a framework for

its measurement, and expands disclosures about fair value meas-

urements. The adoption of SFAS 157 did not have an impact on the

measurement of the corporation’s financial assets and liabilities,

but did result in additional disclosures.

In 2007, the Financial Accounting Standards Board (FASB) issued

FASB Staff Position FAS 157-2 (FSP 157-2), which provided a one

year deferral for the implementation of SFAS 157 for non-financial

assets and liabilities measured at fair value that are recorded or

disclosed on a non-recurring basis. The corporation elected to apply

the FSP 157-2 deferral, and accordingly, will not apply SFAS 157 to

its goodwill impairment testing, indefinite-lived intangibles impair-

ment testing, other long-lived assets, and non-financial assets or

liabilities measured at fair value in business acquisitions, until

fiscal 2010. The corporation does not believe the implementation

of SFAS 157 for our non-financial assets and liabilities will have a

material impact on the consolidated financial statements, but we do

expect it will impact the way we determine the fair value of goodwill,

indefinite long-lived intangible assets and other long-lived assets.

Sara Lee Corporation and Subsidiaries 73