Sara Lee 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

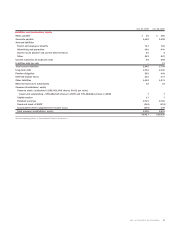

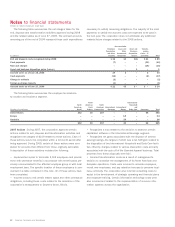

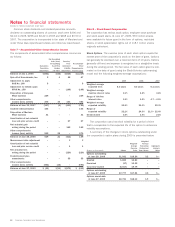

Note 3 – Impairment Charges

The corporation has recognized impairment charges related to its

operations in 2009, 2008 and 2007 and the significant impairments

are recorded in “Impairment charges” in the Consolidated Statements

of Income. The tax benefit is determined using the statutory tax

rates for the tax jurisdiction in which the impairment occurred. The

impact of these charges is summarized in the following tables:

Pretax

Impairment After Tax

Charge Tax Benefit Charge

2009

North American Foodservice $(107) $««– $(107)

International Bakery (207) 25 (182)

Total impairments 2009 $(314) $25 $(289)

2008

North American Retail $÷(20) $««8 $÷(12)

North American Foodservice (431) 16 (415)

International Bakery (400) – (400)

Total impairments 2008 $(851) $24 $(827)

2007

North American Retail $÷(34) $12 $÷(22)

North American Fresh Bakery (16) 6 (10)

International Beverage (118) 9 (109)

International Household and Body Care (4) – (4)

Total impairments 2007 $(172) $27 $(145)

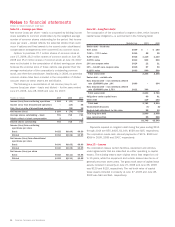

The corporation tests goodwill and intangible assets not subject

to amortization for impairments in the second quarter of each fiscal

year and whenever a significant event occurs or circumstances change

that would more likely than not reduce the fair value of these intangi-

ble assets. The following is a discussion of each impairment charge.

2009

North American Foodservice Goodwill

As a result of the review

performed in the second quarter of 2009, the corporation determined

that the carrying amount of its North American foodservice beverage

reporting unit, which is reported in the North American Foodservice

segment, exceeded its fair value. The foodservice beverage reporting

unit had experienced a significant decline in profitability due to a

highly competitive marketplace and difficult economic conditions.

Based upon our consideration of the results of an appraisal of long-

lived assets and internal estimates of discounted cash flows,

management compared the implied fair value of the goodwill in the

reporting unit with the carrying value and concluded that a $107

impairment charge needed to be recognized. The impairment loss

recognized equaled the entire amount of remaining goodwill in the

North American Foodservice Beverage reporting unit. No tax benefit

was recognized on the charge.

International Bakery Property, Goodwill and Trademarks

During

the goodwill review performed in the second quarter of 2009, the

Spanish bakery operation was identified as a reporting unit that

might become impaired in future periods if forecasted earnings

improvements did not occur. The Spanish bakery reporting unit is

part of the International Bakery segment. Weaker than previously

anticipated performance and a decline in forecasted financial

performance in the second half of 2009 compelled management

to re-perform the goodwill impairment test in the fourth quarter.

As a result of the review in the fourth quarter, the corporation con-

cluded that the carrying amount of the Spanish bakery reporting

unit exceeded its fair value. Based upon our consideration of the

results of an appraisal of long-lived assets and internal estimates

of discounted cash flows, management compared the implied fair

value of the goodwill in the reporting unit with the carrying value

and concluded that a $124 goodwill impairment charge needed

to be recognized for which there is no tax benefit. The impairment

loss recognized equaled the entire amount of remaining goodwill in

the Spanish bakery reporting unit. In conjunction with the actions

resulting in the impairment of the Spanish bakery goodwill, the corpo-

ration assessed the realization of the Spanish bakery long-lived

assets. The reduced profitability of the business indicated that the

cash flows of certain long-lived assets, including trademarks and

fixed assets, did not recover the carrying value of these assets. The

corporation considered the results of a third party fair value estimate

of these long-lived assets and recorded an impairment charge of

$83 ($58 after tax) for the difference between fair value and carrying

value. Of this total, $79 related to trademarks and its associated

fair value was estimated using the royalty savings method.

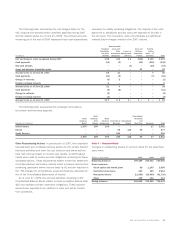

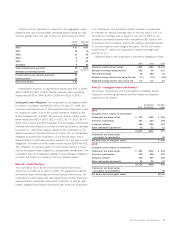

2008

North American Retail Property and Trademarks

During the fourth

quarter of 2008, management determined that a North American

retail meats facility would be disposed due to its high cost struc-

ture and reduced demand for the products produced at the facility.

Based on estimates of cash flows to be generated through the date

of disposition, the corporation concluded that it was necessary to

recognize an impairment charge of $20, of which $7 and $13 are

related to property and trademarks, respectively. The after tax

impact of this impairment charge is $12.

North American Foodservice and International Bakery Goodwill

In the

second half of 2008, weaker than previously anticipated performance

and a decline in forecasted financial performance compelled manage-

ment to re-perform the goodwill impairment test for two reporting

units in the North American Foodservice and International Bakery

segments. As a part of this review, the corporation concluded that

the carrying amounts of the North American foodservice bakery and

Spanish bakery reporting units exceeded their respective fair values.

Based upon our consideration of the results of a third-party appraisal

of long-lived assets and internal estimates of discounted cash

flows, management compared the implied fair value of the goodwill

in each reporting unit with the carrying value and concluded that a

$782 goodwill impairment charge needed to be recognized in the

fourth quarter of 2008. Of this amount, $382 related to the North

American foodservice bakery reporting unit and $400 related to the

Spanish bakery reporting unit. No tax benefit is recognized

on the goodwill impairments.

Sara Lee Corporation and Subsidiaries 57