Sara Lee 2009 Annual Report Download - page 73

Download and view the complete annual report

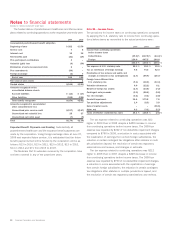

Please find page 73 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 17 – Guarantees

The corporation is a party to a variety of agreements under which

it may be obligated to indemnify a third party with respect to certain

matters. Typically, these obligations arise as a result of contracts

entered into by the corporation under which the corporation agrees

to indemnify a third party against losses arising from a breach of

representations and covenants related to matters such as title to

assets sold, the collectibility of receivables, specified environmental

matters, lease obligations assumed and certain tax matters. In each

of these circumstances, payment by the corporation is conditioned on

the other party making a claim pursuant to the procedures specified

in the contract. These procedures allow the corporation to challenge

the other party’s claims. In addition, the corporation’s obligations

under these agreements may be limited in terms of time and/or

amount, and in some cases the corporation may have recourse

against third parties for certain payments made by the corporation.

It is not possible to predict the maximum potential amount of future

payments under certain of these agreements, due to the conditional

nature of the corporation’s obligations and the unique facts and

circumstances involved in each particular agreement. Historically,

payments made by the corporation under these agreements have

not had a material effect on the corporation’s business, financial

condition or results of operations. The corporation believes that

if it were to incur a loss in any of these matters, such loss would

not have a material effect on the corporation’s business, financial

condition or results of operations.

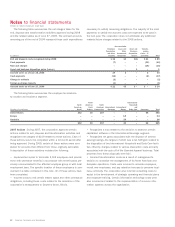

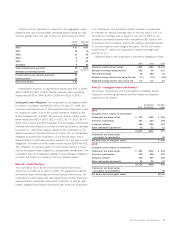

The material guarantees for which the maximum potential

amount of future payments can be determined, are as follows:

•The corporation is contingently liable for leases on property

operated by others. At June 27, 2009, the maximum potential amount

of future payments that the corporation could be required to make

if all the current operators default is $135. This contingent obliga-

tion is more completely described in Note 13 to the Consolidated

Financial Statements, “Leases”.

•The corporation has guaranteed the payment of certain third-party

debt. The maximum potential amount of future payments that the

corporation could be required to make, in the event that these third

parties default on their debt obligations, is $16. At the present

time, the corporation does not believe it is probable that any of

these third parties will default on the amount subject to guarantee.

Additionally, the corporation has pledged as collateral, a manufac-

turing facility in Brazil in connection with a tax dispute in that country.

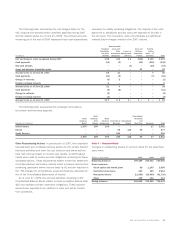

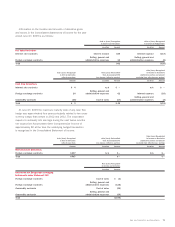

Note 18 – Financial Instruments

Background Information The corporation uses derivative financial

instruments, including forward exchange, futures, options and swap

contracts, to manage its exposures to foreign exchange, commodity

prices and interest rate risks. The use of these derivative financial

instruments modifies the exposure of these risks with the intent to

reduce the risk or cost to the corporation. The corporation does not

use derivatives for trading or speculative purposes and is not a

party to leveraged derivatives.

The corporation recognizes all derivative instruments as either

assets or liabilities at fair value in the consolidated balance sheet.

The corporation uses either hedge accounting or mark-to-market

accounting for its derivative instruments. For derivatives that

qualify for hedge accounting, the corporation designates these

derivatives as fair value, cash flow or net investment hedges by

formally documenting the hedge relationships, including identifica-

tion of the hedging instruments and the hedged items, as well as

its risk management objectives and strategies for undertaking the

hedge transaction. The process includes linking derivatives that

are designated as hedges of specific assets, liabilities, firm

commitments or forecasted transactions.

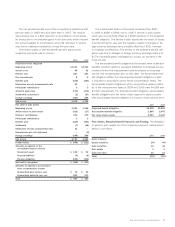

As noted above, the corporation uses derivative financial

instruments to manage its exposure to commodity prices. A com-

modity derivative not declared a hedge in accordance with SFAS 133,

”Accounting for Derivative Instruments and Hedging Activities,” is

accounted for under mark-to-market accounting with changes in

fair value recorded in the Consolidated Statements of Income. Prior

to 2009, gains and losses on unrealized commodity derivatives

accounted for under mark-to-market accounting were included in

segment operating income. In 2009, the corporation now includes

these unrealized mark-to-market gains and losses in general corpo-

rate expenses until such time that the exposure being hedged affects

the earnings of the business segment. At that time, the cumulative

gain or loss previously recorded in general corporate expenses for

the derivative instrument will be reclassified into the business

segment’s results.

On the date the derivative is entered into, the corporation

designates the derivative as one of the following types of hedging

instruments and accounts for the derivative as follows:

Sara Lee Corporation and Subsidiaries 71