Sara Lee 2009 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

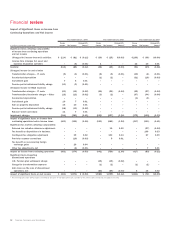

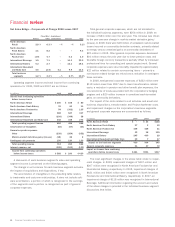

Exit Activities, Asset and Business Dispositions Exit activities,

asset and business dispositions are as follows:

In millions 2009 2008 2007

Charges for (income from) exit activities

Severance $114 $31 $«93

Exit of leased and owned facilities (1) 5 13

Other 1 3–

Asset and business dispositions – (1) (12)

Total $114 $38 $«94

The net charges in 2009 are $76 million higher than 2008 as

a result of higher severance costs related to restructuring actions

taken in the International Beverage and International Bakery

segments. The net charges recognized in 2008 are $56 million

lower than the prior year primarily due to a $62 million reduction in

employee severance costs. The severance costs and other costs

were higher in 2007 because of the implementation of extensive

restructuring plans to terminate employees in all our North American

segments and the International Beverage segment. In 2007, the

corporation also recognized costs to exit leased space in connection

with the relocation of the corporation’s headquarters to Downers

Grove, Illinois.

Impairment Charges During 2009, the corporation recognized a

$314 million non-cash charge primarily for the impairment of goodwill

and other long-lived assets associated with the Spanish bakery

operations and goodwill associated with the North American food-

service beverage operations as both operations were not expected

to generate sufficient profitability to support the remaining goodwill

balances. During 2008, the corporation recognized an $851 million

non-cash charge primarily for the impairment of goodwill associated

with the North American foodservice bakery and Spanish bakery

operations and writedowns of certain other assets in North America.

In 2007, impairment charges of $172 million were recognized and

represent charges for the impairment of goodwill, intangible assets,

fixed assets, and investments held by the corporation. These charges

impacted each of the corporation’s business segments. Additional

details regarding these impairment charges are discussed in Note 3

to the Consolidated Financial Statements, titled “Impairment Charges.”

Receipt of Contingent Sale Proceeds Under the terms of the

sale agreement for its cut tobacco business, the corporation will

receive annual cash payments of 95 million euros through July

2009, contingent on tobacco continuing to be a legal product in

the Netherlands, Germany and Belgium. The U.S. dollar amounts

received in 2009, 2008 and 2007 upon the expiration of the

contingency were $150 million, $130 million and $120 million,

respectively, based upon respective foreign currency exchange

Sara Lee Corporation and Subsidiaries 21

As previously noted, reported SG&A reflects amounts recognized

for actions associated with Project Accelerate, the business trans-

formation program and other significant amounts. These amounts

include the following:

In millions 2009 2008 2007

Transformation costs – IT $«21 $«40 $÷42

Transformation/Accelerate costs – other 18 3 67

Curtailment gain (10) – –

Gain on property disposition (14) ––

Pension partial withdrawal

liability charge 18 ––

Balance sheet corrections (11) – –

Total $«≥22 $«43 $109

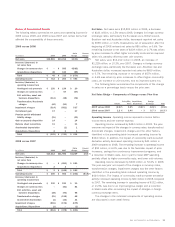

Transformation IT costs in 2009 were $19 million lower than the

prior year as 2008 included both software amortization expense and

$25 million of expenses associated with the implementation of new

computer systems. In 2009, $21 million of software amortization

was recognized as part of transformation costs, which was $6 million

higher than the amortization expenses reported in 2008. The year-

over-year increase was attributable to the increasing number of

computer systems that were put into use over the course of 2008

and 2009. The $15 million increase in other transformation/

Accelerate costs was due primarily to transition and contract termi-

nation costs associated with the transition of business support

services to an outside third party vendor as part of a business

process outsourcing initiative under Project Accelerate.

Transformation costs in 2008 were down $67 million from 2007

due to a reduction in costs associated with the corporation’s decision

to centralize the management of its North American and European

operations, which resulted in higher costs being incurred in 2007

for employee relocation, recruitment and retention bonuses in order

to maintain business continuity. These cost reductions were partially

offset by $15 million of computer software amortization expense

related to systems that were put into use in 2008.

In 2009, the corporation entered into a new collective labor

agreement in the Netherlands which resulted in the recognition of

a $17 million curtailment gain, $10 million of which was recognized

in SG&A. In 2009, the North American Fresh Bakery segment

recognized a $31 million charge to establish an estimated partial

withdrawal liability as a result of the cessation of contributions

to a multi-employer pension plan. Of the total charge, $18 million

was recognized in SG&A.

During 2009, the International Beverage segment disposed of a

parcel of vacant land, which resulted in the recognition of a $14 million

gain. The corporation also recognized $11 million of income related

to the correction of balance sheet account errors associated with the

adjustment of certain individually insignificant balance sheet amounts.