Sara Lee 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The corporation recognized income tax expense of $58 in 2009,

$118 in 2008, and $194 in 2007 related to certain earnings outside

of the U.S. which were not deemed to be indefinitely reinvested.

Hanesbrands historically generated a significant amount of cash from

operations in the U.S. and this cash was used to service the corpo-

ration’s debt, as well as to pay dividends and support domestic

capital requirements. As a result of the 2007 spin off of Hanesbrands

and the disposition of a number of significant European operations,

the level of cash necessary to finance the domestic operations and

the cash considered to be permanently invested outside the U.S.

was modified at the end of 2006. Aside from the items mentioned

above, the corporation intends to continue to invest a portion of its

earnings outside of the U.S. and, therefore, has not recognized U.S.

tax expense on these earnings. U.S. federal income tax and with-

holding tax on these foreign unremitted earnings would be

approximately $400 to $425 as of the end of 2009.

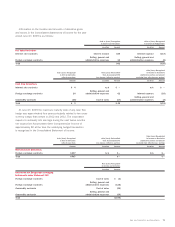

Current and deferred tax provisions (benefits) were:

2009 2008 2007

Current Deferred Current Deferred Current Deferred

U.S. $÷89 $(61) $310 $(247) $÷18 $(144)

Foreign 214 (22) 168 (32) 123 4

State 4 – (10) 12 (4) (8)

$307 $(83) $468 $(267) $137 $(148)

Cash payments for income taxes from continuing operations

were $273 in 2009, $459 in 2008, and $378 in 2007.

Sara Lee Corporation and eligible subsidiaries file a consolidated

U.S. federal income tax return. The company uses the asset-and-

liability method required by SFAS 109 to provide income taxes on

all transactions recorded in the consolidated financial statements.

This method requires that income taxes reflect the expected future

tax consequences of temporary differences between the carrying

amounts of assets or liabilities for book and tax purposes. Accordingly,

a deferred tax liability or asset for each temporary difference is

determined based upon the tax rates that the company expects to

be in effect when the underlying items of income and expense are

realized. The company’s expense for income taxes includes the cur-

rent and deferred portions of that expense. A valuation allowance

is established to reduce deferred tax assets to the amount the

company expects to realize.

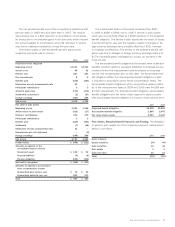

The deferred tax liabilities (assets) at the respective year-ends

were as follows:

2009 2008

Deferred tax (assets)

Pension liability $÷(307) $÷«(192)

Employee benefits (19) (97)

Unrealized foreign exchange (158) (187)

Nondeductible reserves (74) (193)

Net operating loss and other tax carryforwards (335) (384)

Other (160) (19)

Gross deferred tax (assets) (1,053) (1,072)

Less valuation allowances 213 283

Net deferred tax (assets) (840) (789)

Deferred tax liabilities

Property, plant and equipment $÷«172 $÷««166

Intangibles 252 274

Unrepatriated earnings 10 125

Deferred tax liabilities 434 565

Total net deferred tax (assets) liabilities $÷(406) $÷«(224)

Tax-effected net operating loss and other tax carryforwards expire

as follows: $19 in 2010, $17 in 2011, $2 in 2012, $1 in 2013,

$2 in 2014, $1 in 2015, $5 in 2017, $7 in 2018, $2 in 2019, and

$23 in 2020 and beyond. There is no expiration date on $217 of net

operating loss carryforwards. There are state net operating losses of

$39 that begin to expire in 2010 through 2029.

Valuation allowances have been established on net operating

losses and other deferred tax assets in the United Kingdom, Brazil,

Russia, and other foreign and U.S. state jurisdictions as a result of

the corporation’s determination that there is less than a 50% likeli-

hood that these assets will be realized.

In June 2006, the FASB issued FASB Interpretation No. 48

“Accounting for Uncertainty in Income Taxes – an Interpretation of

FASB Statement 109” (FIN 48), which provides guidance on the finan-

cial statement recognition, measurement, reporting and disclosure

of uncertain tax positions taken or expected to be taken in a tax

return. FIN 48 addresses the determination of whether tax benefits,

either permanent or temporary, should be recorded in the financial

statements. For those tax benefits to be recognized, a tax position

must be more-likely-than-not to be sustained upon examination by

the tax authorities. The amount recognized is measured as the

largest amount of benefit that is greater than 50% likely of being

realized upon audit settlement.

The company adopted and applied FIN 48 on July 1, 2007 and

recognized an increase to the retained earnings component of

stockholders’ equity of $13.

Sara Lee Corporation and Subsidiaries 81