Sara Lee 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to financial statements

Dollars in millions except per share data

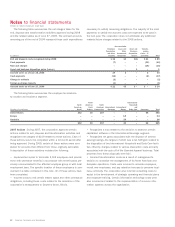

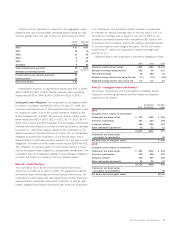

The year-over-year change in the value of trademarks and brand

names is primarily due to changes in foreign currency exchange rates.

The amortization expense reported in continuing operations for

intangible assets subject to amortization was $112 in 2009, $120

in 2008 and $112 in 2007. The estimated amortization expense

for the next five years, assuming no change in the estimated useful

lives of identifiable intangible assets or changes in foreign exchange

rates, is as follows: $107 in 2010, $105 in 2011, $56 in 2012,

$44 in 2013 and $34 in 2014. At June 27, 2009, the weighted

average remaining useful life for trademarks is 15 years; customer

relationships is 16 years; computer software is 3 years; and other

contractual agreements is 2 years.

During 2009, the corporation recognized impairment charges of

$79 related to certain trademarks associated with the International

Bakery segment. These charges are more fully described in Note 3

to the Consolidated Financial Statements, “Impairment Charges.”

In 2009, trademarks of $8 and customer relationships and other

contractual agreements of $3 were recognized with the acquisition

of the Café Moka beverage business in Brazil.

During 2008, the corporation recognized impairment charges of $13

related to certain trademarks that are related to the North American

Retail segment. These charges are more fully described in Note 3 to

the Consolidated Financial Statements, “Impairment Charges.”

During 2007, the corporation recognized impairment charges

of $26 and $16 related to certain trademarks that are used in the

International Beverage and North American Fresh Bakery segments,

respectively. These charges are more fully described in Note 3 to the

Consolidated Financial Statements, “Impairment Charges.” In addi-

tion, as a result of the annual impairment review, the corporation

concluded that certain trademarks were no longer indefinite-lived

and amortization was initiated. Trademarks of $28 and certain other

intangible assets of $2 were acquired in 2007 in the International

Household and Body Care segment.

68 Sara Lee Corporation and Subsidiaries

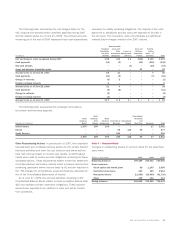

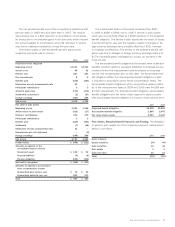

Goodwill In 2009, the International Beverage segment acquired

Café Moka, a Brazilian based producer and wholesaler of coffee,

and recognized $18 of goodwill.

In 2009, non-deductible goodwill of $107 and $124 was

impaired in the North American foodservice beverage and Spanish

bakery reporting units, respectively. These charges are more fully

described in Note 3 to the Consolidated Financial Statements,

“Impairment Charges.”

In 2008, non-deductible goodwill of $382 and $400 was

impaired in the North American foodservice bakery and Spanish

bakery reporting units, respectively. These charges are more fully

described in Note 3 to the Consolidated Financial Statements,

“Impairment Charges.”

In 2008, the corporation determined that the amount of goodwill

attributed to certain reporting units needed to be revised. Goodwill

has been reallocated based upon the relative fair value of the

reporting units that existed at the time the corporation realigned

its business units into new segments during 2006. During 2006

and through the first quarter of 2008, the goodwill allocated to the

International Bakery segment had been denominated in U.S. dollars.

In the second quarter of 2008, the corporation determined that

goodwill allocated to its International Bakery segment should have

been denominated in European euros and subject to translation

into the company’s reporting currency from 2006 to present. While

the adjustment related to the reallocation of goodwill had no impact

on the corporation’s total goodwill value, the adjustment related

to the redenomination of goodwill had the impact of increasing

the corporation’s total value of goodwill and increasing the total

currency translation adjustment included in the accumulated other

comprehensive income section of stockholders’ equity and other

comprehensive income.

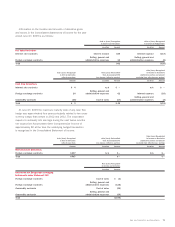

The goodwill reported in continuing operations associated with

each business segment and the changes in those amounts during

2009 and 2008 are as follows:

North International

North American North Household

American Fresh American International International and

Retail Bakery Foodservice Beverage Bakery Body Care Total

Net book value at June 30, 2007 $102 $284 $«954 $193 $«622 $543 $2,698

Impairments – – (382) – (400) – (782)

Reclass to net assets held for sale – – (19) – – – (19)

Reallocation – 3 48 – (51) – –

Redenomination – – – 24 63 19 106

Foreign exchange/other – – – 46 110 64 220

Net book value at June 28, 2008 $102 $287 $«601 $263 $«344 $626 $2,223

Impairments – – (107) – (124) – (231)

Acquisition –––18––18

Foreign exchange/other 1 – – (51) (39) (58) (147)

Net book value at June 27, 2009 $103 $287 $«494 $230 $«181 $568 $1,863