Sara Lee 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

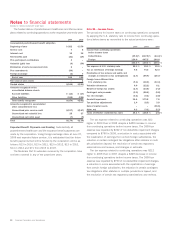

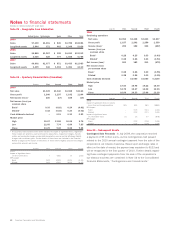

Notes to financial statements

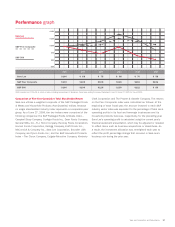

Dollars in millions except per share data

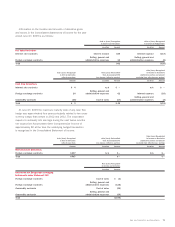

The funded status of postretirement health-care and life-insurance

plans related to continuing operations at the respective year-ends were:

2009 2008

Accumulated postretirement benefit obligation

Beginning of year $«252 $«279

Service cost 78

Interest cost 13 16

Net benefits paid (21) (19)

Plan participant contributions 3–

Actuarial (gain) loss (9) (39)

Elimination of early measurement date 6–

Plan amendments (84) –

Foreign exchange (3) 7

End of year 164 252

Fair value of plan assets –1

Funded status $(164) $(251)

Amounts recognized on the

consolidated balance sheets

Accrued liabilities $÷(12) $÷(17)

Other liabilities (152) (234)

Total liability recognized $(164) $(251)

Amounts recognized in accumulated

other comprehensive loss

Unamortized prior service credit $(197) $(167)

Unamortized net actuarial loss 25 37

Unamortized net initial asset (7) (9)

Total $(179) $(139)

Expected Benefit Payments and Funding Substantially all

postretirement health-care and life-insurance benefit payments are

made by the corporation. Using foreign exchange rates at June 27,

2009 and expected future service, it is anticipated that the future

benefit payments that will be funded by the corporation will be as

follows: $13 in 2010, $13 in 2011, $13 in 2012, $13 in 2013,

$14 in 2014 and $71 from 2015 to 2019.

The Medicare Part D subsidies received by the corporation have

not been material in any of the past three years.

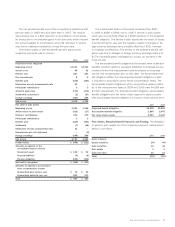

Note 21 – Income Taxes

The provisions for income taxes on continuing operations computed

by applying the U.S. statutory rate to income from continuing opera-

tions before taxes as reconciled to the actual provisions were:

2009 2008 2007

Income from continuing operations

before income taxes

United States (39.0) % (347.5) % (44.4) %

Foreign 139.0 447.5 144.4

100.0 % 100.0 % 100.0 %

Tax expense at U.S. statutory rate 35.0 % 35.0 % 35.0 %

Tax on remittance of foreign earnings 9.8 74.0 42.4

Finalization of tax reviews and audits and

changes in estimate on tax contingencies (2.7) (59.9) (25.7)

Foreign taxes different than

U.S. statutory rate (9.1) (30.0) (13.4)

Valuation allowances 0.9 (12.2) 6.1

Benefit of foreign tax credits (2.7) (14.5) (7.2)

Contingent sale proceeds (9.0) (28.6) (9.8)

Tax rate changes (0.1) (0.1) (3.8)

Goodwill impairment 14.4 173.5 7.8

Tax provision adjustments 1.4 (8.5) 3.8

Sale of capital assets – – (35.5)

Other, net 0.2 (3.1) (2.3)

Taxes at effective worldwide tax rates 38.1 % 125.6 % (2.6) %

The tax expense related to continuing operations was $23

higher in 2009 than in 2008 despite a $428 increase in income

from continuing operations before income taxes. The 2009 tax

expense was impacted by $242 of non-deductible impairment charges

compared to $790 in 2008, a reduction in costs associated with

the repatriation of earnings from certain foreign subsidiaries, the

reduction in certain contingent tax obligations after statutes in multi-

ple jurisdictions lapsed, the resolution of certain tax regulatory

examinations and reviews, and changes in estimate.

The tax expense related to continuing operations was $212

higher in 2008 than in 2007 despite a $269 decrease in income

from continuing operations before income taxes. The 2008 tax

expense was impacted by $790 of non-deductible impairment charges,

a reduction in costs associated with the repatriation of earnings

from certain foreign subsidiaries, the reduction in certain contingent

tax obligations after statutes in multiple jurisdictions lapsed, and

the resolution of certain tax regulatory examinations and reviews.

80 Sara Lee Corporation and Subsidiaries