Sara Lee 2009 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2009 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•Finalization of Tax Reviews and Audits –A $96 million benefit in

2008 resulted from the resolution of tax audits and the expiration

of statutes of limitations in France, Morocco, the Netherlands, the

Philippines and various state and local jurisdictions. Of this amount,

$40 million related to the resolution of tax audits and $56 million

related to the expiration of statutes of limitations. In 2007, the

corporation realized a $110 million tax benefit upon reducing its

tax contingency reserves related to uncertain tax positions.

•Receipt of Contingent Sales Proceeds – The corporation recognized

a tax benefit of $46 million related to its receipt of non-taxable

contingent sales proceeds pursuant to the sale terms of its European

cut tobacco business in 1999, compared to a $42 million tax benefit

in 2007.

•Valuation Allowance – A $19 million benefit relates to the net

reversal of valuation allowances, primarily on German deferred tax

assets, compared to a $27 million tax charge in 2007. During

2008, the corporation determined that a valuation allowance was

no longer necessary for certain German deferred tax assets as a

result of revised profitability projections for its German operations.

This benefit was partially offset by the establishment of valuation

allowances for certain state deferred tax assets in which the

corporation does not anticipate future realization. The corporation

determined that a valuation allowance was necessary for deferred

tax assets in certain state jurisdictions as a result of revised

projections indicating insufficient taxable income of the appropriate

character within the carryback and carryforward periods available

under the respective tax statutes.

•Foreign Earnings – The corporation’s global mix of earnings, the

tax characteristics of the corporation’s income, and the benefit from

certain foreign jurisdictions that have lower tax rates also reduced

the corporation’s tax expense during 2008, similar to 2007.

•Sale of Capital Assets – In 2007, the corporation sold shares of

a subsidiary resulting in a $169 million tax benefit. No comparable

transaction occurred in 2008.

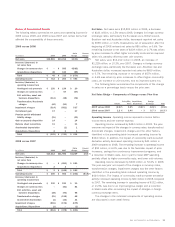

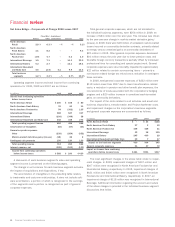

Income (Loss) from Continuing Operations and Diluted Earnings per

Share (EPS) from Continuing Operations Income from continuing

operations in 2009 was $364 million, which was $405 million

higher than 2008. The loss from continuing operations in 2008 was

$41 million, which was $481 million lower than the $440 million

of income reported in 2007.

Diluted EPS from continuing operations was income of $0.52

in 2009 versus a loss of $0.06 in 2008 and income of $0.59 in

2007. The diluted EPS from continuing operations in each succeeding

year was favorably impacted by lower average shares outstanding

as the corporation has been repurchasing shares of its common stock

as part of an ongoing share repurchase program. The corporation

repurchased 11 million shares, 20 million shares and 42 million shares

of common stock during 2009, 2008 and 2007, respectively.

Sara Lee Corporation and Subsidiaries 23

•Valuation Allowance – The corporation recognized tax expense

of $5 million related to a net increase in valuation allowances,

primarily on current year Russian net operating losses, compared to

a $19 million tax benefit in 2008. The 2009 tax charge was partially

offset by the utilization of Brazilian net operating losses that the

corporation did not previously anticipate would be realized. The

corporation expects that its effective tax rate could be favorably or

unfavorably impacted in future fiscal years as a result of changes

in facts and circumstances that cause the corporation to revise its

conclusions on the ability to realize certain net operating losses and

other deferred tax attributes. However, because of the inherent

uncertainty with respect to the occurrence of such facts and circum-

stances, management is not able to predict potential outcomes

or the related impact on the corporation’s effective tax rate.

•Foreign Earnings – The corporation’s global mix of earnings, the

tax characteristics of the corporation’s income, and the benefit from

certain foreign jurisdictions that have lower tax rates also reduced

the corporation’s tax expense during 2009, similar to 2008. As

specifically highlighted in Part I. Item 1A. Risk Factors, of the corpo-

ration’s Form 10-K, the corporation expects that its effective tax

rate will be impacted in future fiscal years as a result of its global

mix of earnings. Because the impact of the corporation’s global mix

of earnings is dependent on factors such as tax legislation in the

jurisdictions in which the corporation does business, the corporation’s

actual results, the relative mix of earnings amongst its respective

jurisdictions in any respective period, and tax characteristics of the

corporation’s income, acquisitions and dispositions, among other

factors, management is not able to predict the impact or trend that

the global mix of earnings will have on its effective tax rate.

2008 vs. 2007

In 2008, the corporation recognized tax expense

on continuing operations of $201 million, or an effective tax rate

of 125.6%, compared to a tax benefit of $11 million in 2007, or an

effective tax rate of (2.6%). The significant components impacting

the corporation’s 2008 effective tax rate are as follows:

•Goodwill Impairment – The corporation’s 2008 effective tax

rate increased by 173.5% as a result of recognizing $790 million

of non-deductible goodwill impairments, compared to $95 million

of non-deductible goodwill impairments in 2007.

•Remittance of Foreign Earnings – The corporation incurred a tax

charge of $118 million related to the repatriation of earnings from

certain foreign subsidiaries, compared to a $194 million tax charge

in 2007. The 2008 charge increased the effective rate by 74.0%.