Pitney Bowes 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

81

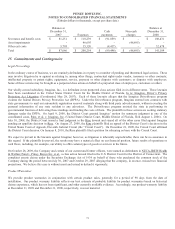

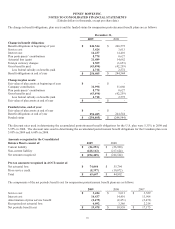

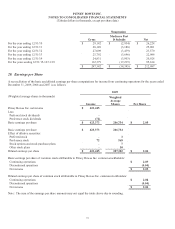

19. Retirement Plans and Postretirement Medical Benefits

We have several defined benefit and defined contribution retirement plans covering substantially all employees worldwide. Benefits

are primarily based on employees’ compensation and years of service. Our contributions are determined based on the funding

requirements of U.S. federal and other governmental laws and regulations. We use a measurement date of December 31 for all of our

retirement plans.

U.S. employees hired after January 1, 2005, Canadian employees hired after April 1, 2005, and U.K. employees hired after July 1,

2005, are not eligible for our defined benefit retirement plans.

During 2009, the Board of Directors approved and adopted a resolution amending both U.S. pension plans, the Pitney Bowes Pension

Plan and the Pitney Bowes Pension Restoration Plan, to provide that benefit accruals as of December 31, 2014, will be determined and

frozen and no future benefit accruals under the plans will occur after that date. Due to the freezes, the assets and liabilities of the plans

were re-measured, resulting in a reduction of pension expense of $2.0 million for 2009. This expense reduction was offset by a one-

time curtailment loss of $2.1 million which represents the unamortized prior service costs as of December 31, 2014.

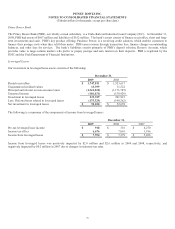

During 2009, we voluntarily contributed a total of $125 million in cash to our global defined benefit pension plans in excess of legally

required minimum contributions to increase the funding levels of the plans. Specifically, $100 million was contributed to the U.S.

qualified plan and $25 million to certain foreign qualified plans.

For our U.S. defined contribution plans, we contributed $27.2 million, $32.1 million and $30.5 million in 2009, 2008 and 2007,

respectively.

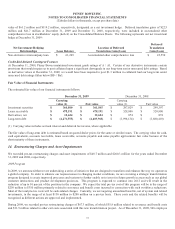

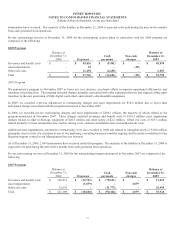

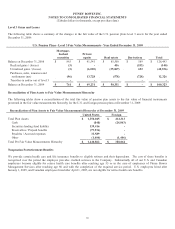

Defined Benefit Pension Plans

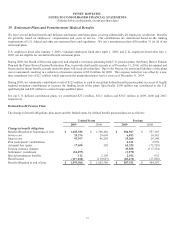

The change in benefit obligations, plan assets and the funded status for defined benefit pension plans are as follows:

United States Foreign

2009 2008 2009 2008

Change in benefit obligation:

Benefit obligation at beginning of year $ 1,605,380 $ 1,596,486 $ 384,507 $ 557,185

Service cost 24,274 29,699 6,853 10,562

Interest cost 93,997 96,205 25,200 29,140

Plan participants’ contributions - - 2,231 2,978

Actuarial loss (gain) 17,698 528 63,325 (75,728)

Foreign currency changes - - 45,858 (117,234)

Settlement / curtailment (24,297) - (1,579) -

Special termination benefits 112 2,105 2,012 632

Benefits paid (117,658) (119,643) (20,475) (23,028)

Benefit obligation at end of year $ 1,599,506 $ 1,605,380 $ 507,932 $ 384,507