Pitney Bowes 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.23

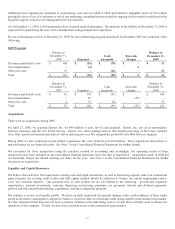

Seasoned Issuer with the SEC which allows us to issue debt securities, preferred stock, preference stock, common stock, purchase

contracts, depositary shares, warrants and units.

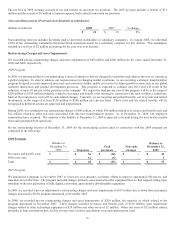

On September 15, 2009, we repaid the 8.55% notes with a $150 million face value at their maturity. The repayment of these notes

was funded through cash generated from operations and issuance of commercial paper. No additional long-term notes will mature

until 2012.

On June 29, 2009, we entered into an interest rate swap for an aggregate notional amount of $100 million to effectively convert our

interest payments on a portion of the $400 million, 4.625% fixed rate notes due in 2012, into variable interest rates. The variable rates

payable are based on one month LIBOR plus 249 basis points. In July 2009, we entered into three additional interest rate swaps for an

aggregate notional amount of $300 million to effectively convert our interest payments on the remainder of the $400 million, 4.625%

fixed rate notes due in 2012, into variable interest rates. The variable rates payable are based on one month LIBOR plus 248 basis

points for $100 million notional amount and one month LIBOR plus 250 basis points for $200 million notional amount.

On March 2, 2009, we issued $300 million of 10-year fixed-rate notes with a coupon rate of 6.25%. The interest is paid semi-annually

beginning September 15, 2009. The notes mature on March 15, 2019. We simultaneously unwound four forward starting swap

agreements (forward swaps) used to hedge the interest rate risk associated with the forecasted issuance of the fixed-rate debt. The

unwind of the derivatives resulted in a loss (and cash payment) of $20.3 million which was recorded to other comprehensive income,

net of tax, and will be amortized to net interest expense over the 10-year term of the notes. The proceeds from these notes were used

for general corporate purposes, including the repayment of commercial paper.

On March 4, 2008, we issued $250 million of 10-year fixed-rate notes with a coupon rate of 5.60%. The interest is paid semi-annually

beginning September 15, 2008. The notes mature on March 15, 2018. We simultaneously entered into two interest rate swaps for a

total notional amount of $250 million to convert the fixed rate debt to a floating rate obligation bearing interest at 6 month LIBOR

plus 111.5 basis points. The proceeds from these notes were used for general corporate purposes, including the repayment of

commercial paper and repurchase of our stock.

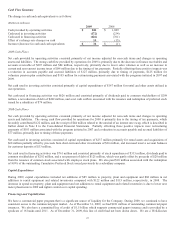

During 2009, we voluntarily contributed a total of $125 million in cash to our global defined benefit pension plans in excess of legally

required minimum contributions to increase the funding levels of the plans. Specifically, $100 million was contributed to the U.S.

qualified plan and $25 million to certain foreign qualified plans. The voluntary contributions were funded by cash flows from

operations and the issuance of commercial paper.

During 2009, the Board of Directors approved and adopted a resolution amending both U.S. pension plans, the Pitney Bowes Pension

Plan and the Pitney Bowes Pension Restoration Plan, to provide that benefit accruals as of December 31, 2014, will be determined and

frozen and no future benefit accruals under the plans will occur after that date.

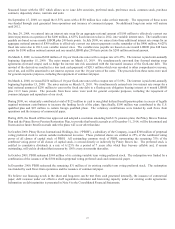

In October 2009, Pitney Bowes International Holdings, Inc. (“PBIH”), a subsidiary of the Company, issued $300 million of perpetual

voting preferred stock to certain outside institutional investors. These preferred shares are entitled to 25% of the combined voting

power of all classes of capital stock of PBIH. All outstanding common stock of PBIH, representing the remaining 75% of the

combined voting power of all classes of capital stock, is owned directly or indirectly by Pitney Bowes Inc. The preferred stock is

entitled to cumulative dividends at a rate of 6.125% for a period of 7 years after which they become callable and, if remain

outstanding, will yield a dividend that increases by 150% every six months thereafter.

In October 2009, PBIH redeemed $344 million of its existing variable term voting preferred stock. The redemption was funded by a

combination of the issuance of the $300 million perpetual voting preferred stock and commercial paper.

In December 2009, PBIH redeemed the remaining $31 million of its existing variable term voting preferred stock. The redemption

was funded by cash flows from operations and the issuance of commercial paper.

We believe our financing needs in the short and long-term can be met from cash generated internally, the issuance of commercial

paper, debt issuance under our effective shelf registration statement and borrowing capacity under our existing credit agreements.

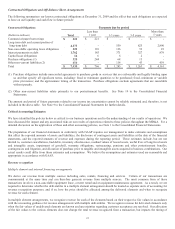

Information on debt maturities is presented in Note 8 to the Consolidated Financial Statements.