Pitney Bowes 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

Overview

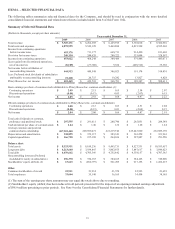

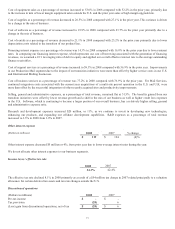

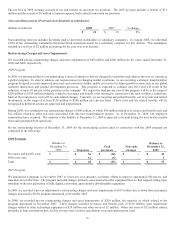

In 2009, revenue decreased 11% to $5.6 billion due largely to continuing challenging global economic conditions and the negative

impact of foreign currency translation which adversely impacted revenue by 2%.

Pitney Bowes Inc. net income was $423 million in 2009 compared with $420 million in 2008 and diluted earnings per share of

common stock attributable to Pitney Bowes Inc. common stockholders was $2.04 compared with $2.00 in 2008. Diluted earnings per

share was reduced by restructuring charges of 15 cents and 69 cents in 2009 and 2008, respectively. In 2009, diluted earnings per

share also included a loss of 6 cents for tax adjustments related to a non-cash charge associated with out-of-the-money stock options

that expired during the year, a net loss of 4 cents comprised primarily of accruals for interest and taxes associated with discontinued

operations partly offset by the positive impacts of a bankruptcy settlement and expiration of an indemnity agreement, and a 1 cent

positive tax adjustment associated with the repricing of leveraged lease transactions. In 2008, diluted earnings per share also included

positive tax adjustments of 4 cents related primarily to deferred tax assets associated with certain U.S. leasing transactions and a loss

of 13 cents for the accrual of interest and taxes associated with discontinued operations.

A continued global economic downturn resulted in a decline in revenue for the year in six of our seven business segments.

Historically, mail volumes have tracked economic conditions and the unprecedented volume decreases in 2009 were indicative of the

extent of the economic slowdown. Although there is not a direct correlation between mail volumes and a majority of our revenues, the

decline in mail volumes was one of a number of factors that affected our 2009 revenues.

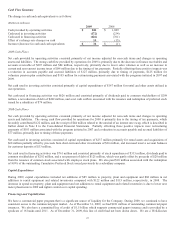

EBIT margins, however, were up in four of our segments from 2008 reflecting our continued cost management actions. We reduced

our selling, general and administrative expense by over $170 million during 2009, despite increased pension costs of $14 million when

compared to the prior year. In addition, we generated $824 million in cash from operations during 2009. We also reduced our debt by

$242 million during 2009.

See “Results of Operations” for 2009, 2008 and 2007 for a more detailed discussion of our results of operations.

Outlook

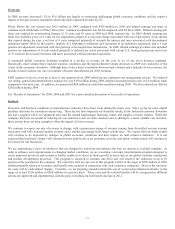

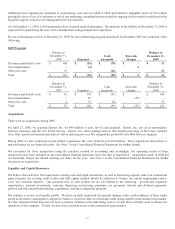

Economic and business conditions in mail-intensive industries have been weak during the entire year. Sales cycles for most capital

purchase decisions by customers remain long. These factors have impacted our financial results, as the sustained economic downturn

has had a negative effect on equipment sales and the related high-margin financing, rental, and supplies revenue streams. While the

company has been successful in reducing its cost structure across its entire business and is shifting to a more variable cost structure,

these actions have not been enough to offset the impact of lower revenue.

We continue to expect our mix of revenue to change, with a greater percentage of revenue coming from diversified revenue streams

associated with fully featured smaller systems and a smaller percentage from larger system sales. We expect that our future results

will continue to be impacted by changes in global economic conditions and their impact on mail intensive industries. It is not

expected that total mail volumes will rebound to prior peak levels in an economic recovery, and future volume trends will continue to

be a factor for our businesses.

We are undertaking a series of initiatives that are designed to transform and enhance the way we operate as a global company. In

order to enhance our responsiveness to changing market conditions, we are executing a strategic transformation program designed to

create improved processes and systems to further enable us to invest in future growth in areas such as our global customer interactions

and product development processes. This program is expected to continue into 2012 and will result in the reduction of up to 10

percent of the positions in the company. We expect the total pre-tax cost of this program will be in the range of $250 million to $350

million primarily related to severance and benefit costs incurred in connection with such workforce reductions. Most of the total pre-

tax costs will be cash-related charges. Currently, we are targeting annualized benefits, net of system and related investments, in the

range of at least $150 million to $200 million on a pre-tax basis. These costs and the related benefits will be recognized as different

actions are approved and implemented, with the goal of reaching the full benefit run rate in 2012.