Pitney Bowes 2009 Annual Report Download - page 67

Download and view the complete annual report

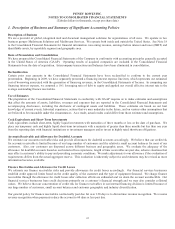

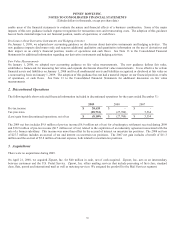

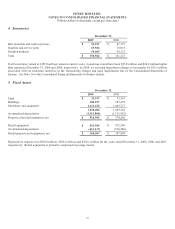

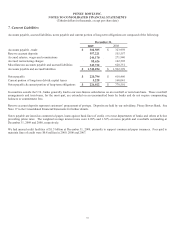

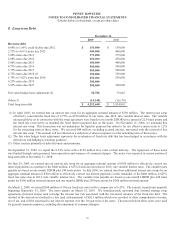

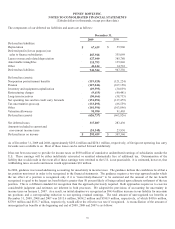

Please find page 67 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

49

Translation of Non-U.S. Currency Amounts

Assets and liabilities of subsidiaries operating outside the U.S. are translated at rates in effect at the end of the period and revenue and

expenses are translated at average monthly rates during the period. Net deferred translation gains and losses are included in

accumulated other comprehensive loss in stockholders’ equity (deficit) in the Consolidated Balance Sheets.

Derivative Instruments

In the normal course of business, the company is exposed to the impact of interest rate changes and foreign currency fluctuations. The

company limits these risks by following established risk management policies and procedures, including the use of derivatives. The

derivatives are used to manage the related cost of debt and to limit the effects of foreign exchange rate fluctuations on financial

results.

In our hedging program, we normally use forward contracts, interest-rate swaps, and currency swaps depending upon the underlying

exposure. We do not use derivatives for trading or speculative purposes. Changes in the fair value of the derivatives are reflected as

gains or losses. The accounting for the gains or losses depends on the intended use of the derivative, the resulting designation, and the

effectiveness of the instrument in offsetting the risk exposure it is designed to hedge.

To qualify as a hedge, a derivative must be highly effective in offsetting the risk designated for hedging purposes. The hedge

relationship must be formally documented at inception, detailing the particular risk management objective and strategy for the hedge.

The effectiveness of the hedge relationship is evaluated on a retrospective and prospective basis.

As a result of the use of derivative instruments, we are exposed to counterparty risk. To mitigate such risks, we enter into contracts

with only those financial institutions that meet stringent credit requirements as set forth in our derivative policy. We regularly review

our credit exposure balances as well as the creditworthiness of our counterparties. See Note 13 to the Consolidated Financial

Statements for additional disclosures on derivative instruments.

New Accounting Pronouncements

Revenue Recognition

In September 2009, new guidance was introduced addressing the accounting for revenue arrangements with multiple elements and

certain revenue arrangements that include software. The new literature will allow companies to allocate consideration in a multiple

element arrangement in a way that better reflects the economics of the transaction. This will result in the elimination of the residual

method. In addition, tangible products that have software components that are “essential to the functionality” of the tangible product

will be scoped out of the software revenue guidance. The new guidance will also result in more expansive disclosures. The new

guidance will be effective on January 1, 2011, with early adoption permitted. We are currently evaluating the impact of adopting the

new guidance.

Pension Disclosures

On December 31, 2009, we adopted new accounting guidance requiring more detailed disclosures about employers’ postretirement

benefit plan assets, including investment strategies, major categories of assets, concentrations of risk within plan assets and valuation

techniques used to measure the fair value of assets. The Company has complied with the additional disclosure requirements. See

Note 19 to the Consolidated Financial Statements for our postretirement benefit plan disclosures.

Noncontrolling Interests

On January 1, 2009, we adopted new accounting guidance on noncontrolling interests. The new guidance addresses the accounting

and reporting for the outstanding noncontrolling interest (previously referred to as minority interest) in a subsidiary and for the

deconsolidation of a subsidiary. It also establishes additional disclosures in the consolidated financial statements that identify and

distinguish between the interests of the parent’s owners and of the noncontrolling owners of a subsidiary. The guidance requires

retroactive adoption of the presentation and disclosure requirements for existing minority interests while all other requirements of the

guidance are applied prospectively.

Business Combinations

On January 1, 2009, we adopted new accounting guidance on business combinations. The new guidance revises principles and

requirements for how a company (a) recognizes and measures in their financial statements the identifiable assets acquired, the

liabilities assumed, and any noncontrolling interest (previously referred to as minority interest); (b) recognizes and measures the

goodwill acquired in a business combination or a gain from a bargain purchase; and (c) determines what information to disclose to