Pitney Bowes 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

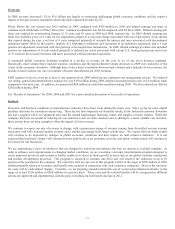

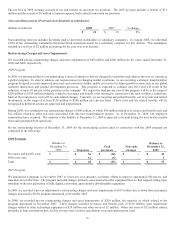

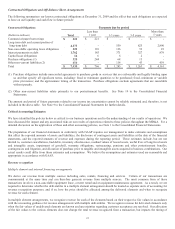

Cash Flow Summary

The change in cash and cash equivalents is as follows:

(Dollars in millions)

2009 2008

Cash provided by operating activities $ 824 $ 1,009

Cash used in investing activities (172) (234)

Cash used in financing activities (626) (761)

Effect of exchange rate changes on cash 10 (15)

Increase (decrease) in cash and cash equivalents $ 36 $ (1)

2009 Cash Flows

Net cash provided by operating activities consisted primarily of net income adjusted for non-cash items and changes in operating

assets and liabilities. The strong cash flow provided by operations for 2009 is primarily due to the decrease in finance receivables and

accounts receivable of $207 million and $84 million, respectively, primarily due to lower sales volumes as well as an increase in

current and non-current income taxes of $86 million due to the timing of tax payments. Partially offsetting these positive impacts was

a reduction in accounts payable and accrued liabilities of $127 million, primarily due to timing of payments, $125 million for

voluntary pension plan contributions and $105 million for restructuring payments associated with the programs initiated in 2007 and

2009.

Net cash used in investing activities consisted primarily of capital expenditures of $167 million for rental and other assets utilized in

our operations.

Net cash used in financing activities was $626 million and consisted primarily of dividends paid to common stockholders of $298

million, a net reduction of debt of $242 million, and a net cash outflow associated with the issuance and redemption of preferred stock

issued by a subsidiary of $79 million.

2008 Cash Flows

Net cash provided by operating activities consisted primarily of net income adjusted for non-cash items and changes in operating

assets and liabilities. The strong cash flow provided by operations for 2008 is primarily due to the timing of tax payments, which

favorably contributed $122 million, and the receipt of $44 million related to the unwind of an interest rate swap, which is described in

further detail in Note 8 to the Consolidated Financial Statements. Partially offsetting these positive impacts were restructuring

payments of $103 million associated with the program initiated in 2007 and a reduction in accounts payable and accrued liabilities of

$77 million, primarily due to timing of these payments.

Net cash used in investing activities consisted of capital expenditures of $237 million primarily for rental assets and acquisitions of

$68 million partially offset by proceeds from short-term and other investments of $36 million, and increased reserve account balances

for customer deposits of $33 million.

Net cash used in financing activities was $761 million and consisted primarily of stock repurchases of $333 million, dividends paid to

common stockholders of $292 million, and a net payment of debt of $125 million, which was partly offset by proceeds of $20 million

from the issuance of common stock associated with employee stock plans. We also paid $10 million associated with the redemption

of 100% of the outstanding Cumulative Preferred Stock issued previously by a subsidiary company.

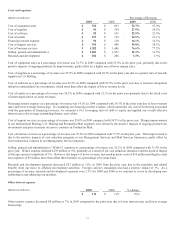

Capital Expenditures

During 2009, capital expenditures included net additions of $85 million to property, plant and equipment and $82 million in net

additions to rental equipment and related inventories compared with $122 million and $115 million, respectively, in 2008. The

decrease in spend on property, plant and equipment and net additions to rental equipment and related inventories is due to lower new

meter placements in 2009 and tighter control over capital spending.

Financings and Capitalization

We have a commercial paper program that is a significant source of liquidity for the Company. During 2009, we continued to have

consistent access to the commercial paper market. As of December 31, 2009, we had $221 million of outstanding commercial paper

issuances. We also have a committed line of credit of $1.5 billion which supports commercial papers issuance and is provided by a

syndicate of 16 banks until 2011. As of December 31, 2009, this line of credit had not been drawn down. We are a Well-Known