Pitney Bowes 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

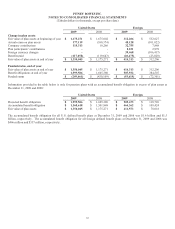

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

72

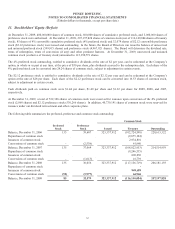

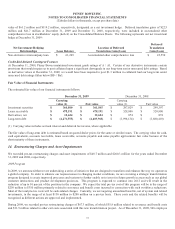

value of $61.2 million and $119.2 million, respectively, designated as a net investment hedge. Deferred translation gains of $22.5

million and $41.7 million at December 31, 2009 and December 31, 2008, respectively, were included in accumulated other

comprehensive loss in stockholders’ equity (deficit) on the Consolidated Balance Sheets. The following represents our net investment

hedge at December 31, 2009:

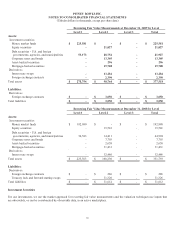

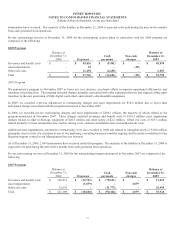

Net Investment Hedging

Relationships Loan Balance

Location of Deferred

Translation Gain (Loss)

Deferred

Translation

Gain (Loss)

Non-derivative intercompany loan $ 61,209 Accumulated other comprehensive loss $ 22,550

Credit-Risk-Related Contingent Features

At December 31, 2009, Pitney Bowes maintained investment grade ratings of A / A1. Certain of our derivative instruments contain

provisions that would require us to post collateral upon a significant downgrade in our long-term senior unsecured debt ratings. Based

on derivative values at December 31, 2009, we would have been required to post $1.3 million in collateral had our long-term senior

unsecured debt ratings fallen below BB- / Ba3.

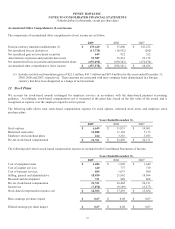

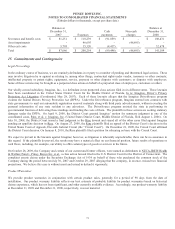

Fair Value of Financial Instruments

The estimated fair value of our financial instruments follows:

December 31, 2009 December 31, 2008

Carrying

value (1) Fair value

Carrying

value (1)

Fair value

Investment securities $ 360,800 $ 361,845 $ 297,829 $ 299,307

Loans receivable $ 478,191 $ 478,191 $ 528,800 $ 528,800

Derivatives, net $ 12,624 $ 12,624 $ 874 $ 874

Long-term debt $ (4,271,555) $ (4,409,961) $ (3,990,134) $ (3,880,418)

(1) Carrying value includes accrued interest and deferred fee income, where applicable.

The fair value of long-term debt is estimated based on quoted dealer prices for the same or similar issues. The carrying value for cash,

cash equivalents, accounts receivable, loans receivable, accounts payable and notes payable approximate fair value because of the

short maturity of these instruments.

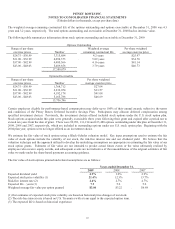

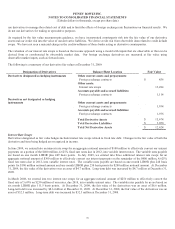

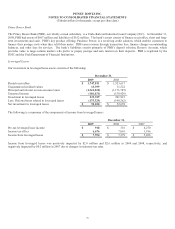

14. Restructuring Charges and Asset Impairments

We recorded pre-tax restructuring charges and asset impairments of $48.7 million and $200.3 million for the years ended December

31, 2009 and 2008, respectively.

2009 Program

In 2009, we announced that we are undertaking a series of initiatives that are designed to transform and enhance the way we operate as

a global company. In order to enhance our responsiveness to changing market conditions, we are executing a strategic transformation

program designed to create improved processes and systems to further enable us to invest in future growth in areas such as our global

customer interactions and product development processes. This program is expected to continue into 2012 and will result in the

reduction of up to 10 percent of the positions in the company. We expect the total pre-tax cost of this program will be in the range of

$250 million to $350 million primarily related to severance and benefit costs incurred in connection with such workforce reductions.

Most of the total pre-tax costs will be cash-related charges. Currently, we are targeting annualized benefits, net of system and related

investments, in the range of at least $150 million to $200 million on a pre-tax basis. These costs and the related benefits will be

recognized as different actions are approved and implemented.

During 2009, we recorded pre-tax restructuring charges of $67.3 million, of which $55.8 million related to severance and benefit costs

and $11.5 million related to other exit costs associated with this new transformation project. As of December 31, 2009, 548 employee