Pitney Bowes 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

88

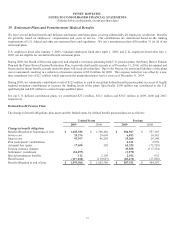

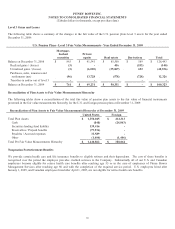

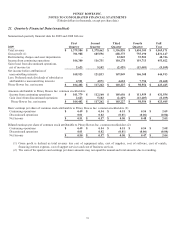

Level 3 Gains and Losses

The following table shows a summary of the changes in the fair value of the U.S. pension plans level 3 assets for the year ended

December 31, 2009:

U.S. Pension Plans - Level 3 Fair Value Measurements - Year Ended December 31, 2009

Mortgage-

backed

securities

Private

equity Real estate Derivatives Total

Balance at December 31, 2008 $ 863 $ 41,541 $ 85,500 $ 589 $ 128,493

Realized gains / (losses) (3) - 416 (553) (140)

Unrealized gains / (losses) (3) (6,038) (35,007) 692 (40,356)

Purchases, sales, issuances and

settlements (net) (96) 13,728 (578) (728) 12,326

Transfers in and/or out of level 3 -----

Balance at December 31, 2009 $ 761 $ 49,231 $ 50,331 $ - $ 100,323

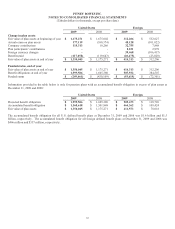

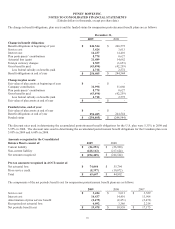

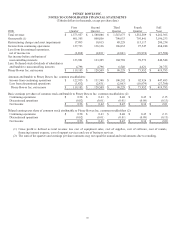

Reconciliation of Plan Assets to Fair Value Measurements Hierarchy

The following tables show a reconciliation of the total fair value of pension plan assets to the fair value of financial instruments

presented in the fair value measurements hierarchy for the U.S. and foreign pension plans at December 31, 2009:

Reconciliation of Plan Assets to Fair Value Measurements Hierarchy at December 31, 2009

United States Foreign

Total Plan Assets $ 1,350,045 $ 414,313

Cash (848) (24,843)

Securities lending fund liability 139,416 -

Receivables / Prepaid benefits (79,936) -

Payables / Accrued expenses 33,589 -

Other (1,404) (1,406)

Total Per Fair Value Measurements Hierarchy $ 1,440,862 $ 388,064

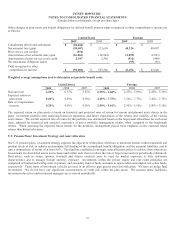

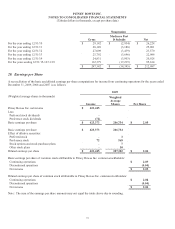

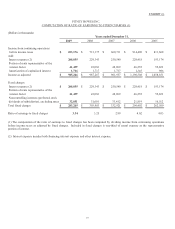

Nonpension Postretirement Benefits

We provide certain health care and life insurance benefits to eligible retirees and their dependents. The cost of these benefits is

recognized over the period the employee provides credited services to the Company. Substantially all of our U.S. and Canadian

employees become eligible for retiree health care benefits after reaching age 55 or in the case of employees of Pitney Bowes

Management Services after reaching age 60 and with the completion of the required service period. U.S. employees hired after

January 1, 2005, and Canadian employees hired after April 1, 2005, are not eligible for retiree health care benefits.