Pitney Bowes 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

65

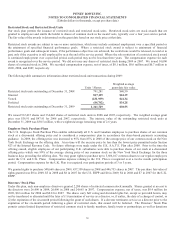

The weighted average remaining contractual life of the options outstanding and options exercisable at December 31, 2008 was 4.3

years and 3.2 years, respectively. The total options outstanding and exercisable at December 31, 2008 had no intrinsic value.

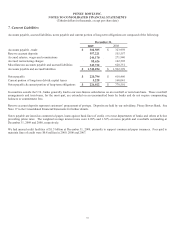

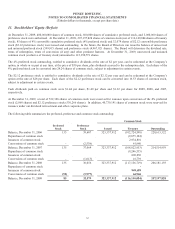

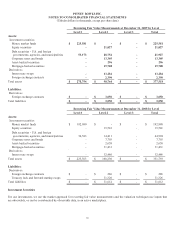

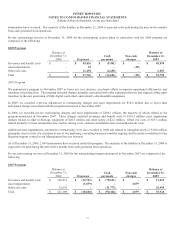

The following table summarizes information about stock options outstanding and exercisable at December 31, 2009:

Options Outstanding

Range of per share Weighted average Per share weighted

exercise prices Number remaining contractual life average exercise price

$24.75 - $30.99 3,315,684 4.2 years $25.97

$31.00 - $36.99 4,094,373 5.09 years $34.70

$37.00 - $42.99 4,480,366 4.16 years $41.14

$43.00 - $48.03 5,689,656 3.79 years $46.73

17,580,079

Options Exercisable

Range of per share Per share weighted

exercise prices Number average exercise price

$24.75 - $30.99 1,768,712 $27.04

$31.00 - $36.99 2,630,074 $33.57

$37.00 - $42.99 4,192,174 $41.04

$43.00 - $48.03 5,165,786 $46.69

13,756,746

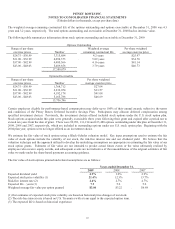

Certain employees eligible for performance-based compensation may defer up to 100% of their annual awards, subject to the terms

and conditions of the Pitney Bowes Deferred Incentive Savings Plan. Participants may allocate deferred compensation among

specified investment choices. Previously, the investment choices offered included stock options under the U.S. stock option plan.

Stock options acquired under this plan were generally exercisable three years following their grant and expired after a period not to

exceed ten years from the date of grant. There were 99,993, 131,214 and 163,480 options outstanding under this plan at December 31,

2009, 2008 and 2007, respectively, which are included in outstanding options under our U.S. stock option plan. Beginning with the

2004 plan year, options were no longer offered as an investment choice.

We estimate the fair value of stock options using a Black-Scholes valuation model. Key input assumptions used to estimate the fair

value of stock options include the volatility of our stock, the risk-free interest rate and our dividend yield. We believe that the

valuation technique and the approach utilized to develop the underlying assumptions are appropriate in estimating the fair value of our

stock option grants. Estimates of fair value are not intended to predict actual future events or the value ultimately realized by

employees who receive equity awards, and subsequent events are not indicative of the reasonableness of the original estimates of fair

value we made under the share-based payments accounting guidance.

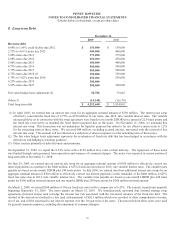

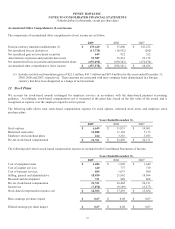

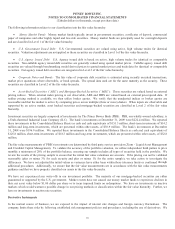

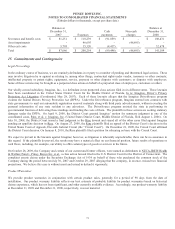

The fair value of stock options granted and related assumptions are as follows:

Years ended December 31,

2009 2008 2007

Expected dividend yield 4.5% 3.0% 2.9%

Expected stock price volatility (1) 21.4% 12.3% 13.7%

Risk-free interest rate (2) 2.4% 2.7% 4.7%

Expected life – years (3) 7.5 5.0 5.0

Weighted-average fair value per option granted $3.04 $3.22 $6.69

(1) Our estimates of expected stock price volatility are based on historical price changes of our stock.

(2) The risk-free interest rate is based on U.S. Treasuries with a term equal to the expected option term.

(3) The expected life is based on historical experience.