Pitney Bowes 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

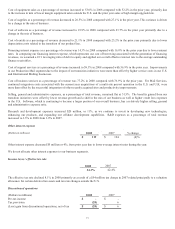

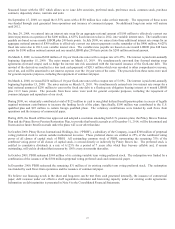

securities, 4% real estate investments and 4% private equity investments. The composition of our U.K. pension plan assets at

December 31, 2009 was approximately 67% equity securities, 32% fixed income securities and 1% cash. Investment securities are

exposed to various risks such as interest rate, market and credit risks. In particular, due to the level of risk associated with equity

securities, it is reasonably possible that changes in the values of such investment securities will occur and that such changes could

materially affect our future results.

New Accounting Pronouncements

Revenue Recognition

In September 2009, new guidance was introduced addressing the accounting for revenue arrangements with multiple elements and

certain revenue arrangements that include software. The new literature will allow companies to allocate consideration in a multiple

element arrangement in a way that better reflects the economics of the transaction. This will result in the elimination of the residual

method. In addition, tangible products that have software components that are “essential to the functionality” of the tangible product

will be scoped out of the software revenue guidance. The new guidance will also result in more expansive disclosures. The new

guidance will be effective on January 1, 2011, with early adoption permitted. We are currently evaluating the impact of adopting the

new guidance.

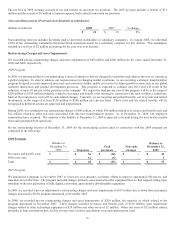

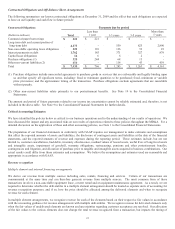

Pension Disclosures

On December 31, 2009, we adopted new accounting guidance requiring more detailed disclosures about employers’ postretirement

benefit plan assets, including investment strategies, major categories of assets, concentrations of risk within plan assets and valuation

techniques used to measure the fair value of assets. The Company has complied with the additional disclosure requirements. See

Note 19 to the Consolidated Financial Statements for our postretirement benefit plan disclosures.

Noncontrolling Interests

On January 1, 2009, we adopted new accounting guidance on noncontrolling interests. The new guidance addresses the accounting

and reporting for the outstanding noncontrolling interest (previously referred to as minority interest) in a subsidiary and for the

deconsolidation of a subsidiary. It also establishes additional disclosures in the consolidated financial statements that identify and

distinguish between the interests of the parent’s owners and of the noncontrolling owners of a subsidiary. The guidance requires

retroactive adoption of the presentation and disclosure requirements for existing minority interests while all other requirements of the

guidance are applied prospectively.

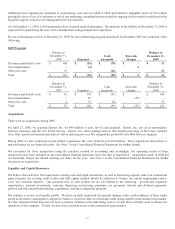

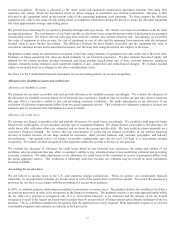

Business Combinations

On January 1, 2009, we adopted new accounting guidance on business combinations. The new guidance revises principles and

requirements for how a company (a) recognizes and measures in their financial statements the identifiable assets acquired, the

liabilities assumed, and any noncontrolling interest (previously referred to as minority interest); (b) recognizes and measures the

goodwill acquired in a business combination or a gain from a bargain purchase; and (c) determines what information to disclose to

enable users of the financial statements to evaluate the nature and financial effects of a business combination. Some of the major

impacts of this new guidance include expense recognition for transaction costs and restructuring costs. The adoption of this guidance

has not had a material impact on our financial position, results of operations, or cash flows.

Disclosures about Derivative Instruments and Hedging Activities

On January 1, 2009, we adopted new accounting guidance on disclosures about derivative instruments and hedging activities. The

new guidance impacts disclosures only and requires additional qualitative and quantitative information on the use of derivatives and

their impact on an entity’s financial position, results of operations and cash flows. See Note 13 to the Consolidated Financial

Statements for additional information regarding our derivative instruments and hedging activities.

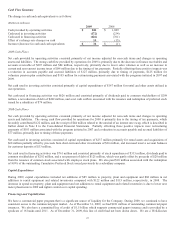

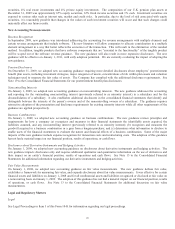

Fair Value Measurements

On January 1, 2008, we adopted new accounting guidance on fair value measurements. The new guidance defines fair value,

establishes a framework for measuring fair value, and expands disclosures about fair value measurements. It was effective for certain

financial assets and liabilities on January 1, 2008 and for all nonfinancial assets and liabilities recognized or disclosed at fair value on

a nonrecurring basis on January 1, 2009. The adoption of this guidance has not had a material impact on our financial position, results

of operations, or cash flows. See Note 13 to the Consolidated Financial Statements for additional discussion on fair value

measurements.

Legal and Regulatory Matters

Legal

See Legal Proceedings in Item 3 of this Form 10-K for information regarding our legal proceedings.