Pitney Bowes 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

83

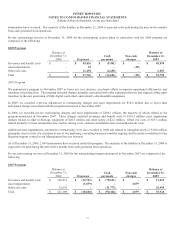

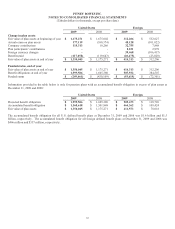

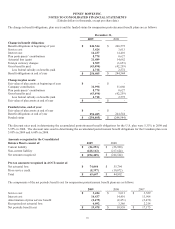

Amounts recognized in the Consolidated United States Foreign

Balance Sheets: 2009 2008 2009 2008

Non-current asset $ - $ - $ 484 $ 184

Current liability (19,424) (6,513) (957) (875)

Non-current liability (230,037) (423,596) (93,146) (71,610)

Net amount recognized $ (249,461) $ (430,109) $ (93,619) $ (72,301)

Pre-tax amounts recognized in accumulated other comprehensive income (“AOCI”) consist of:

Net actuarial loss $ 742,921 $ 833,674 $ 161,441 $ 119,733

Prior service cost/(credit) (40) (113) 756 1,211

Transition obligation (asset) - - (196) (97)

Total $ 742,881 $ 833,561 $ 162,001 $ 120,847

The estimated amounts that will be amortized from AOCI into net periodic benefits cost in 2010 are as follows:

Net actuarial loss $ 30,936 $ 3,858

Prior service cost/(credit) (2,999) 471

Transition obligation - (10)

Total $ 27,937 $ 4,319

Weighted average assumptions used to determine end of year benefit obligations:

Discount rate 5.75% 6.05% 2.25% - 6.00% 2.25% - 6.60%

Rate of compensation increase 3.50% 4.25% 2.50% - 5.60% 2.50% - 5.10%

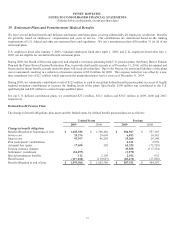

At December 31, 2009 there were no shares of our common stock included in the plan assets of our pension plans.

We anticipate making contributions of up to $20 million each to our U.S. and foreign pension plans during 2010. We will reassess our

funding alternatives as the year progresses.

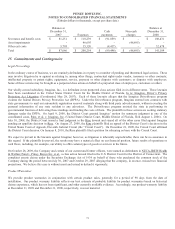

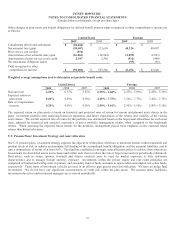

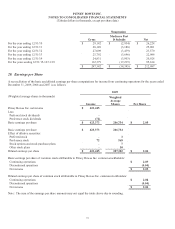

The components of the net periodic benefit cost for defined pension plans are as follows:

United States Foreign

2009 2008 2007 2009 2008 2007

Service cost $ 24,274 $ 29,699 $ 28,500 $ 6,853 $ 10,562 $ 13,427

Interest cost 93,997 96,205 94,173 25,200 29,140 27,720

Expected return on

plan assets (120,662) (132,748) (127,070) (27,193)

(36,713)

(37,079)

Amortization of

transition cost - - - (61) 142 (706)

Amortization of prior

service cost (2,547) (2,560) (2,116) 446 628 663

Recognized net

actuarial loss 26,063 18,944 29,860 2,486 3,981 7,347

Special termination 112 2,105 1,187 2,385 632 906

Settlement / curtailment 4,107 - - 202 - -

Net periodic

benefit cost $ 25,344 $ 11,645 $ 24,534 $ 10,318 $ 8,372 $ 12,278